By Mitchell Barr, Client Associate

The ancient Greeks practiced polytheism, meaning they believed multiple deities controlled the fate of the world. However, they were not content to accept the will of the gods as it presented itself. They were constantly seeking to uncover what the gods had in store, especially when facing a tough decision. This was a great business opportunity for someone who had a crystal ball, and the Greek oracles of the time were quick to capitalize. Oracles could tell you for a small charge whether, for example, Poseidon was going to flood your farm or if it was the right choice to go to war. An oracle’s crystal ball might as well have been a Magic 8 Ball, because their prophecies were just guesses. What the Greeks were after was not really a fortuneteller, but someone who could provide wise counsel in difficult situations.

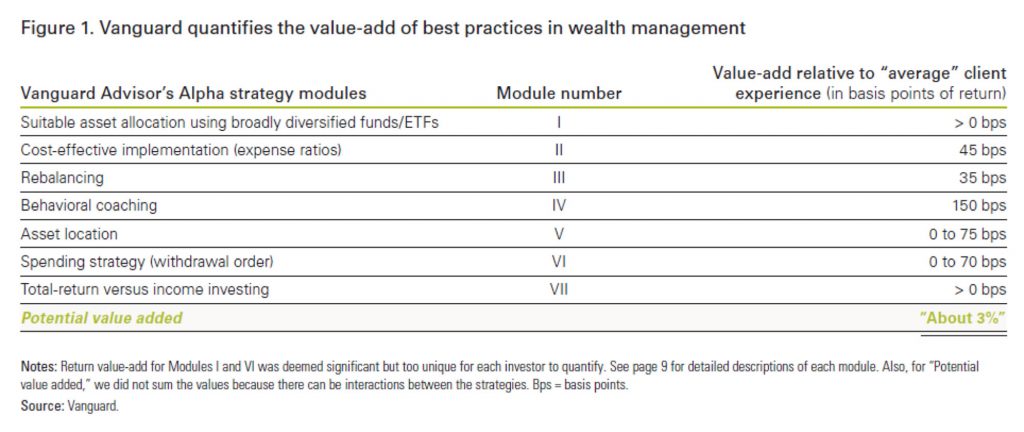

Poseidon is not going to flood your 10th floor office, but we need more than a Magic 8 Ball to figure out whether or not we can retire at 65. Fortunately, we have financial advisors to help us with this. Vanguard has done research on the value human financial advisors can add to a client’s investment returns relative to the average individual investor. In their 2014 study, Vanguard concluded that a good advisor can add as much as 3 percent in net annual returns over a long period of time (Kinniry et al 2014).

Yes, three percent every year is probably far-fetched, and Vanguard is quick to point this out. The largest component of this “Advisor Alpha” is behavioral coaching at 1.5 percent (1 bps = .01%). When returns are great and we are all making money, there is less behavioral coaching needed. The real value is when markets do not perform well because this is where the tide goes out and most people find themselves standing naked. It would be nice if there was an oracle that could tell us when the next recession will hit, but they just don’t exist. We need someone who is trained to stay calm and keep us from making irrational decisions. The ability to consult a trusted advisor makes the bad times a little less scary.

Behavioral coaching requires human interaction and there’s added value in that. With the advent of robo-advisors that can manage portfolios very cheaply and efficiently, the performance differential between investment managers is becoming increasingly less. Computers are great at following a stated process like buying a portfolio of index funds and rebalancing the allocation. However, we need humans to help make sure we don’t lose sight of the basics when our stress levels are raised and we want to sell everything because Mrs. Smith on XYZ financial channel says that we are headed into a depression.

At Versant Capital Management we are well aware of life’s uncertainties, and we acknowledge that we cannot predict the future. We control what we can and prepare mightily for what we can’t. That means keeping expenses low on your portfolio, rebalancing it often, and trying to mitigate taxes as much as possible. We don’t go in for fads and we always maintain diversified portfolios that can withstand a variety of market conditions. And, last but not least, we are always there when the going gets tough to keep you on track to achieveing your goals. When the day comes that Poseidon unleashes his wrath, we will be ready.

[mk_fancy_text color=”#444444″ highlight_color=”#ffffff” highlight_opacity=”0.0″ size=”14″ line_height=”21″ font_weight=”inhert” margin_top=”0″ margin_bottom=”14″ font_family=”none” align=”left”]Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.[/mk_fancy_text]