Prepared by Brandon Yee and Thomas Connelly

Commentary

Commentary

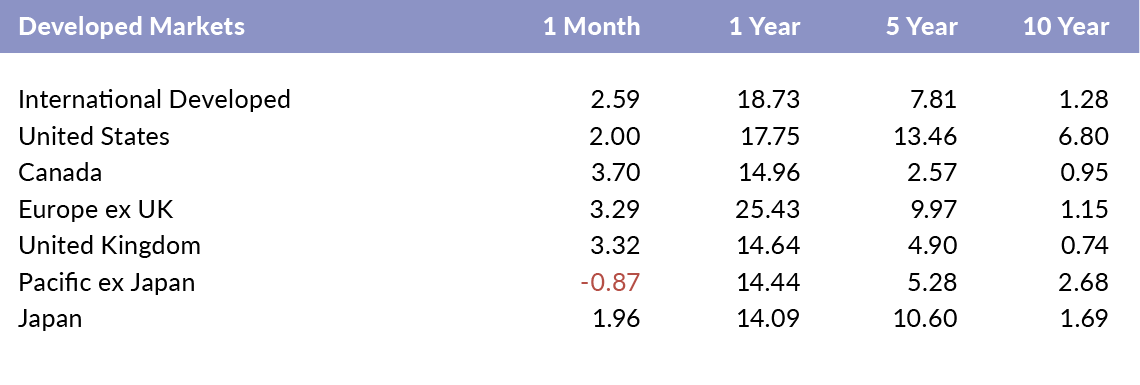

Developed Markets Record Strong Month– In the month of September, most developed markets recorded gains except for the Pacific ex Japan region. Europe ex UK and the U.S. market posted gains of 3.29% and 2.00%, respectively.

Commentary

Commentary

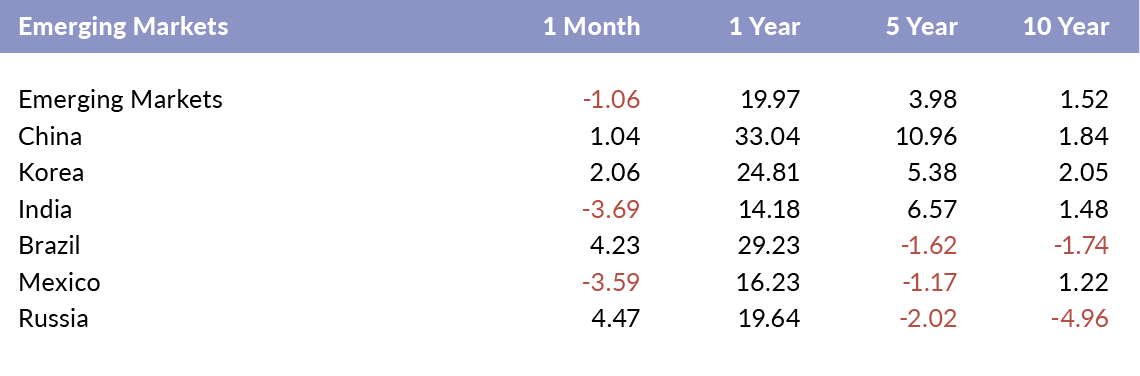

Emerging Markets Rally Takes a Breather – The broader emerging markets dropped one percent in September. India and Mexico were the primary laggards. Russia and Brazil had the largest gains of 4.47% and 4.23%, respectively. Emerging markets have still outperformed developed markets over the past year.

Commentary

Commentary

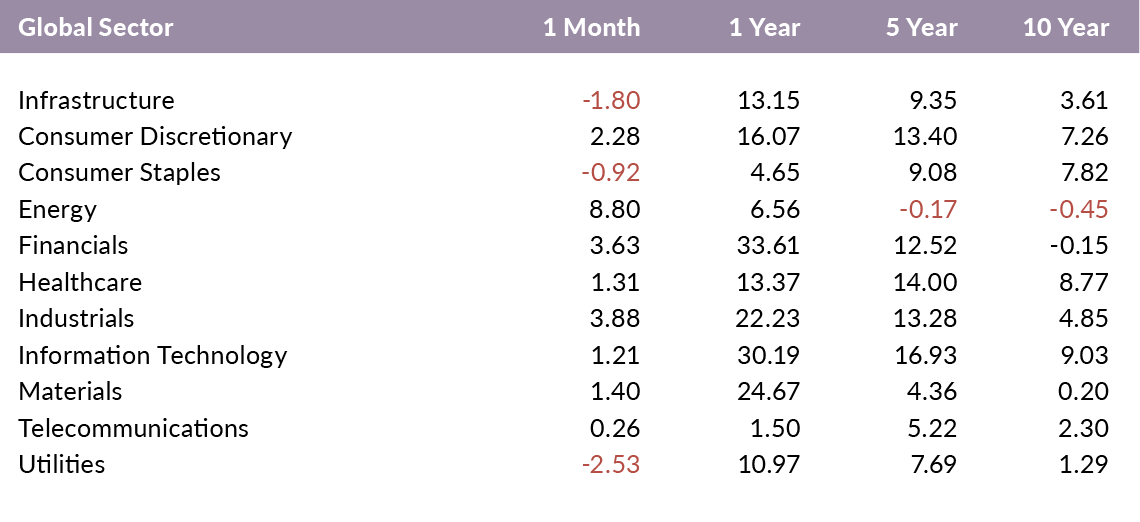

Energy Bounces Back- Energy and industrials posted the strongest global sector returns of 8.80% and 3.88%, respectively. Utilities and infrastructure had the toughest month, dropping 2.53% and 1.80%, respectively.

Commentary

Commentary

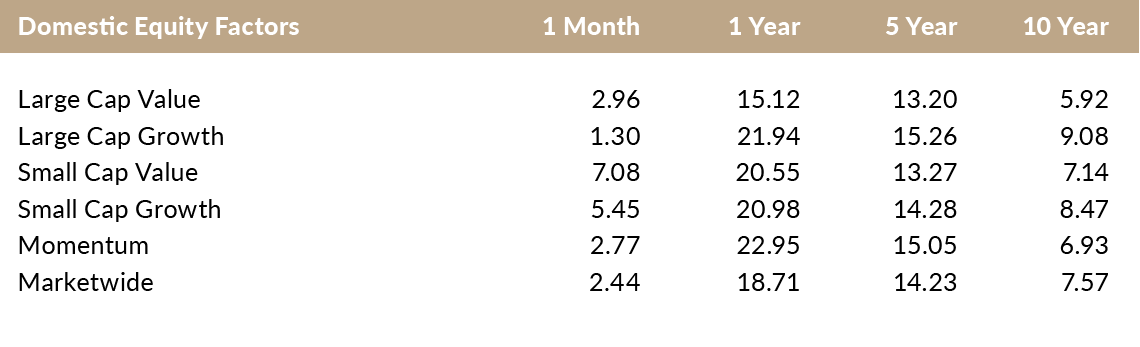

Value Outperforms- In September, domestic value indices outperformed their growth counterparts. Small-cap value stocks recorded a strong return of 7.08%.

Commentary

Commentary

Momentum Edges Higher– In the international developed markets, value indices outperformed growth indices for the month. Momentum posted a strong return of 3.60%.

Commentary

Commentary

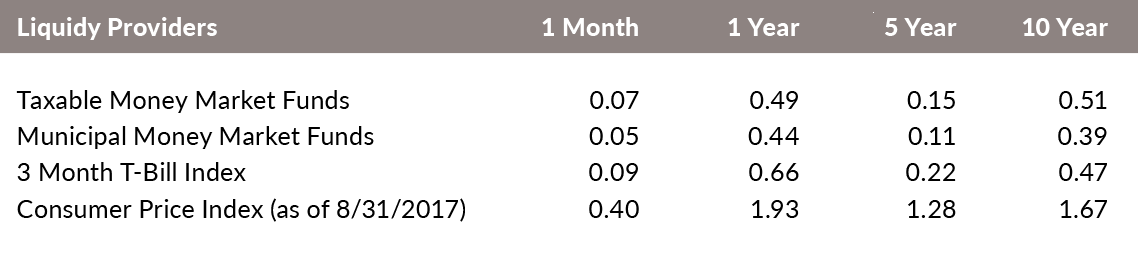

Inflation Picks Up– Money market fund and T-Bill yields are still low. The CPI has increased by 1.93% over the past year, which is higher than the five and ten year numbers.

Commentary

Commentary

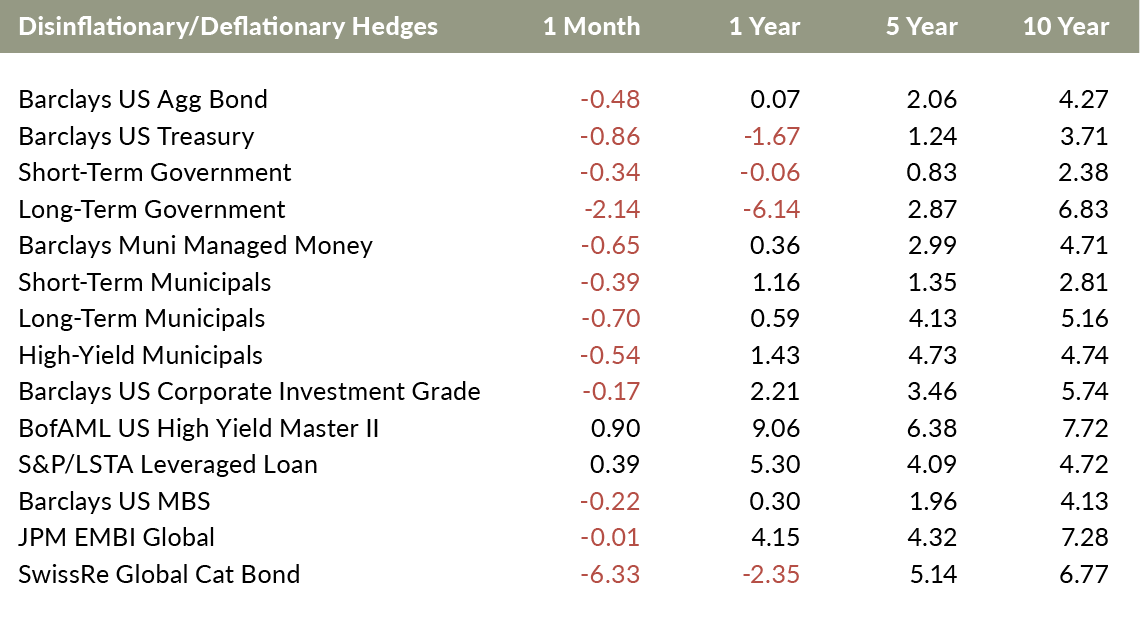

Deflationary Hedges Broadly Lower – The returns of deflationary hedges were mostly lower for the month. High yield and leveraged loans recorded the strongest returns of 0.90% and 0.39%, respectively. Catastrophe bonds were hit hard by the active hurricane season. Long-term government bonds declined by 2.14%.

Commentary

Commentary

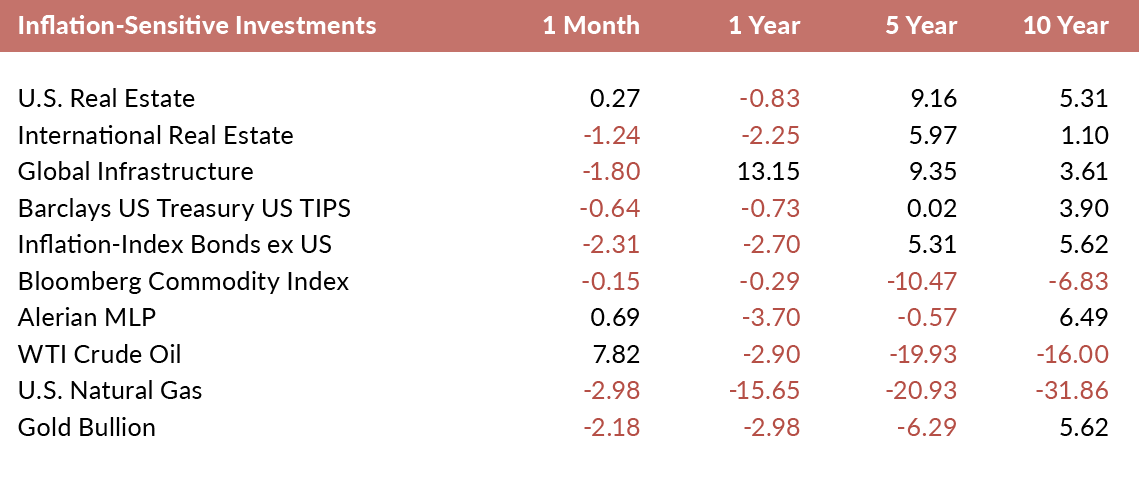

Natural Gas Dips Lower– Inflation-sensitive investment returns were mostly negative in September. Crude oil posted a large gain of 7.82%. Natural gas and TIPs dropped 2.98% and 2.31%, respectively.

Commentary

Commentary

Euro Gaining Ground on U.S. Dollar– The change in the U.S. dollar versus other major currencies has been mixed over the past three months. The Canadian Dollar and Euro appreciated the most versus the U.S. dollar. The Swiss Franc and Indian Rupee lost the most versus the USD over the same time period.

[mk_fancy_text color=”#444444″ highlight_color=”#ffffff” highlight_opacity=”0.0″ size=”14″ line_height=”21″ font_weight=”inhert” margin_top=”0″ margin_bottom=”14″ font_family=”none” align=”left”]Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request[/mk_fancy_text]