Market Briefing

News, analysis and commentary

By Logan Robertson and Thomas J. Connelly, CFA, CFP®

March 27, 2020

The week of March 23rd draws to a close with the S&P 500 and Dow Jones Industrial Average finishing up 10.5% and 12.7% respectively despite extraordinarily large daily moves in both directions. The VIX closed the week out down -.3%, remaining at levels unseen since 2008. Large daily moves, be they gains or losses, are typically signs of an unhealthy market in the short-term.

Treasury yields fell over the week; the 10 Year yield sits at 0.71%. The 3 Month Treasury Bill yield dipped negative this week, but the recovered slightly, finishing at 0.1%. Gold returned 8.3% over the week.

The House passed a $2 trillion fiscal stimulus bill this week to help the economy cope with the coronavirus outbreak; the United States currently leads the world in active cases. President Trump signed the bill this afternoon, committing billions to helping large and small corporations, individuals, and loan assistance.

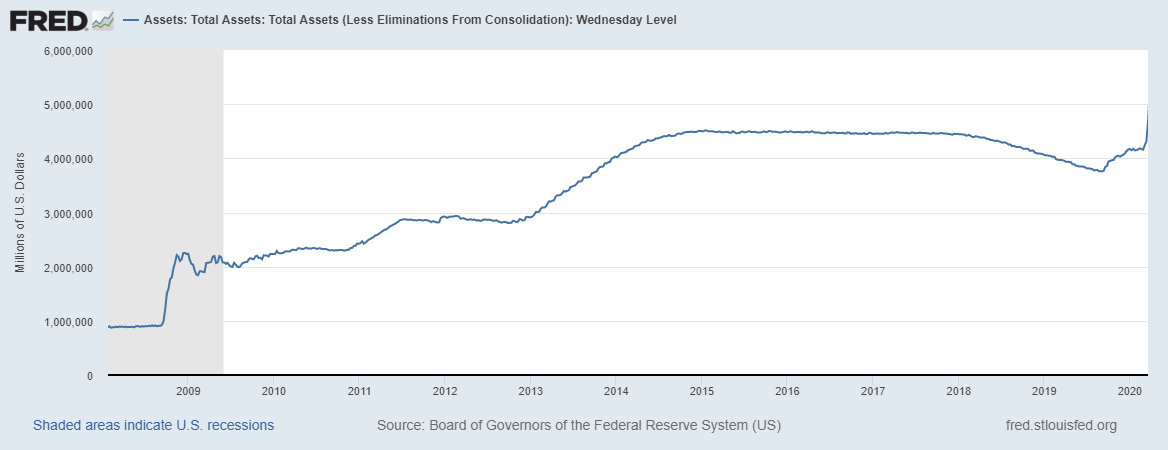

In the realm of monetary stimulus, the Federal Reserve’s balance sheet has initiated liftoff, as “Unlimited QE” takes effect, propelling the number of assets to unprecedented highs ($507 billion in the past week), with Reserve Bank credit just shy of $5 trillion. According to Grant’s Interest Rate Observer, Reserve bank credit annualized growth over the past three months is 43%, and now exceeds its previous post 2009 high by 13%. The monetary spigots are wide open. What happens when all of this spending power, easy liquidity, and low interest rates meets the recovery later this year?

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.