Market Conditions, Fiscal Stimulus, & Investing

March 16, 2020

By Thomas J. Connelly, CFA, CFP®

President & Chief Investment Officer

Today, world stock markets are down sharply again after Friday’s huge rally. Following a second, and much larger Federal Reserve monetary stimulus announcement on Sunday following Thursday’s sizable intervention, US markets shook off the actions of the Federal Reserve with the S&P 500 posting its third worst day since 1926.

Markets feel an awful lot like September through November of 2008. Now firmly in bear market territory, world stock markets are already pricing in recessionary conditions. But the underlying causes and circumstances are very different this time. The underlying economy was solid going into the COVID-19 (coronavirus) pandemic. The financial system is far stronger than in 2007, and the timely and massive injections of liquidity and lowering of rates by the Federal Reserve have thus far enabled market plumbing to handle trading and flows of liquidity during a period of great stress.

The Federal Reserve interventions are geared more towards maintaining liquidity in the treasury markets and making sure dollars are available to the world’s major central banks rather than supporting the stock market. Fed stress tests of individual banks anticipated this type of environment — much different than during the Great Financial Crisis (GFC) when there were failures of major financial institutions, seizing up of all types of credit access, and imminent failure in trading markets and global finance.

What is needed is a globally coordinated fiscal policy aimed at counteracting the shock to economic activity and incomes. Any fiscal intervention needs to place funds in the hands of small- and medium-sized businesses and their employees and to help companies that have legitimate growing concerns in affected sectors, such as energy, travel, and entertainment.

While bits and pieces of fiscal stimulus have been announced here and abroad, we believe markets are looking for a more forceful and global response, which should be forthcoming shortly. Markets do not always respond quickly to stimulus, and the GFC is a great reminder of that.

While it is possible that the loss of economic activity may qualify as a global recession, the pandemic will most likely be a relatively short-term event that will impact the global economy according to its length and severity. But it certainly will end. We believe that markets will recover before the end of the year, perhaps sharply. And because markets often anticipate events well in advance, a recovery may not be accompanied by many positive economic signals or signs of abatement in the pandemic. Monetary interventions recently announced by the Federal Reserve have been sizable relative to history, and we expect a large dose of fiscal stimulus soon. Together with a reduction in energy prices and interest rate reductions, there will be considerable additional income available to consumers and businesses to help offset the loss of economic activity due to the pandemic.

Versant Capital Management is having two types of conversations with clients over the past two weeks. The first and most common is based on the fear of where the coronavirus pandemic is headed, the duration and magnitude of the resulting economic damage, and whether losses to the world’s stock markets will continue and for how long. These fears are entirely understandable given the circumstances surrounding the epidemic, the decline in world stock markets, and the crash in oil prices.

The second type of conversation, which is much rarer, centers around opportunity. With speed matched only by the crash of October 19, 1987 — when the US stock market declined more than 22 percent in a single day — this bear market has declined more than 20 percent in a matter of weeks. Considerable damage has been done to the financial, energy, and materials sectors, which were under varying degrees of stress before 2020. This type of conversation is about when to invest more in certain markets or specific sectors and with what degree of force. We believe these questions are also warranted. Before this period of volatility is over, we will look back on once-in-a-generation buying opportunities that will arise in some global markets and sectors.

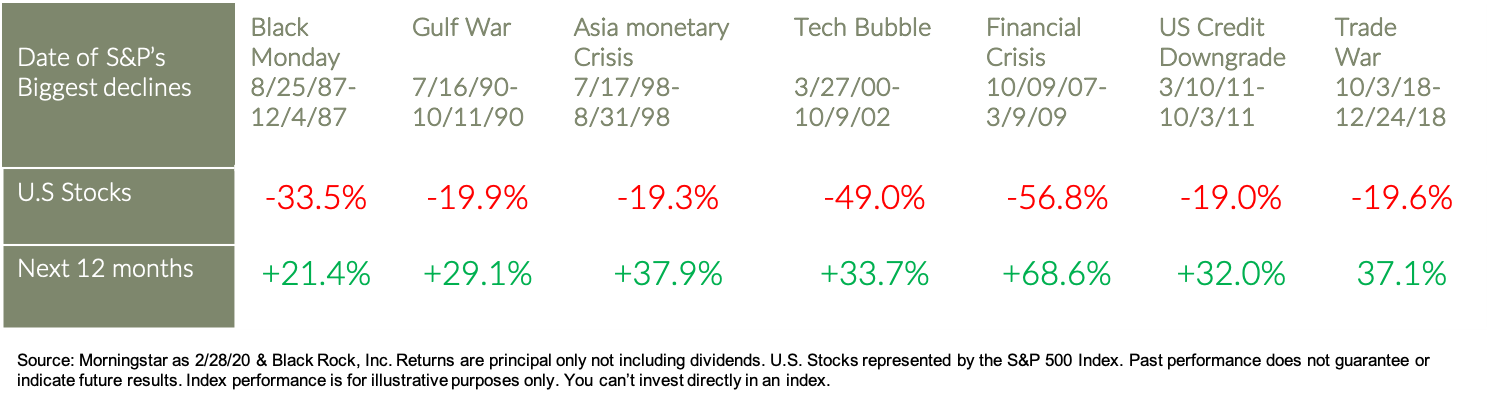

While our rational sympathies lie firmly with the latter conversation, our answer to both is the same right now: Do not sell hastily based on fear at this time. Moves into the market should be staged, for all but the most risk-tolerant investors. The huge daily volatility in the world stock markets means that the downtrend may not be over. With an external supply side shock that will be of finite duration, a sharp market recovery is possible. Indeed, as the chart from Blackrock shows below, every one of the large market declines since 1987 was followed by a sharp reversal in the succeeding 12-month period. It is dangerous to sell into a panic initiated by an event of relatively short duration without knowing the timing of recovery.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.