[vc_row][vc_column][vc_column_text] [/vc_column_text][vc_column_text responsive_align=”left”]A month and a half had passed since the Tax Cuts and Jobs Act of 2017 was first introduced in Congress to the approval of the final version by the conference committee last week. Given this short time period, and the constant evolution of the bill to its current state, focusing on the most impactful changes may have become challenging. To help you in your discussions with your CPA or tax professional, we highlight below five key areas of the new tax bill to focus on before December 31, 2017.

[/vc_column_text][vc_column_text responsive_align=”left”]A month and a half had passed since the Tax Cuts and Jobs Act of 2017 was first introduced in Congress to the approval of the final version by the conference committee last week. Given this short time period, and the constant evolution of the bill to its current state, focusing on the most impactful changes may have become challenging. To help you in your discussions with your CPA or tax professional, we highlight below five key areas of the new tax bill to focus on before December 31, 2017.

State and Local Income Tax & Property Tax Deductions

· Households will be given the option to deduct their combined state and local property and income taxes. This deduction is capped at $10,000 for the combined total of property and income taxes.

· The $10,000 deduction limit applies to both individuals and married couples. For married couples that file separately, the limit is $5,000 each.

· In an effort to prevent households from attempting to prepay their 2018 state income taxes and benefit from the current deductions, the new rules state than any 2018 income taxes paid by the end of 2017 are not deductible in 2017, and will be treated as having been paid at the end of 2018. This rule applies only to the prepayment of income taxes and to actual 2018 tax liabilities. The rules allow for paying 2017 state-estimated taxes by the end of 2017 and benefitting from the full deduction, as well as certain property taxes paid by the end of the year.

Mortgage Deduction

· The mortgage deduction is reduced to $750,000 of principal. The change only applies to new mortgages taken out after December 15, 2017.

· A refinance of mortgages taken out before December 15, 2017 will retain the million-dollar debt limit, which was the old cap.

· Any houses that were under a binding written contract by December 15 to close on a principal residence purchased by January 1, 2018, will be grandfathered.

· Deductibility for home equity indebtedness is eliminated, and existing loans will not be grandfathered.

Miscellaneous Deductions

· The bill repeals all miscellaneous itemized deductions that are otherwise subject to the 2% of AGI (adjusted gross income) floor.

· Examples of miscellaneous itemized deductions include all tax preparation expenses, various unreimbursed employee business expenses, legal fees, and deduction for investment advisory fees.

· Any expenses attributable to a business (business entity, sole proprietorship on Schedule C) will remain deductible, including investment advisory fees and tax prep fees attributable to business accounts.

Kiddie Tax

· Under the current tax law, children under age 19 or full-time students under age 24 are taxed at their own individual tax brackets for any earned income, but their unearned income above a threshold is taxed at the parents’ top marginal tax rate.

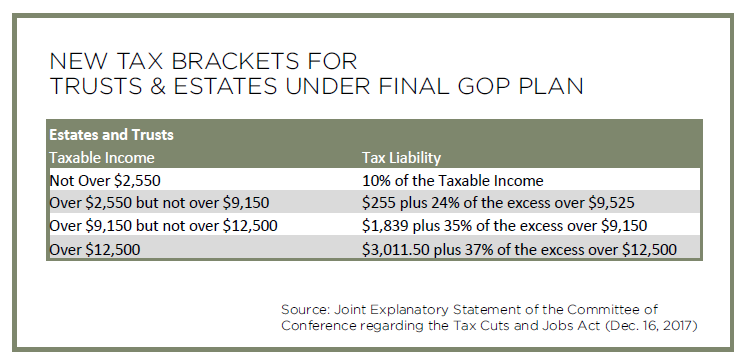

· Under the new law, the Kiddie Tax will instead be calculated based off the trust tax brackets.

The net effect of the change may increase or decrease the tax liability, depending upon the parents’ tax bracket.

The net effect of the change may increase or decrease the tax liability, depending upon the parents’ tax bracket.

Medical Expenses

· The medical expense deduction remains intact. The 10% of AGI threshold is temporarily reduced to 7.5% retroactively for 2017 as well as 2018, then reverts back to a 10% threshold after 2018.

Below are a few actions for you to consider with your tax advisor. Depending on the state that you live in and whether or not you are affected by AMT will determine how to treat these considerations.

Actionable items for consideration

· Prepay property taxes for second half of 2017 if you haven’t yet.

· Prepay state taxes due for 2017 by December 31.

· Expedite payment of any professional fees due for services in 2017, such as investment fees, estate planning fees, etc.

This information does not cover everything that applies to the proposed new tax law. We recommend that you consult with your tax professional or CPA to see how these items may affect your individual tax situation. This article does not constitute tax or legal advice.

Disclosures: Any tax related material contained within this article is subject to the following disclaimer required pursuant to IRS Circular 230: Any tax advice contained in this communication (including any attachments) is not intended to be used, and cannot be used, for purposes of(i) avoiding penalties imposed under the United States Internal Revenue Code or (ii) promoting, marketing or recommending to another person any tax-related matter.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.[/vc_column_text][/vc_column][/vc_row]