Investment Portfolio Management

The Versant investment process is done in partnership with an informed, educated, and engaged client. All parties’ economic and emotional interests are aligned toward accomplishing your goals and objectives. We operate in mutual trust and respect, where constructive questioning and creative thinking are encouraged. Feedback to you is transparent and available on a timely basis.

What We Offer

Personalized Custom Portfolio Allocation

Alternative Investment Strategies Access

Unique and Niche Investment Opportunities

Tax-Efficient Low Cost Investing

Broad Asset Class Diversification

Customized Asset Location Strategies

Global Investment Performance Reporting

Portfolio Rebalancing & Tax Management

Our Core Investment Beliefs

- Investment decisions should be based on theoretical foundations and applied through processes and judgment, not speculation.

- The investment opportunity set is global and changes over time.

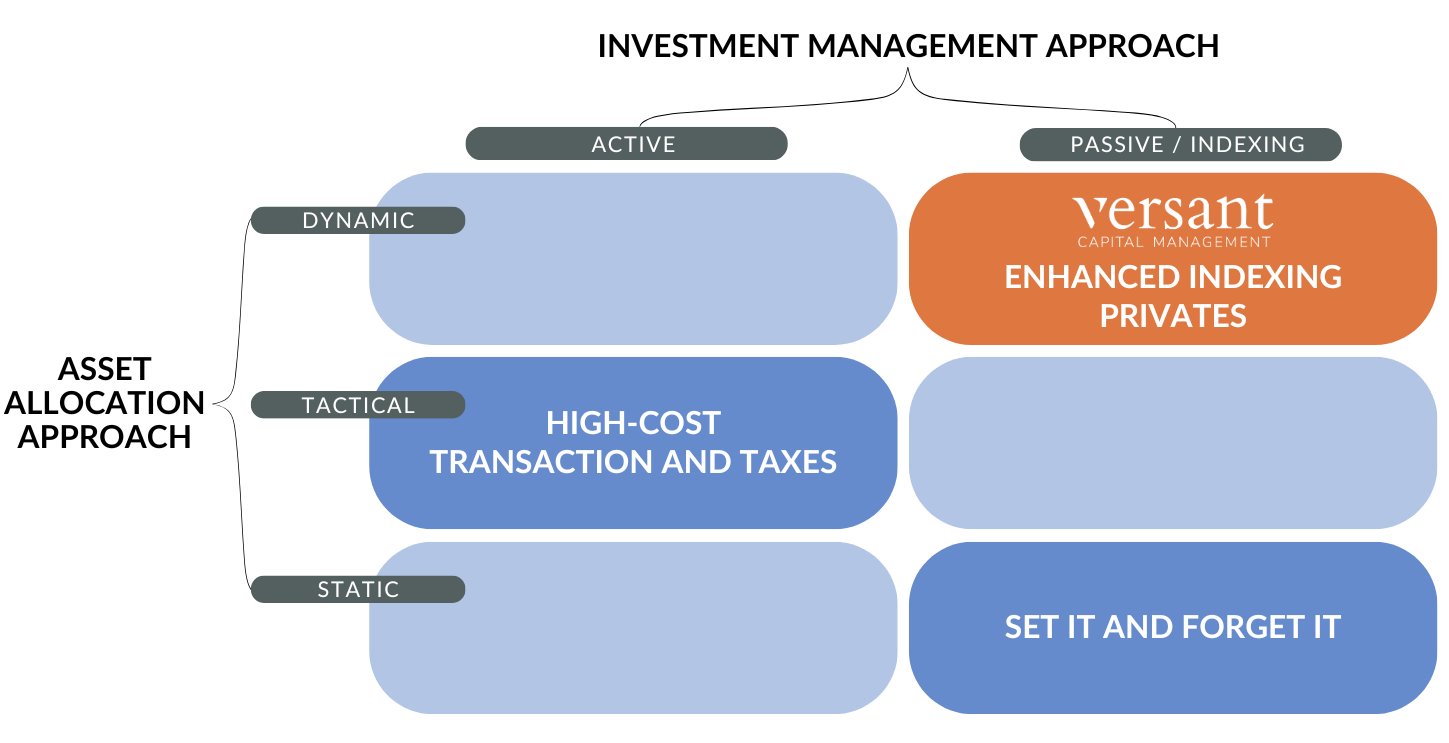

- Traditional active management in the public markets does not work in the long run, especially after fees and taxes.

- Minimizing market frictions, including transaction costs, management costs, administrative and custody costs, and taxes, can provide higher net returns to clients.

- Broad diversification of asset classes can increase compound returns.

- Controlling investor behavior is critical for successful long term investment performance.