INVESTMENT PHILOSOPHY

At Versant Capital Management, your goals, circumstances, and preferences come first. Our duty is to help make your financial and human resources work to meet your goals and objectives.Aligning your interests with ours allows a perspective on investing than is often different from traditional banks and brokerages.

Our investment philosophy rests on the bedrock of Versant’s investment beliefs and its application through our investment process, governed by our core values.

HISTORY | PHILOSOPHY | PROCESS

History

Thomas J. Connelly, CFA®, CFP®, President and Chief Investment Officer

Versant Capital Management’s investment perspective was grounded in the late 1970s when Tom Connelly’s profession as a geologist trained him in the art of observation, the scientific method, geology, chemistry, and physics. As a young scientist, knowledge, critical thinking, perseverance, and upbeat optimism were the characteristics he needed to launch a successful career.

These traits carried over to his new path as an investment professional nearly four decades ago. However, he lacked one skill – the art of sales, which was, and still is, usually tied to compensation in the investment profession. The investment business, as applied to the individual market, was dominated by sales, where decisions were often made in the best interests of the sales organization rather than the client.

In 1990, Tom joined a small group of practitioners in the investment profession who gave financial advice and managed client assets and were compensated only by fees paid by those same clients. There were no commissions, referral fees, markups on investments, soft dollars, or any other source of income that might generate a conflict of interest. Although this model is more prevalent today, the principals at Versant practiced in this mode starting early in their careers.

Versant Model: Focus on client goals

Minimize:

- Turnover & Taxes

- Fees

- Changes in asset allocation

- Proprietary products

Traditional Model: Focus on product sales

Maximize:

- Turnover & Taxes

- Fees

- Changes in asset allocation

- Proprietary products

Investment Philosophy

Our investment beliefs and values are the results of decades of experience and learning, and to practice in our client’s best interests.

“Investment decisions should be based on

theoretical foundations and applied

through processes and judgment.”

Client circumstances, preferences, and quantifiable goals inform portfolio structure.

Accordingly, our measure of success is the likelihood that family resources will meet all future family needs based on our estimates of future market conditions and your circumstances and preferences. Our definition of risk is not annual volatility, standard deviation, returns, or some other statistical metric – it is the likelihood that your financial goals go unmet.

The global economy will continue the process of innovation and growth that began in the late 1700s.

Over most of human history, economic growth averaged little more than 0.1 percent per annum. The onset of the industrial and agricultural revolutions resulted in an expansion of wealth worldwide. The financial system we are now a part of parcels out capital on a global basis to investment opportunities. 1

The core of our investment philosophy is that free markets, by and large, work. Beginning in the late 1700s – a little more than 200 years ago – economic growth in northern Europe accelerated more than 10-fold. 2

“Broad diversification of asset classes

increases compound returns.”

We believe that this process of growth and innovation will continue for the foreseeable future and will continue to provide worldwide growth opportunities through global stocks, real estate, and other growth-oriented investment opportunities.

Markets behave as if micro-efficient but are not necessarily macro-efficient.

In today’s financial markets, individuals with access to data and information weigh their choices and set prices for all investments. In this type of environment, prices of investments tend toward fair value. Markets are said to be “micro-efficient.” If markets are efficient, we should see the results in the investment returns of professionals, and we do.

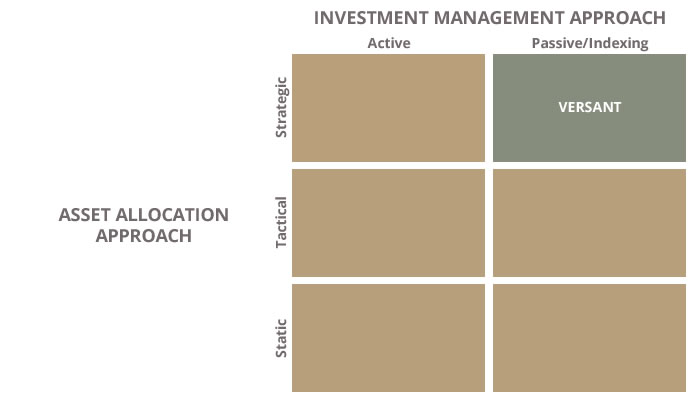

The fraction of surviving stock and bond mutual funds that beat their respective indices over the twenty years ending in 2021 was only 18% and 15%, respectively. And this does not account for higher tax liabilities typically generated by actively managed funds.3 For this reason, our individual investment choices tend to be passive or index funds that replicate entire markets, or underlying return drivers, inexpensively and with fewer tax complications.

“Modern markets show micro-efficiency (for the reason that the minority who spot aberrations from micro-efficiency can make money from those occurrences and, in so doing, they tend to wipe out any persistent inefficiencies). In no contradiction to the previous sentence, we had hypothesized considerable macro-inefficiency, in the sense of long waves in the time series of aggregate indexes of security prices below and above various definitions of fundamental values.”

Paul Samuelson, private letter to Robert Shiller and John Campbell, 1998. Investment decisions and analyses should be forward-looking and not based solely on historical considerations.

Investment decisions and analyses should be forward-looking and not based solely on historical considerations.

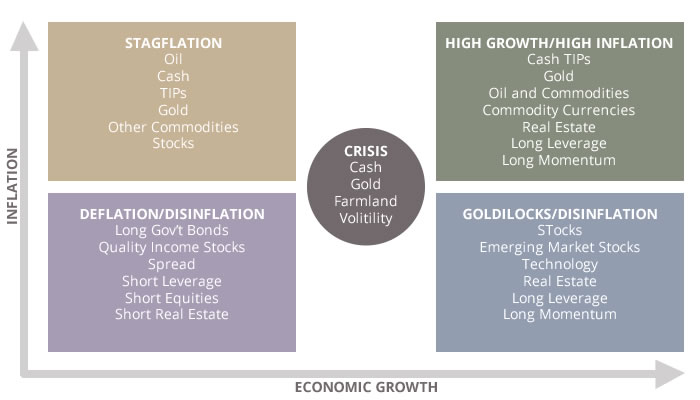

Our definition of an investment is the exchange of current consumption in return for a set of future cash flows, which must be discounted back to current dollars. In other words, we exchange possible current consumption for future consumption, plus “rent” in the form of interest, dividends, rents, premia, or price changes. Our investment process seeks to diversify and reduce risk by seeking out investments, or future sources of cash flows, that behave differently in varying economic or financial environments. Some of these solutions are creative and non-traditional exposures to underlying cash flows.

Expected nominal returns on cash and bond markets are derived from yield curves, whereas future earnings growth and terminal valuations must be forecast to arrive at equity market returns. We estimate over a business cycle because some forecast errors cancel over intermediate periods, and forecasting accuracy decays with time. Forward-looking, long-term investment returns are forecast for global stock, bond, real estate, and cash markets over the next market cycle, typically ten years.

- Maddison, Angus (2007): “Contours of the World Economy, 1–2030 AD. Essays in Macro-Economic History”, Oxford University Press.

- Maddison, Angus (2007): “Contours of the World Economy, 1–2030 AD. Essays in Macro-Economic History”, Oxford University Press.

- Mutual Fund Landscape, Dimensional Fund Advisors, 2022

Since the global opportunity set changes with time, return expectations – as well as your goals, circumstances, and preferences – change, requiring a periodic reexamination of strategy. This is referred to as a strategic asset allocation strategy, where changes are made based on long-term return and valuation considerations rather than short-term tactical strategies based on market or media noise.

The financial media and industry often create needs born of distress or elation that feed off a stream of financial and geopolitical news and commentary that can agitate, titillate and attract viewership. Little of this activity is of typical concern to the long-term investor. Similarly, Wall Street can grow by creating new perceived needs or concerns. Creating a stream of new asset classes, factors, gurus, sectors, or industries can be a distraction and a source of new products and fees from the financial services industry. How do we discern value, legitimate investment ideas, or perspectives from all the noise? We recommend being skeptical, relying on research and evidence, and being cognizant of benefits after all costs are considered.

From a strategic standpoint, Versant portfolio structures are global. They are tailored to your goals, circumstances, and preferences, integrating your financial and human capital assets whether included in the managed portfolio or not. For example, equity exposure in our typical portfolio reflects the world’s stock markets rather than over-weighting the domestic market. In addition, portfolios are structured around evidence-based underlying global sources of returns. Exposure to these risk factors is proportional to your financial needs and personal risk tolerance. Often your financial need for risk might be contrary to your personal tolerance for risk and we are there to help you think through the proper course of action given you goals, preferences and circumstances.

Our clients stand ready to provide market liquidity in times of distress with long-term funds.

Many of your goals are long-term in nature and provide the opportunity to patiently commit capital for long periods. In today’s turnover-addled investment marketplace, this is truly an advantage. A long-term, patient perspective allows you to be a provider of capital in situations where liquidity has dried up and confidence when prices have fallen. At Versant, we allow for a small proportion of equity and fixed income exposures to opportunities where markets, sectors, countries or return drivers have been severely dislocated for the short-term.

Please Note: Limitations. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Versant Capital Management, Inc.) or any planning or consulting services, will be profitable, equal any historical performance level(s), or prove successful.

Investment Management Process

Our investment process is done in partnership with our clients. The interests of all parties are aligned toward accomplishing our client’s goals and objectives. We strive to operate in an environment of mutual trust and respect, where questioning and thinking are encouraged. Investment decisions are based on theoretical or empirical foundations and applied through processes and judgment. Feedback to you is transparent and makes participants in the process accountable for their actions and decision.

Update Portfolio Inputs

Our relationship with the people we serve is managed with the individual or family as the focus, rather than assigning a model or a recommended list of securities to their accounts. We begin with circumstances. We account for current and future resources in the form of assets, tax and ownership characteristics, sources of income, human capital, family capital, family structure, and Social Security or other government benefits. We consider financial resources (whether we manage them or not) in planning toward our client’s goals and objectives.

Investment constraints define the parameters of the investment strategy. Consideration of the age, health, and time horizon of stakeholders help to fine-tune the quantification of goals. Determination of cash or liquidity reserve requirement help protect against the danger of having to liquidate long-term assets in times of market distress. We determine the tax characteristics of each client’s situation, how we will account for assets for tax purposes, and different types of investments, accounts, and legal entities. We examine legal, regulatory, or other circumstances that might impact a family’s goals and objectives.

Investment preferences are considerations for a family regarding the management of their affairs. Concerns regarding the use of an investment or type of investment, preferences regarding social or environmental concerns, and holding of existing securities or highly appreciated positions are examined. An important factor is the determination of risk tolerance. Versant works with an independent third party to analyze risk preferences regarding short-term investment volatility. From our perspective, however, a factor for risk is not having enough resources to meet family objectives. Often, these two factors conflict with each other or among the stakeholders and must be resolved.

A key component of the portfolio input process, and indeed, of the entire wealth management process, is a family’s goals. From an investment standpoint, goals are quantified considering constraints and preferences into future expenses that family resources should meet. Usually, these cash flow needs can be satisfied by switching present consumption into the future at a satisfactory level of risk.

Determine New Portfolio

Various portfolio structures, with differing proportions of growth-oriented assets, are examined against a client’s goals on an after-tax basis to see which combination of assets can accomplish the financial objectives with the least risk. Stakeholders participate in risk profiling conducted by an independent third party to help ensure that the portfolio structure chosen to meet financial objectives is suitable from a psychological point of view.

“Management of market frictions

including transaction costs,

management costs, administrative

and custody costs, and taxes, are crucial.”

Review Portfolio

Periodic portfolio reviews throughout the year seek to maintain the portfolio’s risk and return characteristics by preserving targets at the asset class level.

“Financial reality before behavioral comfort.”

This means that asset classes that have performed well are sold and reinvested into asset classes that are currently out of favor, resulting in a built-in contrarian strategy. Coincident with portfolio review, tax-loss harvesting opportunities are sought where investments in a loss position from an income tax standpoint are sold and replaced with similar investments. This allows the tax loss to be used to a client’s advantage. Portfolio reviews are also used to maintain cash balances to cover current expenditures and fund goals.

Monitor Portfolio

Portfolio monitoring and performance are provided by quarterly reporting that focuses on investment results after taking costs into account. Periodic monitoring of changes in a client’s circumstances, goals, or investment preferences, which can potentially alter portfolio structure, is also conducted.