Prepared by Brandon Yee and Tom Connelly

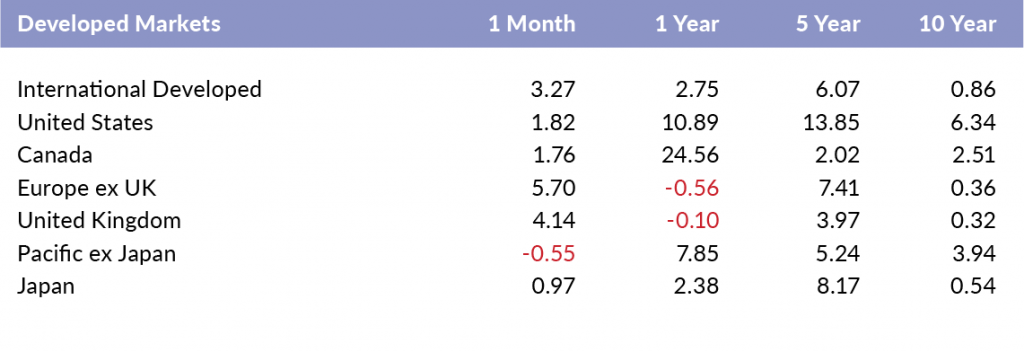

Commentary: European Markets Finish 2016 on a High Note– For the month of December, developed market index returns were positive except for the Pacific ex Japan region. Europe ex UK had the highest return of 5.70%. Canada and the United States posted the strongest one year returns of 24.56% and 10.89%, respectively.

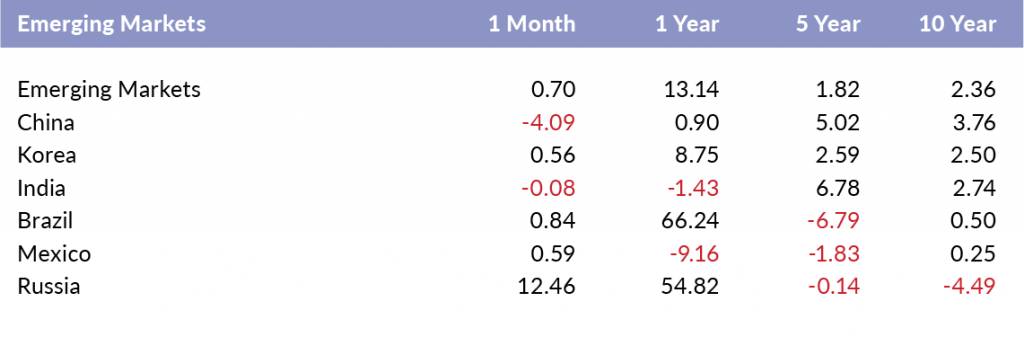

Commentary: Emerging Markets Outpace Developed Markets for the Year– Emerging market returns were mixed in December, with Russia recording the highest return of 12.46%. For the year, emerging markets outpaced international developed markets and the United States’. Brazilian and Russian markets had the highest 2016 returns of 66.24% and 54.82%, respectively.

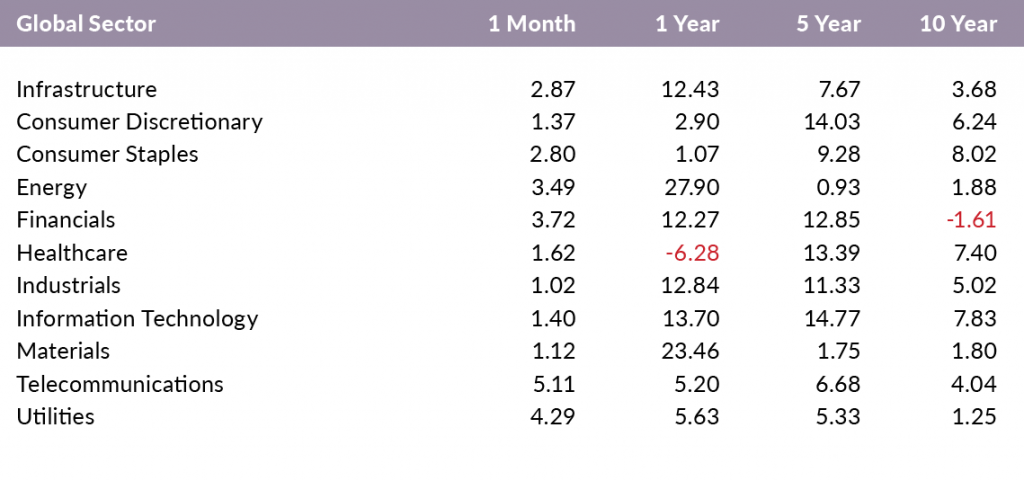

Commentary: Energy Sector Bounces Back– Telecommunications and utilities posted the strongest global sector returns of 5.11% and 4.29%, respectively. In 2016, the energy sector bounced back with a return of 27.90%.Healthcare declined by 6.28% after many years of strong returns.

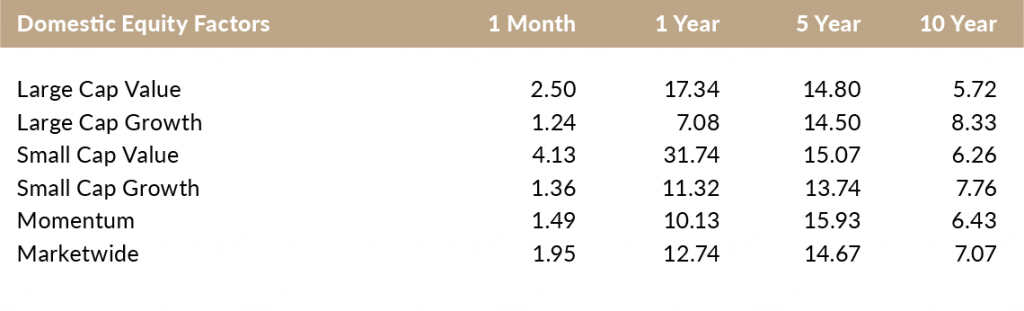

Commentary: Value Outperforms in 2016– In December, domestic value indices outperformed their growth counterparts. The return differential between small cap value and small cap growth was sizable in 2016, with value outperforming by slightly over 20%.

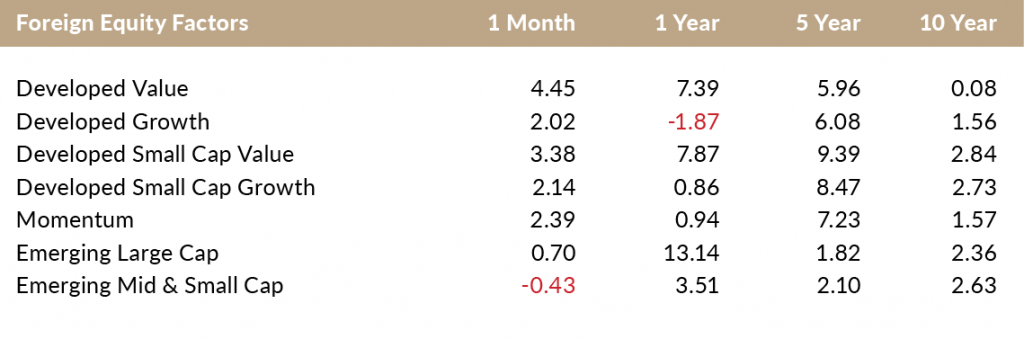

Commentary: Growth Lags in International Markets– In the international developed markets, value indices outperformed growth indices in December and for the year. Momentum’s return was flat in 2016 and smaller cap Emerging market companies failed to keep pace with their larger counterparts.

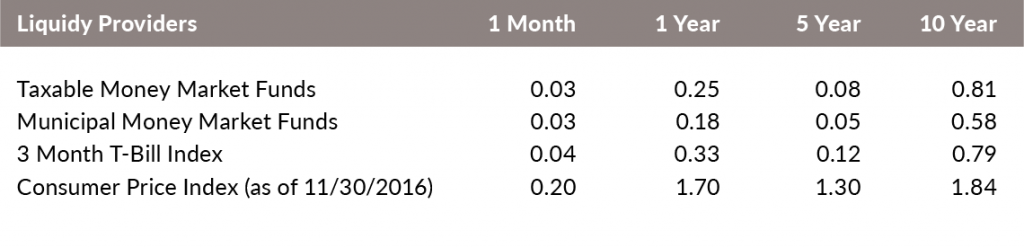

Commentary: Yields Still Historically Low– Money market funds continue to have very low yields, performing in line with the 3 month T-Bill Index. The yields failed to keep pace with changes in the Consumer Price Index.

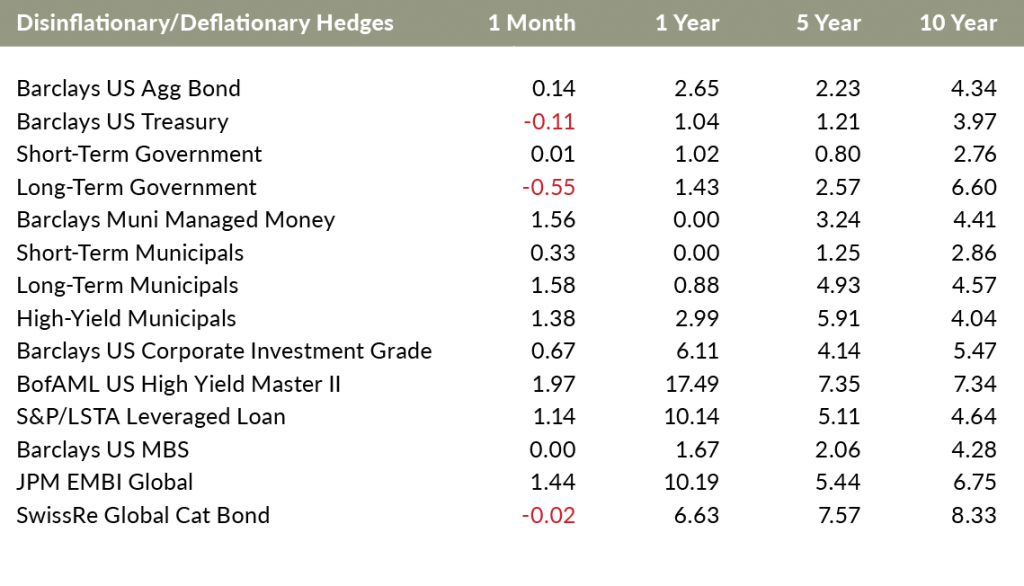

Commentary: Investors Rewarded for Taking on Credit Risk– The returns of deflationary hedges were positive across the board in 2016. High yield and emerging market bonds recorded the highest 2016 returns of 17.49% and 10.19%, respectively. Leveraged loans and catastrophe bonds had strong years as well.

Commentary: Inflation-Sensitive Investments Bounce Back in 2016– Inflation-sensitive investments were mostly positive for the month. Energy related investments, foreign inflation-indexed bonds, and commodities recorded strong 2016 returns.

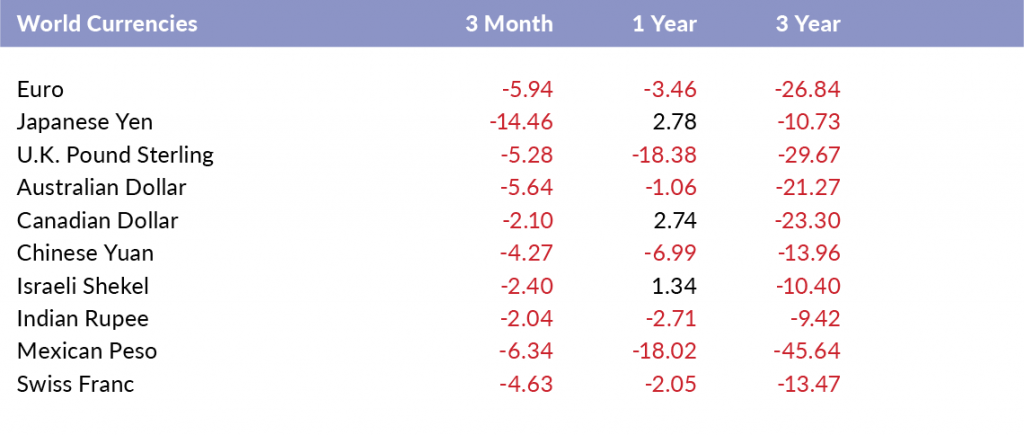

Commentary: The U.S. Dollar Continues its Rise– The U.S. dollar continued to appreciate against other currencies. The Japanese Yen, Mexican Peso, and Euro depreciated the most versus the USD over the past three months. The Pound and Mexican Peso had the biggest declines versus the USD in 2016. The magnitude of the dollar’s bull market against other world currencies is evident over the past three years.