Prepared by Brandon Yee and Thomas Connelly

Commentary

Commentary

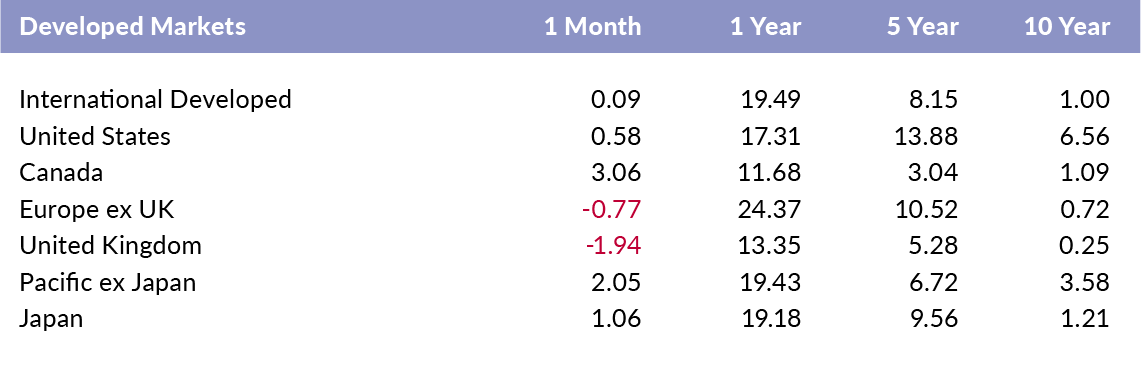

Developed Markets Flat in June– In the month of June, international developed markets were flat. Europe ex UK and the UK market dropped by 0.77% and 1.94%, respectively. The Japanese equity market edged up 1.06%, building upon its strong one year performance.

Commentary

Commentary

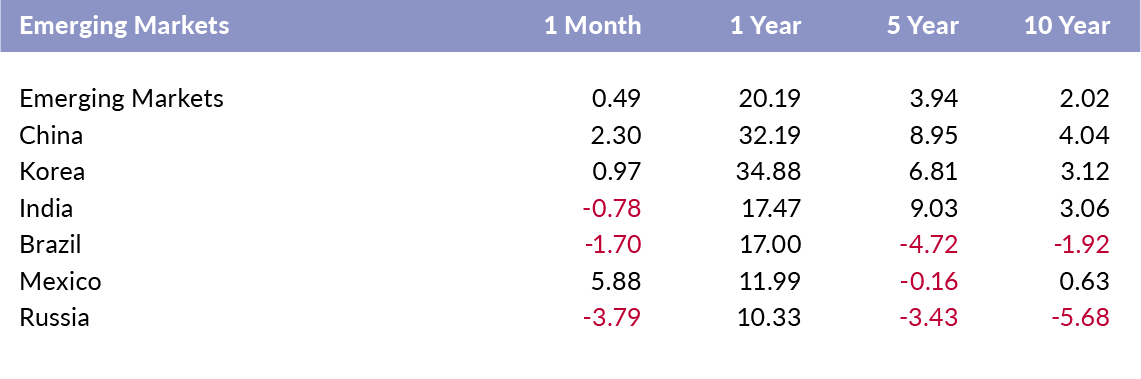

Mexico Records a Strong Month – Emerging markets recorded a gain of 0.49% for the month. Mexico and China had the largest gains of 5.88% and 2.30%, respectively. The Brazilian and Russian equity markets were again the biggest drags, recording losses of 1.70% and 3.79%, respectively.

Commentary

Commentary

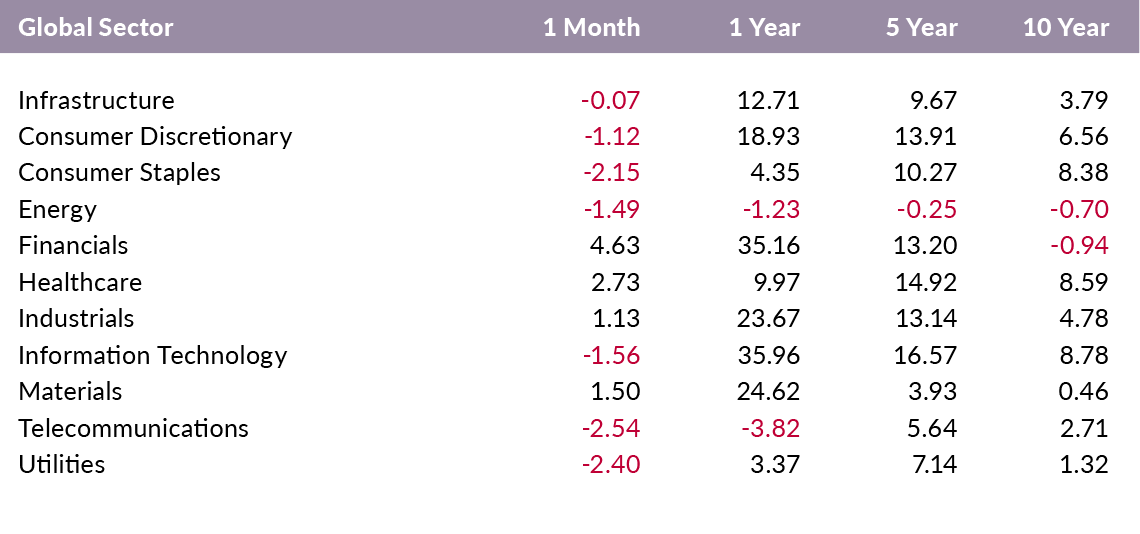

Telecommunications and Utilities Edge Lower– Financials and healthcare posted the strongest global sector returns of 4.63% and 2.73%, respectively. The telecommunications and utility sectors recorded losses of 2.54% and 2.40%.

Commentary

Commentary

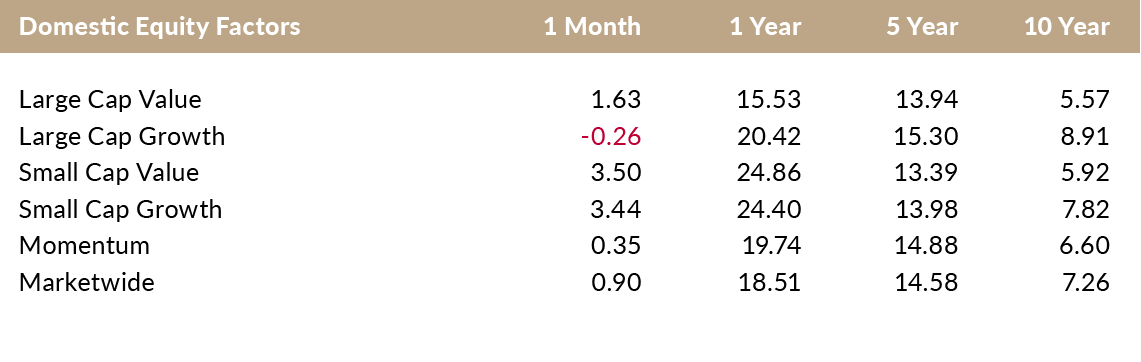

Value Outperforms Growth in June – In June, domestic value indices outperformed their growth counterparts. Over the past year, small-cap value has outperformed small-cap growth, but large-cap value has lagged large-cap growth.

Commentary

Commentary

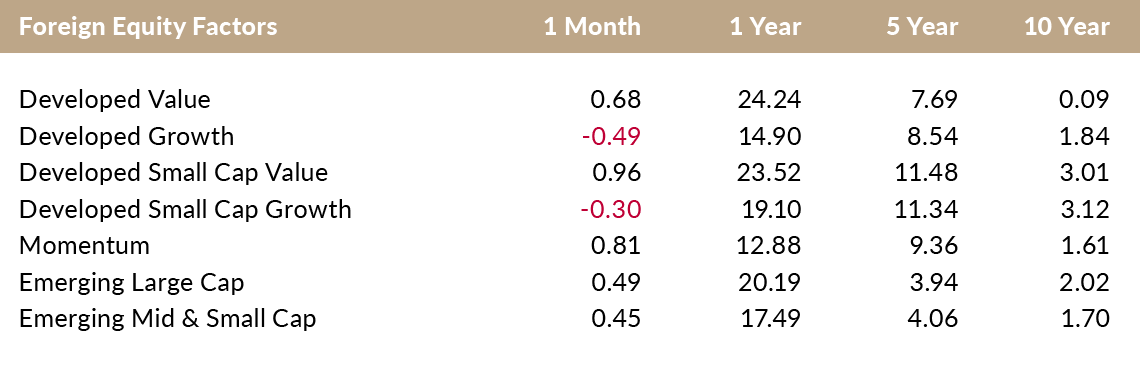

Growth Companies Lag in International Markets– In the international developed markets, value indices outperformed growth indices for the month. Momentum recorded a monthly return of 0.81%.

Commentary

Commentary

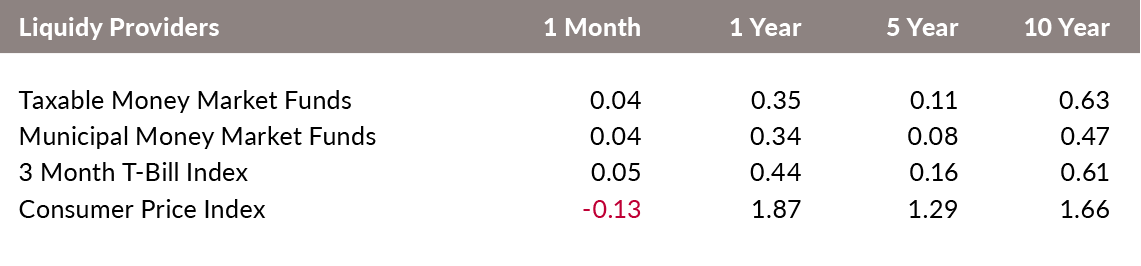

Money Market Yields Remain Low– Money market funds continue to have very low yields, performing in line with the 3 month T-Bill Index. The CPI fell by 0.13%.

Commentary

Commentary

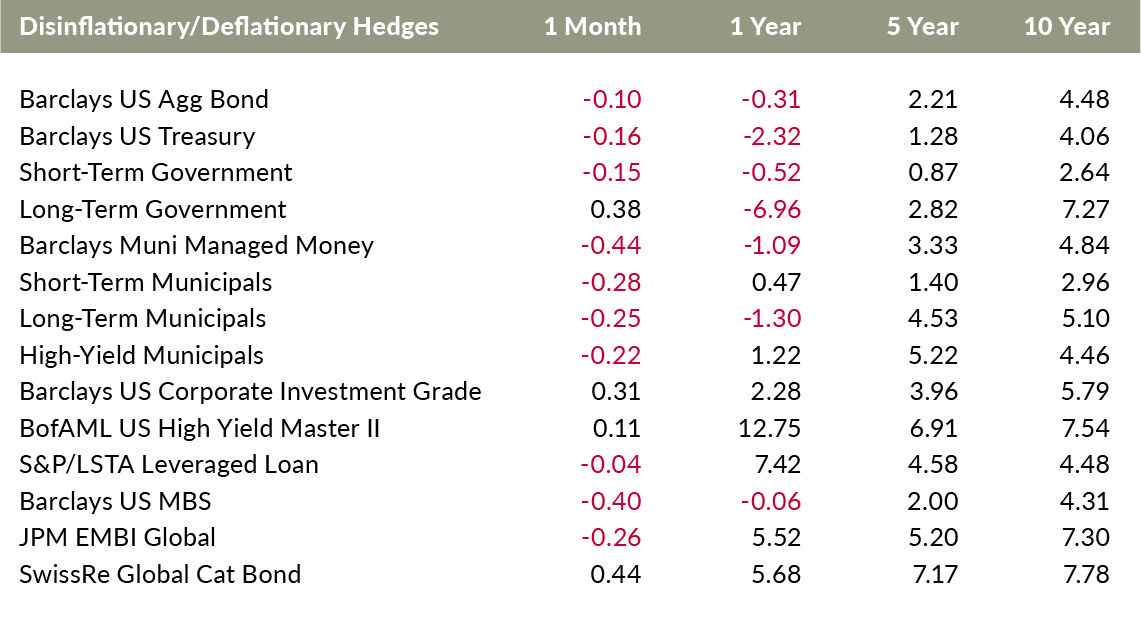

Catastrophe Bonds Edge Higher – The returns of deflationary hedges were mostly negative for the month. Catastrophe bonds and long-term government bonds recorded the strongest returns of 0.44% and 0.38%, respectively. Municipal bonds and mortgage-backed securities dropped the most in June.

Commentary

Commentary

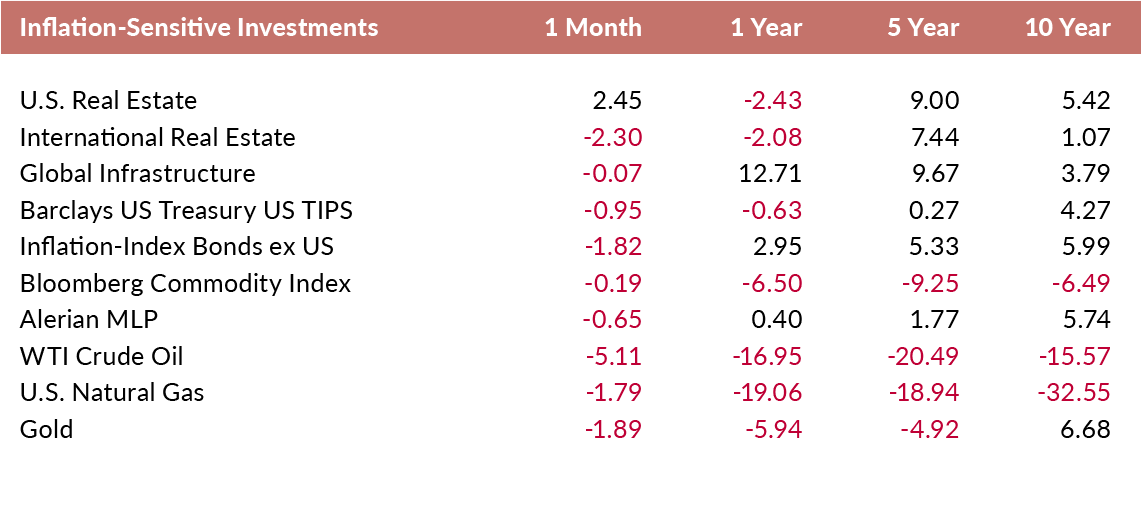

Oil Declines Sharply– Inflation-sensitive investment returns were mostly lower in June. U.S. real estate was up 2.45%. Oil and international real estate dropped by 5.11% and 2.3%, respectively. Gold was down 1.89%.

Commentary

Commentary

The Euro Climbs Back Versus USD– The Euro and Shekel appreciated the most versus the U.S. dollar over the past three months. The Japanese Yen depreciated by 1.91% versus the USD over the same time period.

[mk_fancy_text color=”#444444″ highlight_color=”#ffffff” highlight_opacity=”0.0″ size=”14″ line_height=”21″ font_weight=”inhert” margin_top=”0″ margin_bottom=”14″ font_family=”none” align=”left”]Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request[/mk_fancy_text]