Strategies to Help Stay the Course

Long-Term, Disciplined Investors Can Reap Rewards

Brandon Yee, CFA, CAIA, Versant Capital Management, Inc.

May 12, 2022

Investors may be feeling uneasy during the current period of high volatility in the financial markets brought on by geopolitical conflicts, record-high inflation in the U.S., and rising interest rates. Challenging economic times call for calm market analysis, staying on your long-term investing course, and remaining disciplined. Such steps have historically rewarded investors.

Diversifying globally and across different asset classes can help enhance an investor’s experience by reducing the emotional ups and downs that come with disruption. The following are general strategies and possible courses of action one can take.

1. Take a Step Back and Look at the Bigger Picture

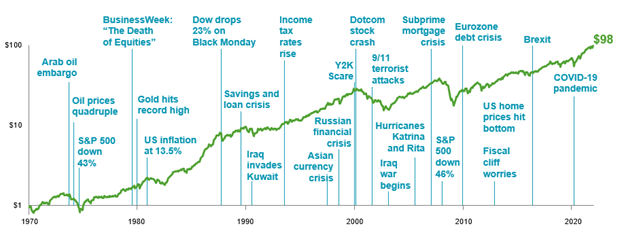

Periodic market volatility and declines are a normal part of investing. 2022 has been tough for investors due to high inflation, the conflict between Russia and Ukraine, and rising interest rates. However, the number and types of risks faced this year by investors are not new. History is replete with examples of challenging situations. Over the past fifty years, the world has weathered various geopolitical risks and financial crises (see graphic below). Yet, world stock investors would have grown from one dollar in 1970 to $98 by the end of 2021.

Markets Have Rewarded Discipline – Growth of a Dollar

MSCI World Index (net dividends), 1970-2021

Source: DFA

2. Avoid Attempting to Time the Market

People are naturally wired to avoid danger and flee if their livelihood is at risk. When faced with market declines, this instinct kicks in, and investors contemplate selling their investments and moving to cash. However, is moving to cash a good option for long-term investors? History has shown that reacting emotionally and moving to the sidelines would most likely be detrimental to portfolio performance as investors may miss out on some of the best-performing days.

If investors missed the five best days of the S&P 500 over the past thirty years, their annualized compound return would be reduced by 14.6% (see graph below).

Moving to Cash and Missing the Best Days Can Hurt Performance

Performance of the S&P 500 Index, 1990-2021

Source: DFA

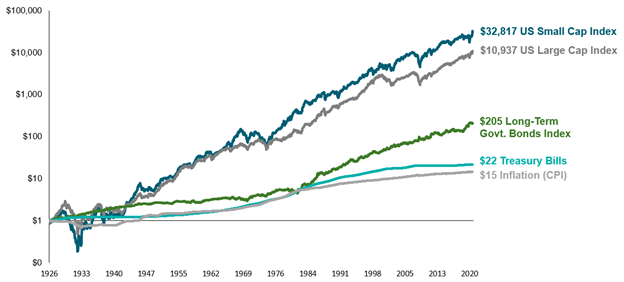

Some investors hold onto cash for months or even years at a time. Missing out on the best year of the S&P 500 from 1991 to 2021 would have reduced their annualized compound return by 18%. In addition, investors investing in only government bonds, Treasury Bills, or other ultra-safe assets would have materially lagged the equity markets and barely improved their purchasing power (see graph below) over the past hundred years.

Moving to Cash or Staying the Course

Monthly Growth of Wealth ($1), 1926-2020

Source: DFA

3. Focus on What You Can Control

What can investors do when faced with market declines or periods of high volatility?

Remember that market declines are pretty frequent and normal.

- Since 1951, the S&P 500 declined five percent or more about three times a year on average.

- S&P 500 declines of ten percent or more averaged about once a year and declines greater than 20% were less frequent but arose approximately once every six years. As of this writing, the S&P 500 is down 16.65% YTD.

Manage taxes and rebalance their investment portfolio to maintain their risk/return preference.

- Market volatility creates an opportune time to harvest losses (sell positions with losses), which creates a tax asset that can offset future gains.

- During periods of relative equity underperformance, investors may choose to sell fixed income or use cash and buy into equities to keep their portfolio in line with their target asset allocation, aka “buy low and sell high.”

Diversify globally and across asset classes to help reduce risk while giving up little in gains.

- Investors can invest in international stocks and bonds, inflation-sensitive investments like precious metals and commodities, or uncorrelated assets such as reinsurance and catastrophe bonds.

- At this writing, the S&P500 is down approximately 16.65% YTD, while the U.S. bond market is down 10.2% YTD. However, investors who diversified and focused on valuations, underweighted expensive markets, and diversified across asset classes have held up better this year.

What steps has Versant taken to help protect my financial situation during this market disruption?

We accept that volatility is a normal part of investing and focus on what we can control to help improve a client’s financial situation. Like when COVID-19-caused the market to drawdown in March of 2020, we have monitored portfolios to readjust and align with clients’ risk tolerance and harvested any material losses. Rebalancing during market declines and into markets that tend to have positive drift (go up over time) can especially benefit investors.

However, some of the most impactful steps to protect clients were proactively put into action before 2022’s drawdown. Over the past forty years, the investment environment has been dramatically influenced by declining interest rates, low inflation, and solid economic growth. These factors have been a performance tailwind to almost every financial asset: stocks, bonds, real estate, etc., during this period. Naturally, we asked the question: will the next forty years be like the last forty years? The answer was most likely not, and so we positioned portfolios accordingly.

For example, to protect against rising interest rates, fixed income allocations had shorter durations (less interest rate risk). To protect against unexpected inflation, we included natural resources equities, oil stocks, and gold-related investments in portfolios. Additionally, our focus on value stocks has helped tremendously given the sizable drawdown of growth stocks, especially technology stocks.

Final Thoughts

Markets declines and volatile markets are a normal part of the investor experience, but they can cause much anxiety. Remaining focused on long-term objectives and what we can control can improve outcomes and help alleviate that stress. Being diversified globally and across multiple asset classes and avoiding popular investments like NFTs, cryptocurrencies, etc., can help protect the investment portfolio you spent decades building.

Brandon Yee, CFA, CAIA – Senior Research Analyst

Brandon conducts investment due diligence for Versant Capital Management and designs and implements tools and processes to support the firm’s research. His biology and finance background helps him look at challenges from multiple angles, resulting in unique and well-rounded investment approaches and solutions.