Here’s the prescription

Improving someone’s financial health is a lot like improving their physical health. The challenges associated with pursuing a better financial outcome include diagnosis of the current situation, development of the appropriate course of action, and sticking with the treatment plan.

David R. Jones, Dimensional Fund Advisors

As much as I value the unfettered access to information the internet provides, I recognize the potential harm that too much information can cause. Take, for example, a friend of mine, who was experiencing some troubling medical symptoms. Typing her symptoms into a search engine led to an evening of research and mounting consternation. By the end of the night, the vast quantity of unfiltered information led her to conclude that something was seriously wrong.

One of the key characteristics that distinguishes an expert is their ability to filter information and make increasingly refined distinctions about the situation at hand. For example, you might describe your troubling symptoms to a doctor simply as a pain in the chest, but a trained physician will be able to ask questions and test several hypotheses before reaching the conclusion that rather than having the cardiac arrest you suspected, you have something completely different. While many of us may have the capacity to elevate our understanding to a high level within a chosen field, reaching this point takes time, dedication, and experience.

My friend, having convinced herself that something was seriously wrong, booked an appointment with a physician. The doctor asked several pertinent questions, performed some straightforward tests, and recommended the following treatment plan: reassurance and education. Not surgery. Not drugs. But an understanding of why and how she had experienced her condition. The consultative nature of a relationship with a trusted professional—both when a situation arises and as we progress through life—is one of the key benefits that an expert can provide.

There are striking parallels with the work of a professional financial advisor. The first responsibility of the doctor or advisor is to understand the person they’re serving so that they can fully assess their situation. Once the plan is underway, the role of the professional is to monitor the person’s situation, evaluate if the course of action remains appropriate, and help to maintain the discipline required for the plan to work as intended.

Like my friend’s doctor, advisors may have experienced conversations with clients that are triggered by news reports or informed by unqualified sources. In some cases, all that is required to help put the client’s mind at ease is a reminder to focus on what is in their control as well as providing reassurance and (re)education that they have a financial plan in place that is helping them move toward their objectives. The benefits of working with the right advisor are demonstrated through the ability to both help clients pursue their financial goals and to help them have a positive experience along the way.

Trouble might arise when we confuse simple and complex conditions. Probably no harm is done when a person, recognizing the onset of a common cold, takes cold medicine, drinks plenty of fluids, and rests. But had my self-diagnosing friend not made an appointment with a specialist, and instead moved from self-diagnosis to self-medication, she may have caused herself real harm. Similarly, thinking that all aspects of your own financial situation can be handled through a basic internet search or casual conversation with a friend might result in a less than optimal financial outcome.

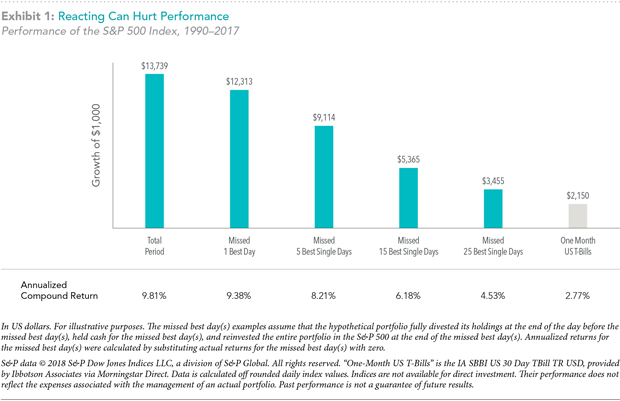

Without the guidance of an advisor, the self-medicating investor might overreact to short-term market volatility by selling some of their investments. In doing so, they risk missing out on some of the best days since there is no reliable way to predict when positive returns in equity markets will occur.1 One might think that missing a few days of strong returns would not make much difference over the long term. But, as illustrated in the graphic below, had an investor missed the 25 single best days in the world’s biggest equity market, the US, between 1990 and the end of 2017, their annualized return would have dropped from 9.81% to 4.53%. Such an outcome can have a major impact on an investor’s financial “treatment” plan.

Improving someone’s financial health is a lot like improving their physical health. The challenges associated with pursuing a better financial outcome include diagnosis of the current situation, development of the appropriate course of action, and sticking with the treatment plan. Many advisors are trained on the intricacies of complex financial situations and work to understand how their clients feel about money and how their clients might react to future events. By providing the prescription of reassurance and education over time, the right advisor can play a vital and irreplaceable role in their client’s lives.

- 1. The 2018 Mutual Fund Landscape report compiled by Dimensional showed that for the 15-year period through 2017, only 14% of US equity mutual funds and 13% of US fixed income mutual funds survived and outperformed their benchmark after costs. Refer to dimensional.com/perspectives/mutual-fund-landscape-2018for more information.

Dimensional makes no representation as to the suitability of any advisor, and we do not endorse, recommend, or guarantee the services of any advisor, including those in the Find an Advisor portion of our website. Investors should carefully and thoroughly evaluate any advisor whom they consider hiring or working with. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. Results for other time periods, including shorter time periods, may include losses. Dimensional Fund Advisors LP (“Dimensional”) is an investment advisor registered with the Securities and Exchange Commission. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. This content is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation or endorsement of any particular security, products, or services.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.