Looking Ahead

4th Quarter Market Observations

By Thomas J. Connelly, CFA, CFP

Chief Investment Officer

I would like to begin by emphasizing that, currently, most markets are far from bubble-like pricing. There are investment opportunities for patient investors with long time horizons. It is crucial to be mindful of costly, media-driven, and leveraged investments, given evolving refinancing risks and the lingering potential for an economic downturn. As part of our routine practice, our investment analyst team continuously evaluates the global investment opportunity set for our client portfolios.

Investment markets during times of war, historically and today

“Many years ago, I learned from one of our diplomats in China that one of the principal Chinese curses heaped upon an enemy is ‘May you live in an interesting age.” -Frederic Coudert, 1939

Throughout my life, this sentiment, sometimes uttered tongue in cheek, expressed hope that one would live an interesting life. Imagine my surprise learning that it was attributed to an ancient Chinese curse.

Now, 1939 would certainly make my top three for “interesting times.” Today is undoubtedly interesting, but the eve of WWII, with Germany and Russia jointly carving up Poland and Japan trying to subdue China in a ground war, must have been frightening, even without the specter of nuclear weapons. Between 70 and 85 million people died during that war, over half in the Soviet Union and China.

Today’s “interesting times” revolve around local and global politics, armed conflict, election politics, and the threat of recession instigated by rising interest rates and inflation. In summary, we believe that current events do not pose an existential risk to your personal or financial safety at this point. We will briefly address each of these events, and will, of course, constantly monitor for material changes in world geopolitics and financial markets.

Our concerns are fanned and amplified by media business models catering to every political persuasion with foreign interference and influences. These business models generate revenue in proportion to the positive or negative emotion they invoke in us. While our current mix of concerns is valid, I would much rather be here now than in Europe in 1914 or anywhere in 1929 or 1939.

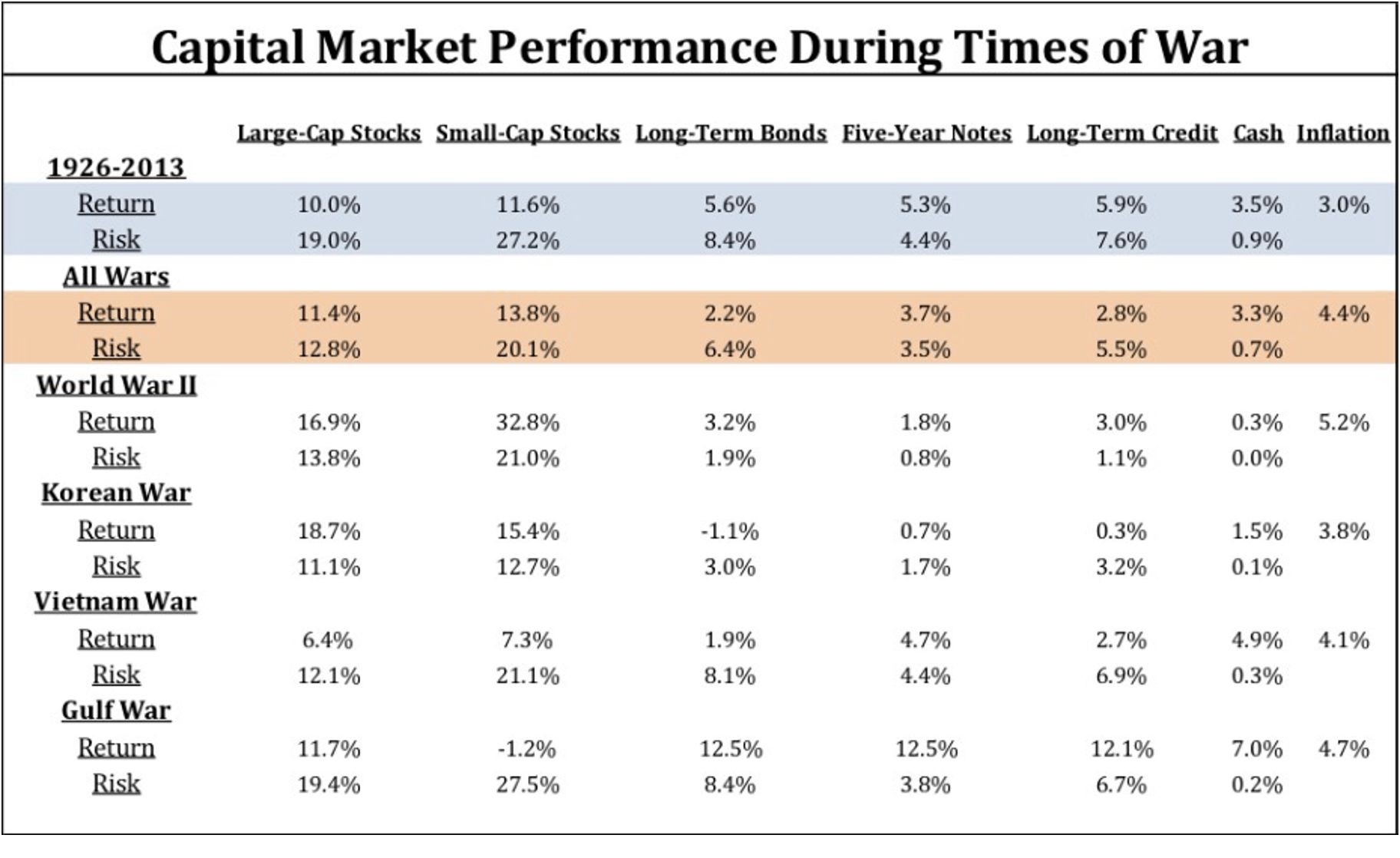

What were US investment market returns during the great wars of the modern age? Mark Armbruster looked at a piece published on August 29th, 2017, in the CFA Institute’s Enterprising Investor blog. Surprisingly, average market returns were positive in the vast majority of asset classes in every war.

Apart from the Vietnam War, stock market returns were strongly in double digits. Certainly, major wars have not been an obstacle to economic progress or markets in the past, except for the countries where war was waged.

Sources – The indices used for each asset class are as follows: the S&P 500 Index for large-cap stocks; CRSP Deciles 6-10 for small-cap stocks; long-term US government bonds for long-term bonds; five-year US Treasury notes for five-year notes; long-term US corporate bonds for long-term credit; one-month Treasury bills for cash; and the Consumer Price Index for inflation. All index returns are total returns for that index. Returns for a war-time period are calculated as the index’s returns four months before and during the entire war. Returns for “All Wars” are the annualized geometric return of the index overall “war-time periods.” Risk is the annualized standard deviation of the index over the given period. Past performance is not indicative of future results.

Sources – The indices used for each asset class are as follows: the S&P 500 Index for large-cap stocks; CRSP Deciles 6-10 for small-cap stocks; long-term US government bonds for long-term bonds; five-year US Treasury notes for five-year notes; long-term US corporate bonds for long-term credit; one-month Treasury bills for cash; and the Consumer Price Index for inflation. All index returns are total returns for that index. Returns for a war-time period are calculated as the index’s returns four months before and during the entire war. Returns for “All Wars” are the annualized geometric return of the index overall “war-time periods.” Risk is the annualized standard deviation of the index over the given period. Past performance is not indicative of future results.

One of the comforting observations arising from recent conflicts is the inability of any nation except the U.S. to project force and maintain a meaningful presence beyond our borders. It takes a well-trained, equipped, and logistically supported force and the ability to transport and protect supply lines. The Russians have proven they cannot tick off any of these boxes, being mired down in Ukraine after a failed attempt at blitzkrieg. They certainly cannot project meaningful and enduring force in Europe in the face of NATO opposition after being exposed as a paper tiger in Ukraine. The Chinese are a danger to their immediate neighbors but cannot project force without an ocean-going navy. So, we are left with a cold-war environment where wars are waged by proxy and not engaged by the main combatants.

The horrible recent events in Israel and Gaza threaten to involve more regional players, which could impact traditional energy flows and local trade in the near term. Over the past few years, we have increased our exposure to producers of traditional energy sources which have proved to be hedges against some types of unexpected inflation in the past and should respond well to any market disruptions due to conflicts in the Middle East. Despite last year’s positive performance, resource stocks are still not expensive relative to their earnings and have the additional benefit of being attractive investments.

The takeaway is that geopolitics makes good grist for news and conversation but has had little discernable long-term negative impact for markets not directly involved.

Political impacts on investment markets

The observation that markets move forward during armed conflict applies even more to political machinations. As we have shown in past pieces and videos, stock market returns are similar regardless of which political party holds power in the Oval Office or either branch of the legislature. We will revisit and update this topic next year before the presidential election. Politics were at the forefront during the founding of the country and the Civil War period but faded into the background during most of our history as far as markets are concerned.

Look back on all the political drama of the past 30 years. The most significant event was the decline of interest rates from 1981 from over 15% to below 1% during the COVID crisis. This formed the backdrop behind technological progress, businesses being formed, new consumer needs and wants created and satisfied, and so on. Apart from the decline in interest rates, these processes continually raise our standard of living and will continue unless we terminate the underlying conditions that make them possible.

There is little evidence of that happening, although some concerning precedents are being set. The determination of the House of Representatives speakership is a short-term concern that will be solved. The US will pay its debt and obligations. The bond rating agencies will certainly consider the difficulties in resolving these issues, which might influence the future cost of debt service. However, none of these concerns are existential except to a news media that needs grist for its drama mill. The two front-running candidates and the addition of Bobby Kennedy running as an independent sure make for some interesting cocktail conversation!

Recessions

The Wall Street Journal recently published an article titled “A Recession is No Longer the Consensus.” In its latest quarterly survey, the recession probability within the next 12 months has declined from over 60% to 48%. The consumer is at the heart of this. Almost 70% of the US economy is generated by consumer spending. There is still some cash left over from the COVID spending programs that targeted consumers. Consumer debt loads are still low, and real wages have been increasing.

The important thing to remember about recessions is that market declines precede a recession by an average of five to seven months and start to recover when the news is gloomiest. Getting the timing right on both events is unlikely, and many investors will do more harm than good in trying. A true sign of market skill is getting the timing right during multiple recessionary periods. Isn’t it amazing that we spend so much time and energy talking about “recession,” yet there is no discussion of professional investors who consistently get it right?

If markets are not priced for perfection (Japan in 1989 or the US in early 2000, for example), it makes more sense from an investment, tax, and cost perspective to stay put and not try to time the uncertain markets. Stock market returns exhibit a positive trajectory due to earnings growth and income distributions. Leaving a positive drift game for an uncertain benefit is indeed a risky strategy.

Interest rates and inflation

The most important questions influencing future real investment returns revolve around the recent volatility of interest rates and inflation. Inflation is decelerating, but some aspects of core inflation are proving to be sticky. Energy and food price changes have been extremely volatile and will continue to display large moves in both directions. Bond markets are currently projecting inflation will average 2.3% over the next ten years, largely in agreement with economists surveys (for example, https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q3-2023).

We believe inflation will continue to subside in the short- and perhaps medium-term. The money supply is contracting, and the Federal Reserve is selling bonds back to the market from its holdings. Both actions are contractionary in the short run. The impetus for future inflation will likely come from government actions responding to economic or financial crises. Historically, traditional responses to market downturns have included lowering interest rates and increasing fiscal deficits.

After the Great Financial Crisis, the Federal Reserve created money to buy back US treasury and mortgage bonds to keep interest rates low. During the COVID crisis, the Treasury put cash into the pockets of consumers and businesses directly while raising debt. In our opinion, this was the proximate cause of the inflation of the last few years.

Government interventions in the future will be biased towards inflationary money printing. We are already running a deficit of over 5.7% during the height of an expansion; we should be running a surplus and retiring debt under these conditions. During the next downturn, we will have some room to lower interest rates again, but how much more spending and borrowing can we do at the expense of future generations? How much will the bond markets allow before demanding higher rates?

Indeed, we believe that the 2023 rise in medium- and long-term interest rates owes much to the never-ending supply of debt issuance by the US Treasury to fund the deficit and replace debt for the quantitative tightening policy at the Fed, not to mention the funding shortfalls of Social Security, Medicare/Medicaid, and the rising cost of financing our debt. Since we are still determining where long-term inflationary and interest rate pressures will fall out, we prefer shorter-term debt in our portfolios with a de-emphasis on credit risk in case recessionary conditions evolve. Markets spreads for credit risk are not attractive enough at this point.

Concerning future inflation, we believe the risk of unexpected inflation is higher than the consensus of 2.3%. The danger of additional fiscal excess and money printing in response to the next crisis is high. Additional portfolio exposure to investments that traditionally perform well in the face of unexpected inflation is warranted.

Opportunities

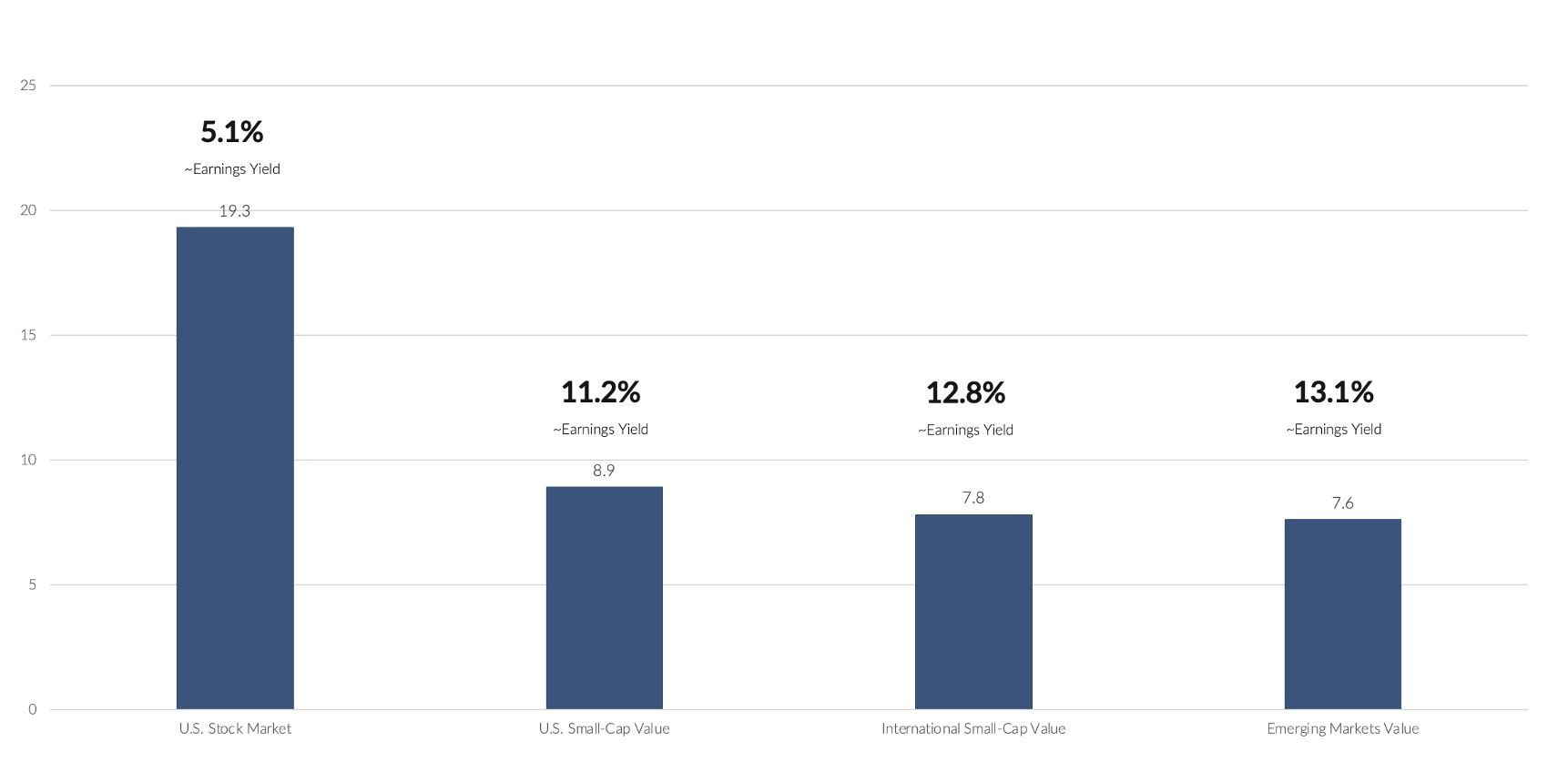

While there is no shortage of negative news, we believe there are opportunities in markets today. Hiding in plain sight are double-digit earnings yields for domestic and foreign small company value and emerging market stocks. The bar chart below depicts values trailing twelve months’ price-earnings ratios as of June 30, 2023.

Source – U.S. stock market, U.S. small-cap value, international small-cap value, and emerging markets value represented by VTSMX, DFSVX, DISVX, and DFEVX, respectively.

These earnings yields and corresponding low valuations are just a short distance from the depths of the Great Financial Crisis in 2008-9. With increased yields from the quality sectors of the bond market, attractively priced inflation-sensitive stocks, and tilts toward value-oriented global small company stocks, we believe reasonable returns are still possible with portfolios far from priced for perfection.

As always, if you have any questions about your investment portfolio or your overall wealth plan, please don’t hesitate to reach out to me or your wealth advisor.

Thomas Connelly, CFA® CFP®, founder and chief investment officer at Versant Capital Management, formulates the investment policy, supervises portfolio management with the Investment Committee, and helps our clients interpret and understand the firm’s investment philosophy.

DISCLOSURE: For complete information on your tax situation, you should consult a qualified tax advisor. While Versant Capital Management doesn’t offer tax advice, we are familiar with certain tax situations that our clients face regularly. Disclosure: Any tax-related material contained within this document is subject to the following disclaimer required pursuant to IRS Circular 230: Any tax information contained in this communication (including any attachments) is not intended to be used and cannot be used for purposes of (i) avoiding penalties imposed under the United States Internal Revenue Code or (ii) promoting marketing or recommending to another person any tax-related matter.