By Tom Connelly, Versant President & CIO

2016 has begun with investment markets down across the globe and investors in a very troubled state of mind. The S&P 500 is down more than 8 percent year to date, and has lost more than 10 percent of its value over the past three weeks. But rarely have we witnessed this level of investor concern outside of an outright recession or financial crisis. We urge you to keep two things in mind before panic sets in. First, we’ve seen this before. Stock market decline is common, and is often erased by subsequent market activity. With an eye on the longer term, history has shown that the stock market always comes back. Second, Versant is here for you. We are rebalancing your portfolio back to your long-term strategy targets, maximizing tax loss selling opportunities, and finding ways to maximize your gains over the long term in this uncertain time. As always, we are happy to meet with you anytime to discuss your concerns and help you navigate this turmoil as comfortably as possible.

Let’s begin with a little perspective.

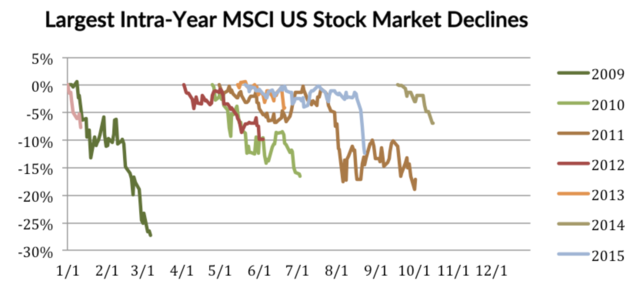

Stock market declines have happened every year in the U.S. since the end of 2008, at some point during the year. In stock markets, volatility comes with the territory. S&P declines ranged from -17 percent in 2011 (April 30th-Octber 2nd) to -4 percent (May 11 – June 21) in 2013, yet total returns each year between 2009 and 2015 ended up positive. In fact, since 1950, the U.S. market has experienced a drawdown of between -5 percent and -10 percent in 35.5 percent of all calendar years. After the great run the market has had since 2009 a few stumbles or even negative years are not surprising.

Not only that, but would it surprise you to learn that the S&P has fallen in each of the past two January’s as well? In January of 2015 the S&P fell -3.00 percent and in 2014 January posted a loss of 3.46 percent, and market returns ended up being positive for each year. Since 1999, only 33 percent of the years in which January was negative for the S&P 500, the year ended up negative as well. This means that two-thirds of the time, a negative January ended up in a positive finish for the year. Since 1926, this indicator was only correct 47 percent of the time, less than a coin toss.

The key takeaway is that losses happen every year and are usually erased by subsequent market movements. If January 2016 finishes in the red it will mean three consecutive years of negative returns in January, with the previous two years finishing in the black. Not unusual.

Long-term Commitments

The other part of the perspective piece is to remember that resources invested in stock markets are long-term commitments to markets. Our financial system will not function in the long run if returns to bonds do not exceed returns to cash, and returns to stocks do not exceed returns to bonds. But this doesn’t mean that every day, every month, or even every year stocks will outperform cash and bonds. Since no one can predict all future events that will impact markets, we must stay invested in order to harvest the superior long-term average returns equity markets have typically offered. Your portfolio commitment to equities consists of funds that will not be required for use for at least five years. We have determined that your resources will be sufficient to meet your goals, with some market turbulence along the way expected. Rather than focus on intermittent financial turbulence, which is always present, focus on your long-term goals, and leave concerns about short-term market movements to the speculators.

Overcoming Fear

We know this is a difficult process and our primal instincts of fear and flight are triggered when there is a perceived threat to our resources. In times of distress investors look to markets and current events to tell them what is going on. Human beings can usually deal with one negative; but they tend to lose their heads in the face of multiple threats. When these conditions persist, the feelings of fear magnify and people shut down or even panic may set in. In these moments we are our own worst enemies in the investment arena. The way to combat fear is to engage our critical faculties. You can go back in history and examine every major bear market, every major market decline and observe that the stock market has always come back at some point. Many investors and media pundits apparently believe that this is the first time in history where a market recovery isn’t going to happen. We intend to stay in our seats and decline to join the panic.

Market doomsayers are currently carrying the day. The reason you are reading this piece is that you are concerned about many of them. But what our clients really want to know is: is this the big one?

Our answer is: We don’t think so, not by a long shot. Since the press seems to be beholden to all the negatives, I’ll focus on some positives you may not have heard about. First of all, the U.S. economy is quite strong. In summary, it is exhibiting strong personal income growing faster than spending, suggesting accelerating spending ahead. The Index of Leading Economic Indicators is rising, there are record high job openings, a new low unemployment rate, record low weekly unemployment claims, strong non-manufacturing PMI, strong real wage gains, car sales blowout, rising housing starts, strong household balance sheets, and a record low household financial obligations ratio. Hardly the stuff of recessions. There are also solid signs that growth may be picking up in Europe and Japan-very similar to the “green shoots” environment in the US in 2010.

Global View

The Chinese economy and market are important but not the defining factor as to what happens to the economy or markets here or abroad. Exports of goods and services to China from the U.S. equate to less than 1 percent of US GDP, and less than 2 percent of S&P 500 corporate sales are directly attributable to China, according to Goldman Sachs. Peripheral Asia is much more economically interdependent with China than the U.S. is.

Add to this list the huge dividend to world consumers from the decline in oil and commodity prices, still feeding back through the world economy, the positive competitive effects from the decline in the US dollar for the rest of the world, and the fact that government spending will be a net positive globally for the first time since 2009.

Perhaps the biggest positive are stock market valuations outside of the US. Emerging stock markets have been driven down in value to levels last seen in the financial crisis. A dollar of corporate earnings in Europe costs much less than in the US. Low valuations are often a portent of higher future returns, and dividend yields in Europe are much higher than bond yields on average. It is great comfort that, after a period of extensive government intervention and monetary expansion, investment opportunities are still available that offer the prospect of meaningful future returns.

Understanding Valuation

Against this backdrop we do have a stock market experiencing a decline in US corporate profitability from previously record high levels. Most of the decline is from the energy industry. Using traditional valuation measure, the trailing twelve-month price earnings ratio and the Cyclically Adjusted Price Earnings ratio, the market is reasonably valued going back to 1990, and expensive (but far from “Bubble territory) going back to the 1880s. Foreign stock market valuations using the same metrics range from average to cheap in Europe and Asia to downright cheap by any measure for emerging markets. At today’s valuations, sustained bear markets rarely happen except in circumstances of extreme inflation or deflation. It is the latter that occupies the market’s concern right now. In our opinion the world’s governments and central banks will do everything they can to avoid a deflationary spiral.

Versant’s Outlook

Our suggestions for going forward into 2016 are the following. In our opinion, the odds of a US downturn, much less another global crisis, are small at this time. Do not join the panic and firesale your growth assets. Take advantage of those who have to firesale their assets. Do take advantage of tax loss selling opportunities. We do this for you as a matter of course. Rebalance your portfolio back to your long-term strategy targets. We also do this for you as a matter of course. This will necessitate selling assets that have done relatively well into those asset classes that have the bad headlines today. Don’t worry about that, you don’t get good prices with good news. Do not be afraid of funding, or even increasing your allocation to foreign markets at this time. They are where the superior valuations and thus higher long-term returns are in our opinion.

This is certainly a difficult time in the financial sphere, and your concerns are very important to everyone who works at Versant. Please feel free to email, call, or schedule a meeting with us here to discuss current market issues, your portfolio, or changes in you personal circumstances. We will be in touch with each of you shortly to schedule annual update meetings.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.