[vc_row][vc_column][vc_column_text responsive_align=”left”]U.S. Long-Term Asset Returns: The search for perspective

Brandon Yee, Research Analyst

On a monthly basis, Versant Capital Management provides clients with total investment return data for different asset classes across multiple dimensions. We include one-month, one-year, five-year, and ten-year return data points to provide perspective and most importantly, a tool to help you manage the constant and increasingly intense stimuli from the various financial news outlets. The impact of events such as elections, natural perils, or health scares on financial markets can easily be assessed.

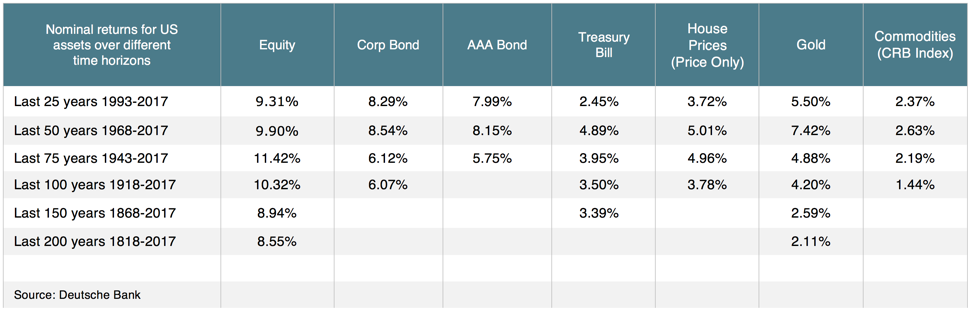

However, a ten-year period is still short relative to the long history of financial markets. Deutsche Bank1 recently released a long-term asset return study, which looks at asset class returns over the past two hundred years. Table 1 summarizes the nominal returns for U.S. assets over various time horizons.

What conclusions can we draw from Table 1?

What conclusions can we draw from Table 1?

- All of the returns across the different asset classes and time horizons are positive on a nominal basis.

- The returns within the same asset class are remarkably similar across the different time horizons.

- Investors were generally rewarded for taking on more risk. Equities outperformed corporate bonds. Corporate bonds outperformed AAA bonds, which outperformed Treasury Bills. Interestingly, housing price returns were very similar to Treasury bill returns on a price only basis. However, another study conducted by Oscar Jorda et al. concluded that the returns from residential housing were similar to equities when taking into account rental income.2

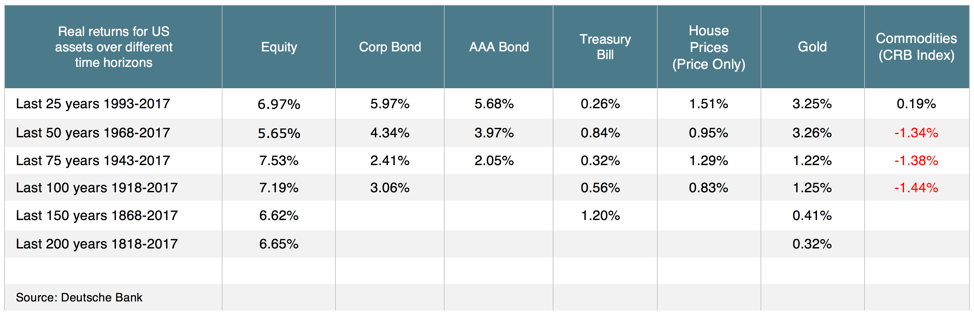

What do the returns look like when we take inflation into consideration (Table 2)?

The first observation from above no longer holds true. Commodities had negative real returns in the 50-year, 75-year, and 100-year time horizons. Housing and Treasury Bills barely broke even while gold returns only became competitive once the convertibility of the U.S. dollar to gold was terminated in 1971.

After looking at these returns, some may ask, why not construct a 100% equity portfolio and call it a day? Some people are close to retirement, and protection of principal is important. The U.S. equity market had three decades when real returns were negative, 1910-1919, 1970-1979, and 2000-2009. Can you comfortably meet your future liabilities with a ten-year annualized return of negative 3.42% return after taking inflation into account?

Future returns may look nothing like these historical returns, but it is still important to gain perspective on how markets have performed over different time horizons. Having this perspective can give rise to important questions, such as:

- Can we expect these long-term returns in our current environment?

- Has there been a regime change in the economic processes that generate returns that would make a certain asset more or less attractive relative to its historical performance?

- Why do millennials prefer cash when returns have been so meager?

Next month we will take a look at the returns in international developed and emerging markets.[/vc_column_text][vc_column_text responsive_align=”left”][mk_fancy_text color=”#444444″ highlight_color=”#ffffff” highlight_opacity=”0.0″ size=”14″ line_height=”21″ font_weight=”inhert” margin_top=”0″ margin_bottom=”14″ font_family=”none” align=”left”]

1Reid, Jim, Nick Burns, Sukanto Chanda, and Craig Nicol. 2017. “Long-Term Asset Return Study: The Next Financial Crisis.” Deutsche Bank Markets Research.

2Jorda, Oscar, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, Alan. M. Taylor. 2017. “The Rate of Return on Everything, 1870-2015.[/mk_fancy_text][/vc_column_text][vc_column_text responsive_align=”left”][mk_fancy_text color=”#444444″ highlight_color=”#ffffff” highlight_opacity=”0.0″ size=”14″ line_height=”21″ font_weight=”inhert” margin_top=”0″ margin_bottom=”14″ font_family=”none” align=”left”]

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request[/mk_fancy_text][/vc_column_text][/vc_column][/vc_row]