[vc_row][vc_column width=”2/3″ css=”.vc_custom_1498685691432{padding-top: 50px !important;}”][vc_column_text]

Churchill and Orwell: The Fight for Freedom

Churchill and Orwell: The Fight for Freedom is described as a dual biography of Churchill and Orwell, who preserved democracy from the threats of authoritarianism, from the left and right alike.

Publishing house Penguin Random House:

Both George Orwell and Winston Churchill came close to death in the mid-1930’s—Orwell shot in the neck in a trench line in the Spanish Civil War, and Churchill struck by a car in New York City. If they’d died then, history would scarcely remember them. At the time, Churchill was a politician on the outs, his loyalty to his class and party suspect. Orwell was a mildly successful novelist, to put it generously. No one would have predicted that by the end of the 20th century they would be considered two of the most important people in British history for having the vision and courage to campaign tirelessly, in words and in deeds, against the totalitarian threat from both the left and the right. In a crucial moment, they responded first by seeking the facts of the matter, seeing through the lies and obfuscations, and then they acted on their beliefs. Together, to an extent not sufficiently appreciated, they kept the West’s compass set toward freedom as its due north.[/vc_column_text][/vc_column][vc_column width=”1/3″ css=”.vc_custom_1498685962415{padding-top: 50px !important;}”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column css=”.vc_custom_1498686120953{padding-top: 30px !important;}”][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column css=”.vc_custom_1498686120953{padding-top: 30px !important;}”][vc_column_text]

HumbleDollar

The HumbleDollar is a blog edited by Jonathan Clements, a financial writer and author that I greatly admire. The objective of the blog is to ” tell you everything you need to know about money—all in one place, and without the hype and hollow promises that characterize so much financial writing.”

From the site:

Managing money may be simple, but it isn’t easy. Most of us struggle to save diligently, invest intelligently and figure out what will make us happy.

Want a happier, more prosperous financial future? We advocate a relentless focus on the things you can control. Try to spend thoughtfully, save diligently, hold down investment costs, minimize taxes, avoid unnecessary investment risk, buy insurance against major financial threats and give some thought to your heirs. And as you do all of these things, keep an eye on the big picture, so you don’t shortchange one of your financial goals or end up with a yawning gap in your insurance coverage.

Recent post topics include personal finance, whether you really need an emergency fund in retirement, “hidden gems” that can save you a lot of money, and tax breaks that can accelerate deduction for 2018 in 2017.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column css=”.vc_custom_1498758893005{padding-top: 50px !important;}”][vc_column_text]

How to Break Your Smartphone Addiction

In many ways technology is revolutionary, and there’s one device that has transformed our lives — the smartphone. They are with us most of the time, they record our life events, and offer us easy access to information. But they can also make us feel anxious when we don’t have our phone in-hand, and they can interrupt our work and free time.

In many ways technology is revolutionary, and there’s one device that has transformed our lives — the smartphone. They are with us most of the time, they record our life events, and offer us easy access to information. But they can also make us feel anxious when we don’t have our phone in-hand, and they can interrupt our work and free time.

New York University marketing and psychology professor Adam Alter discusses his new book, Irresistible: The Rise of Addictive Technology and the Business of Keeping Us Hooked in this podcast (with transcript). Alter explains how we are hardwired for addiction and what to do about it.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column css=”.vc_custom_1498758893005{padding-top: 50px !important;}”][vc_column_text]

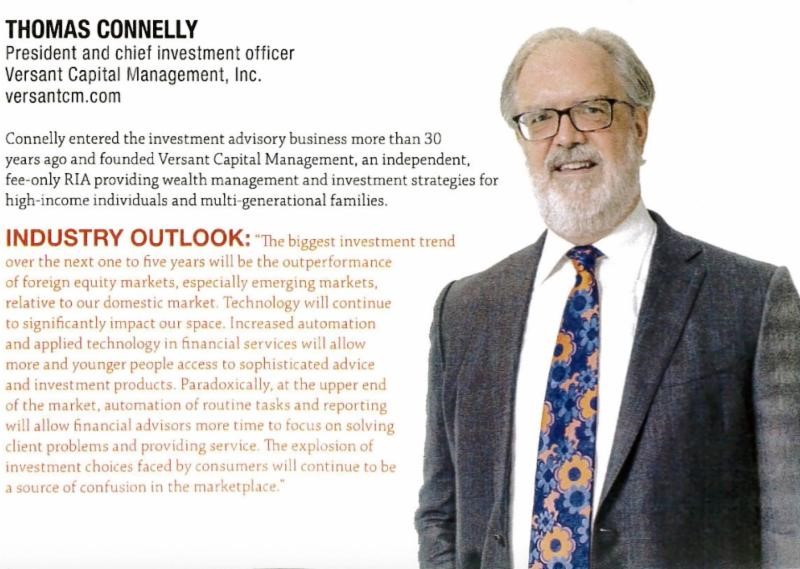

What Tom’s saying – Arizona Business Magazine

Tom was recently featured in Arizona Business Magazine’s 2018 edition of “Arizona Business Leaders,” where he provided a industry outlook:

[/vc_column_text][vc_empty_space height=”50px”][vc_column_text]Tom Connelly is the President and Chief Investment Officer at Versant Capital Management, Inc. His background is not only financial – he has considerable interests other than just making money. His broad curiosity informs and inspires Tom to create an expansive context to investment numbers, which leads to deeper and more strategic conversations with clients.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column css=”.vc_custom_1498687253490{padding-top: 50px !important;}”][vc_column_text][mk_fancy_text color=”#444444″ highlight_color=”#ffffff” highlight_opacity=”0.0″ size=”14″ line_height=”21″ font_weight=”inhert” margin_top=”0″ margin_bottom=”14″ font_family=”none” align=”left”]Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.[/mk_fancy_text]

[/vc_column_text][vc_empty_space height=”50px”][vc_column_text]Tom Connelly is the President and Chief Investment Officer at Versant Capital Management, Inc. His background is not only financial – he has considerable interests other than just making money. His broad curiosity informs and inspires Tom to create an expansive context to investment numbers, which leads to deeper and more strategic conversations with clients.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column css=”.vc_custom_1498687253490{padding-top: 50px !important;}”][vc_column_text][mk_fancy_text color=”#444444″ highlight_color=”#ffffff” highlight_opacity=”0.0″ size=”14″ line_height=”21″ font_weight=”inhert” margin_top=”0″ margin_bottom=”14″ font_family=”none” align=”left”]Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.[/mk_fancy_text]

[mk_fancy_text color=”#444444″ highlight_color=”#ffffff” highlight_opacity=”0.0″ size=”14″ line_height=”21″ font_weight=”inhert” margin_top=”0″ margin_bottom=”14″ font_family=”none” align=”left”]Disclaimer: The opinions in the articles and books and on the websites referenced are for general information only. Neither Versant Capital Management, Inc. (VCM) nor any of its affiliates or employees makes any warranty, express or implied, or assumes any liability or responsibility for the accuracy, completeness, regulatory compliance, or usefulness of any information, tools, resources or process described, or represents that its use would fully protect against cyber security incidents, including but not limited to system breaches, compromise of firm security and/or improper access to confidential information. The article contains links to content that is available on third-party websites. Please note that VCM does not endorse these sites or the products and services you might find there.[/mk_fancy_text]

[/vc_column_text][/vc_column][/vc_row]