Monthly Market Report: July 2022

Markets Rally in July

Prepared by Brandon Yee, CFA, CAIA, and Thomas Connelly, CFA, CFP

DEVELOPED MARKETS

Developed Markets Rebound

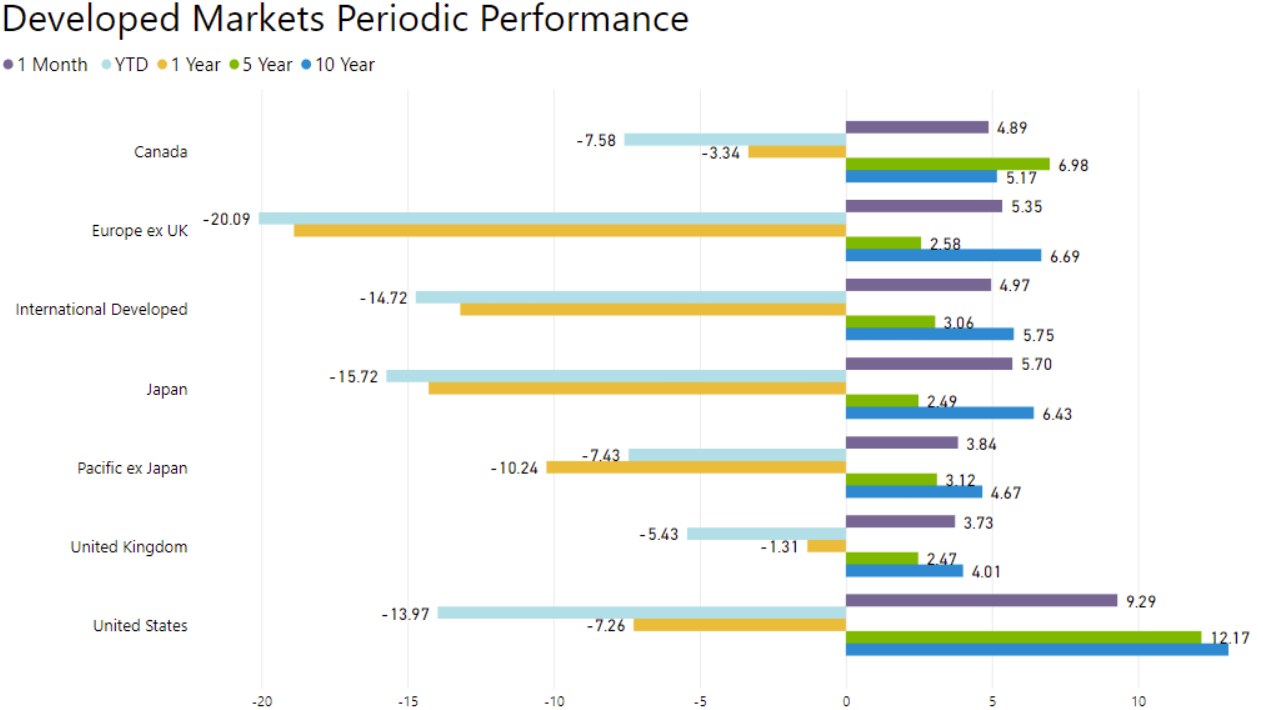

In July, international developed stock markets returned 4.97%. The US and Japan recorded returns of 9.29% and 5.70%, respectively. The UK and Pacific ex Japan lagged other markets. International developed markets are down -14.72% YTD, while the US market is down -13.97%. Geopolitical risks, persistently high inflation, and central bank tightening continue to be headwinds. Investors are expecting the Federal Reserve to reduce its holdings of Treasury bonds and mortgage-backed securities, which could cause long-term interest rates to increase. A rising rate environment could negatively impact stocks with long durations, such as growth stocks.

EMERGING MARKETS

Emerging Markets Flat

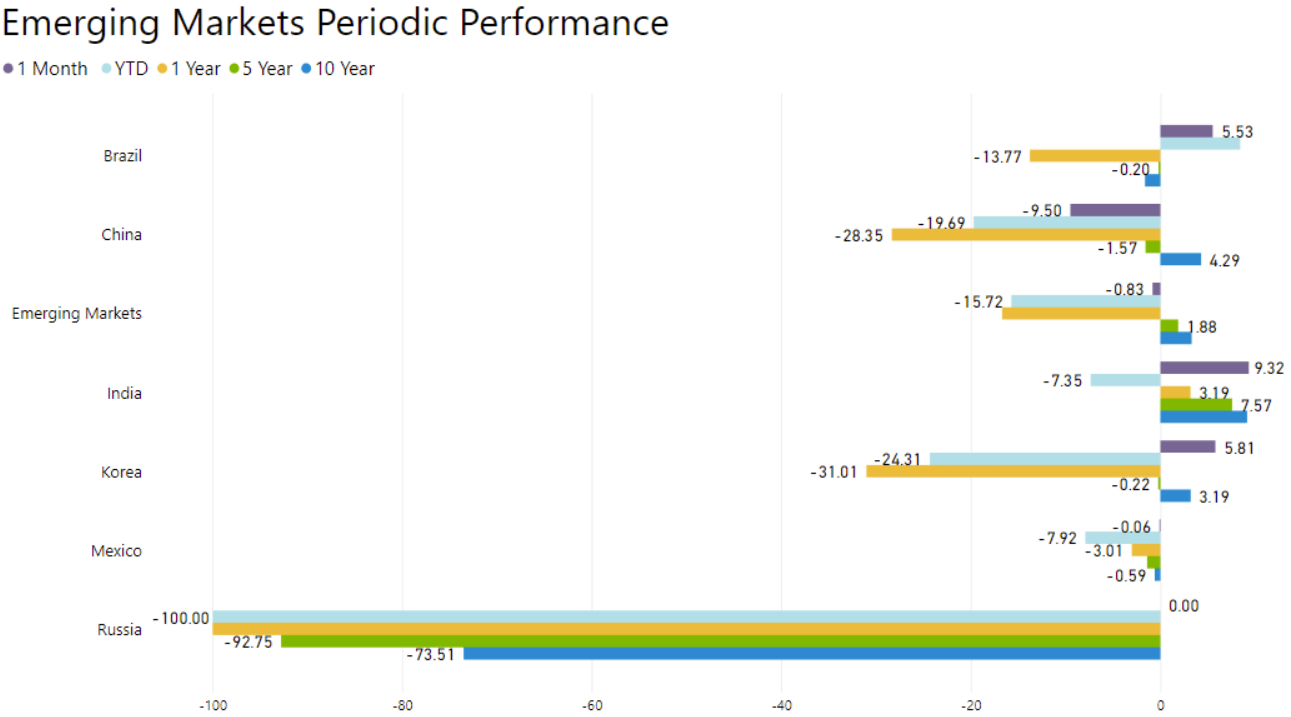

Broader emerging markets posted a -0.83% return for the month. India and Korea recorded positive returns of 9.32% and 5.81%, respectively. Mexico and China lagged other markets in July. Countries that export natural resources, such as Brazil, have benefited from this year’s inflationary environment. High energy and food prices have been headwinds to emerging market economies. China’s zero-Covid policy has also been a drag on economic activity.

GLOBAL SECTOR

Information Technology and Consumer Discretionary Outperform

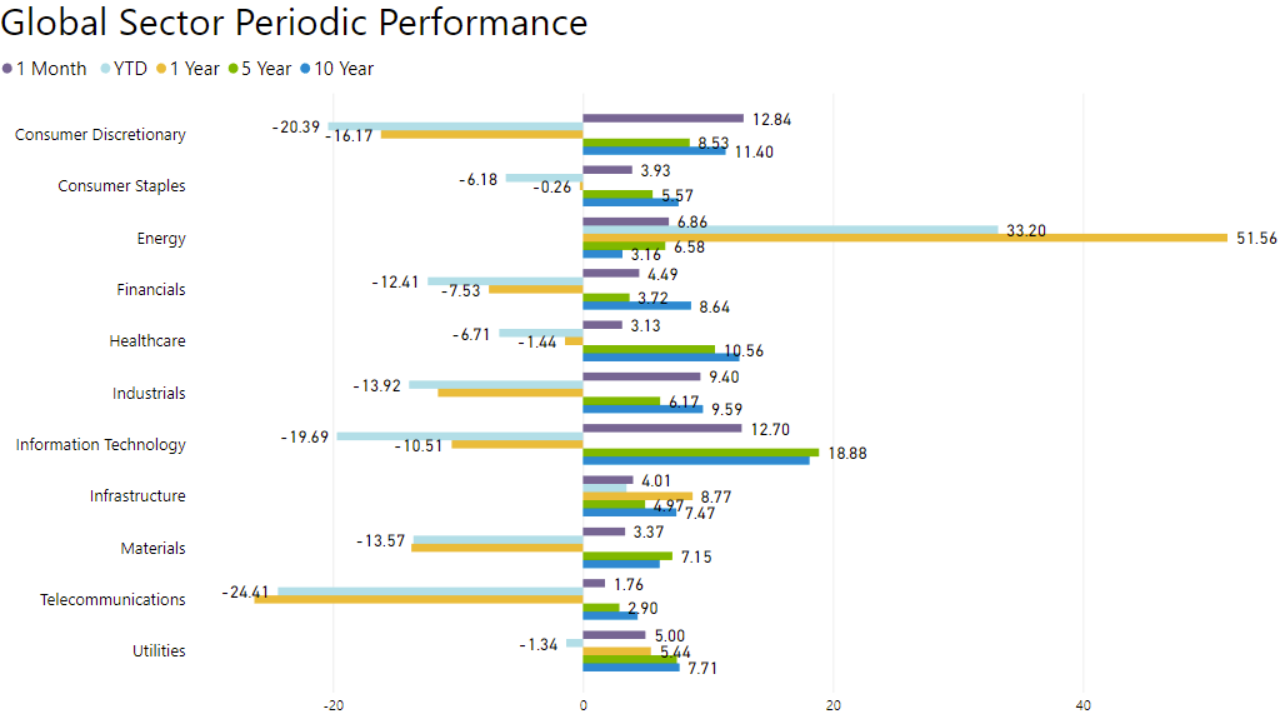

In July, information technology and consumer discretionary recorded positive returns of 12.70% and 12.84%, respectively. Year to date, these sectors are still in bear market territory. Telecommunications and healthcare lagged other sectors this month. The energy sector is up 33.2% YTD and 51% over the past year. Oil supply and demand dynamics will likely remain favorable in the short and medium term.

DOMESTIC EQUITY FACTORS

Growth Rallies in July

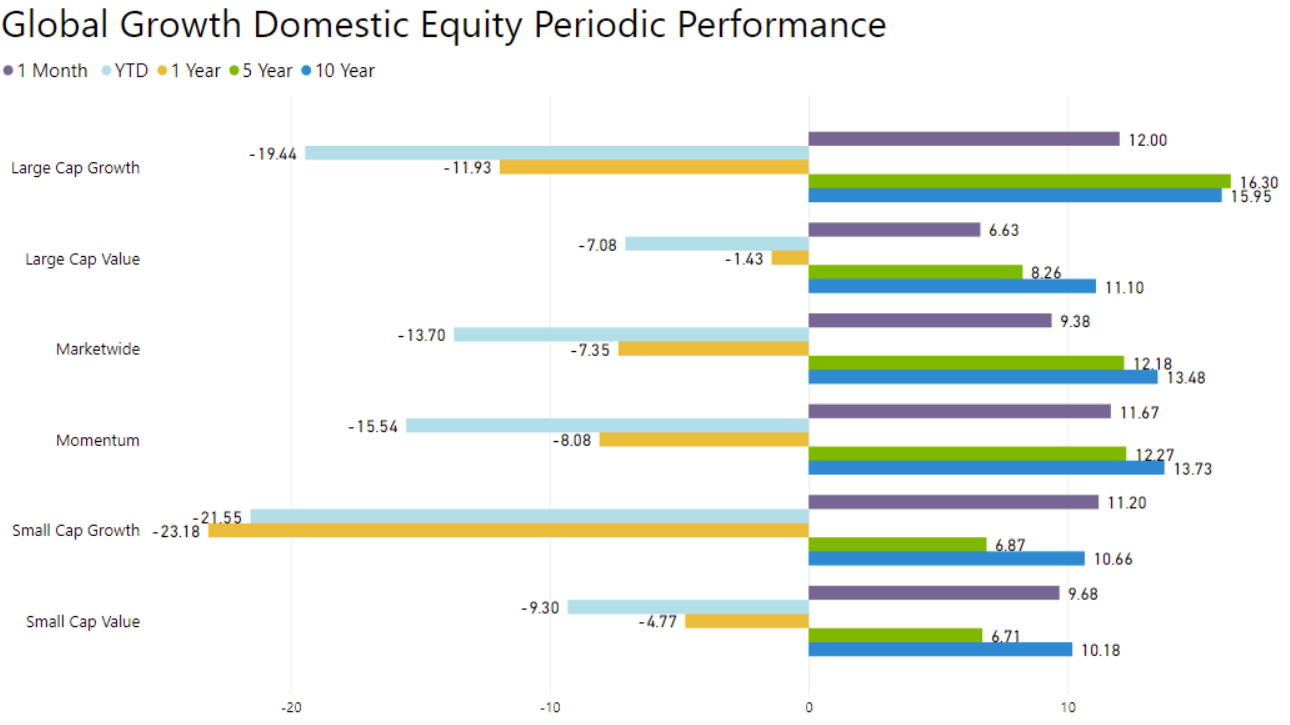

In July, value underperformed growth in the large- and small-cap space. Momentum recorded a return of 11.67%. Value stocks are still outperforming growth in 2022. Their ten-year annualized returns are approaching growth’s ten-year return. Even after value’s strong performance, value stocks are still cheap relative to growth stocks. Value-oriented sectors such as energy, financials, and materials may still have much more room to run.

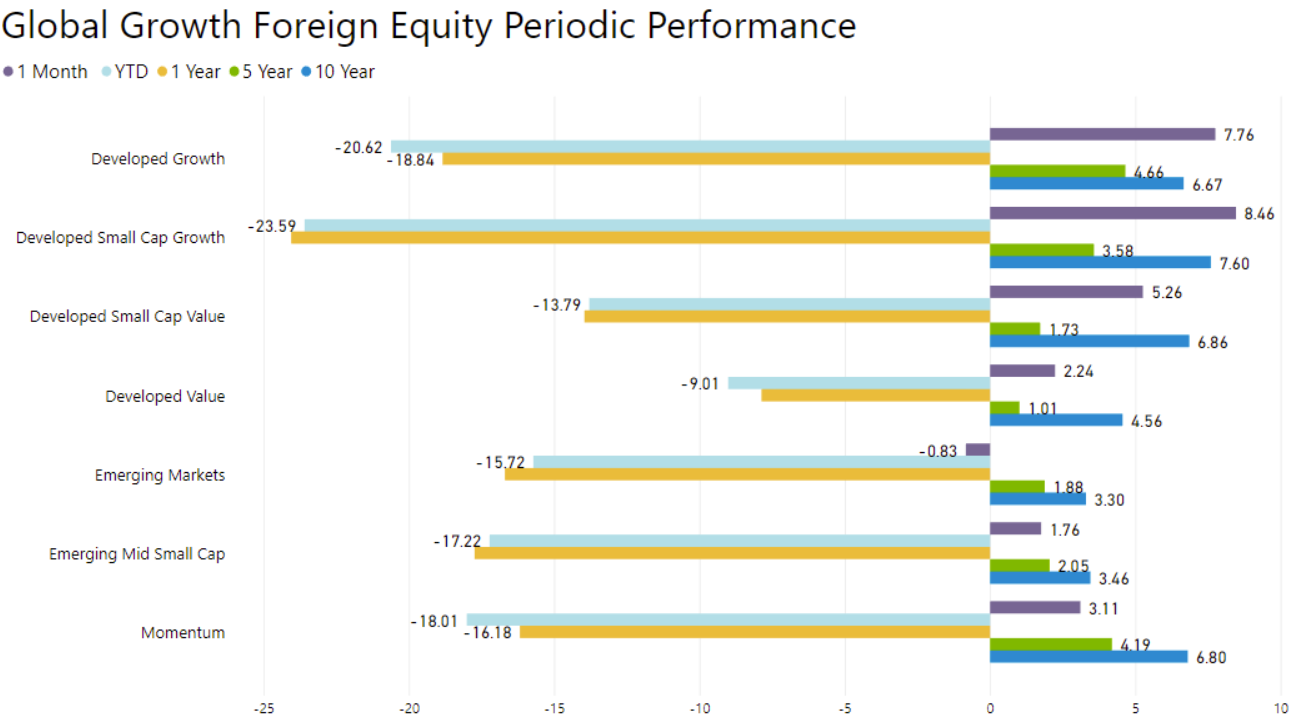

FOREIGN EQUITY FACTORS

Value Underperforms in the International Markets

Value underperformed growth in the large-cap and small-cap space for the month in the international developed markets. Momentum recorded a return of 3.11%, while small-cap emerging market stocks posted a return of 1.76%. Valuations of value stocks are still very low relative to growth stocks in both international developed and emerging markets, which is consistent with the US market. The rotation from growth into value may resume as investors become wary of high valuations in growth stocks. Rising interest rates may also pose more risk to growth stocks than value stocks.

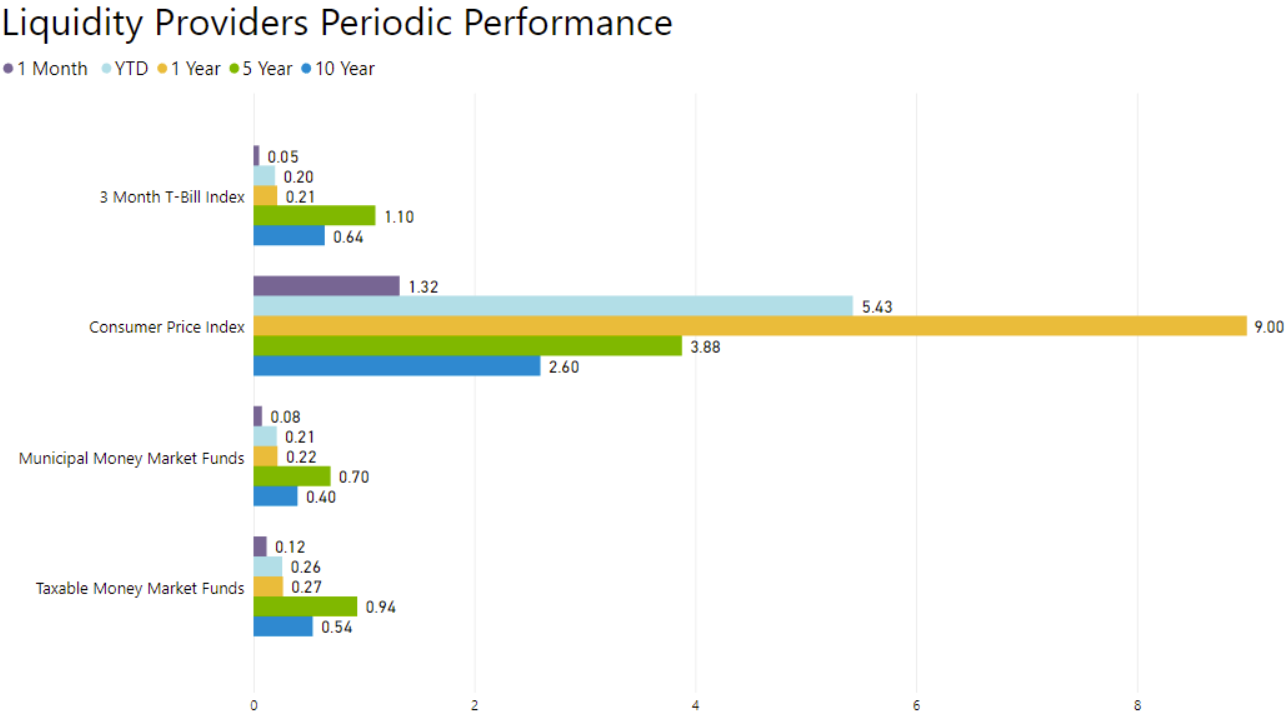

LIQUIDITY PROVIDERS

Short-Term Interest Rates Rise

In July, the three-month Treasury bill index returned 0.05%. From the beginning of the year through the end of July, the interest rate on the 90-day Treasury bill increased from 0.08% to 2.41%. Savers are now getting paid much more in interest; however, they will still face low real interest rates if inflation remains high. The CPI has increased by 9% over the past year through June.

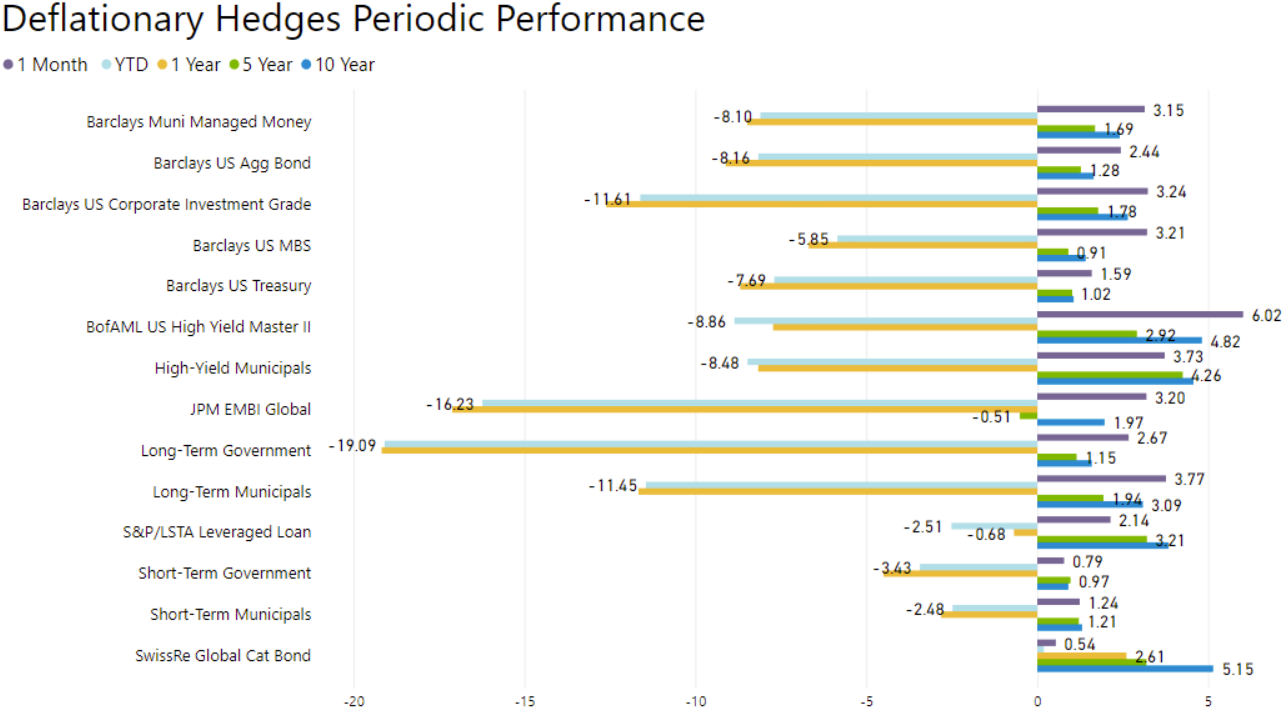

DISINFLATION DEFLATIONARY HEDGES

Fixed Income Investments Rebound

The returns of deflationary hedges were mainly positive for the month. Long-term municipal bonds returned 3.77% in July. The Bloomberg Barclays US Agg Bond Index returned 2.44% for the month. High-yield bonds are down -8.86% YTD. If interest rates continue to rise, less creditworthy borrowers may face difficulties meeting their financial obligations. Among the deflationary hedges, only the SwissRe Global Catastrophe Bond index has a positive performance YTD. Catastrophe bonds are up 2.61% over the past year, providing a competitive yield without the equity-like volatility of leveraged loans and high-yield bonds. Real yields continue to remain around historical lows.

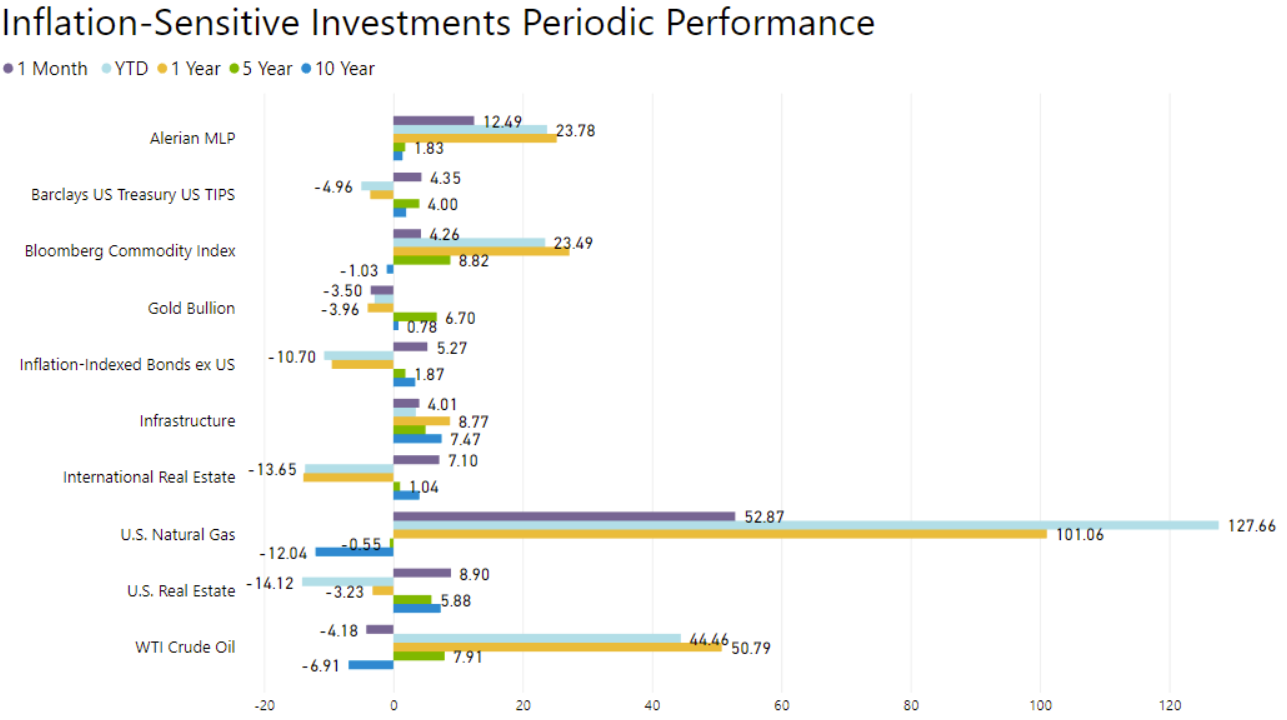

INFLATION SENSITIVE INVESTMENTS

Commodity Markets Providing Diversification Benefits

Inflation-sensitive investment returns were mainly positive for the month. US natural gas and the Alerian MLP were up 52.87% and 12.49%, respectively. The Bloomberg Commodity index posted a return of 4.26% in July. Gold bullion is down -2.90% YTD. This year, the US dollar has materially strengthened, moderating gold’s return in US dollar terms. However, gold bullion is up much more relative to other major currencies. Like oil’s future supply prospects, the future supply of gold may be constrained as exploration and capital expenditures have been muted.

WORLD CURRENCIES

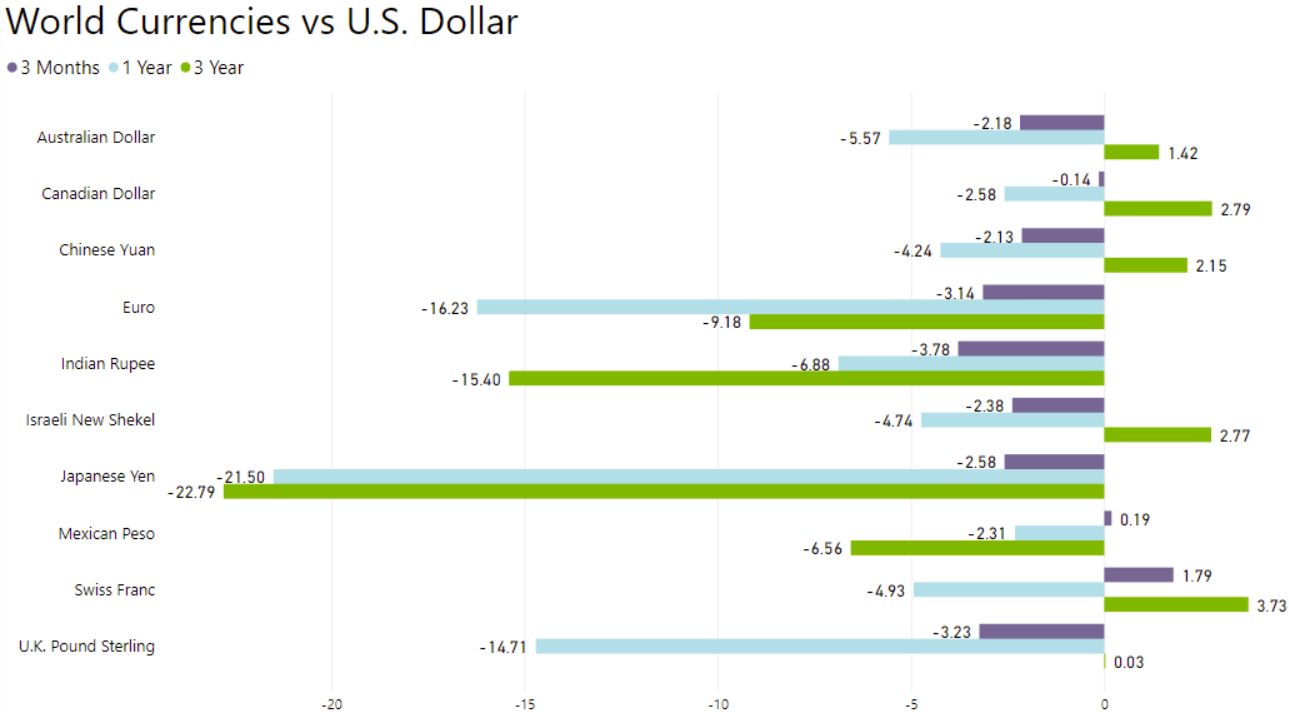

U.S. Dollar Strengthens Versus Other Currencies

Over the past three months, the U.S. dollar appreciated against most major currencies except the Swiss Franc and Mexican Peso. However, the continuation of large US fiscal deficits may weigh on the US dollar in the medium-term to long-term. Gross federal debt to GDP stands at 123% and is forecasted to increase through the decade.

Brandon Yee, CFA, CAIA – Research Analyst

Brandon conducts investment due diligence for Versant Capital Management, and designs and implements tools and processes to support the firm’s research. His background in biology and finance help him to look at challenges from multiple angles, resulting in unique and well-rounded approaches and solutions.

Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.