Investors Look to International Markets

Prepared by Brandon Yee, CFA, CAIA, and Thomas Connelly, CFA, CFP®

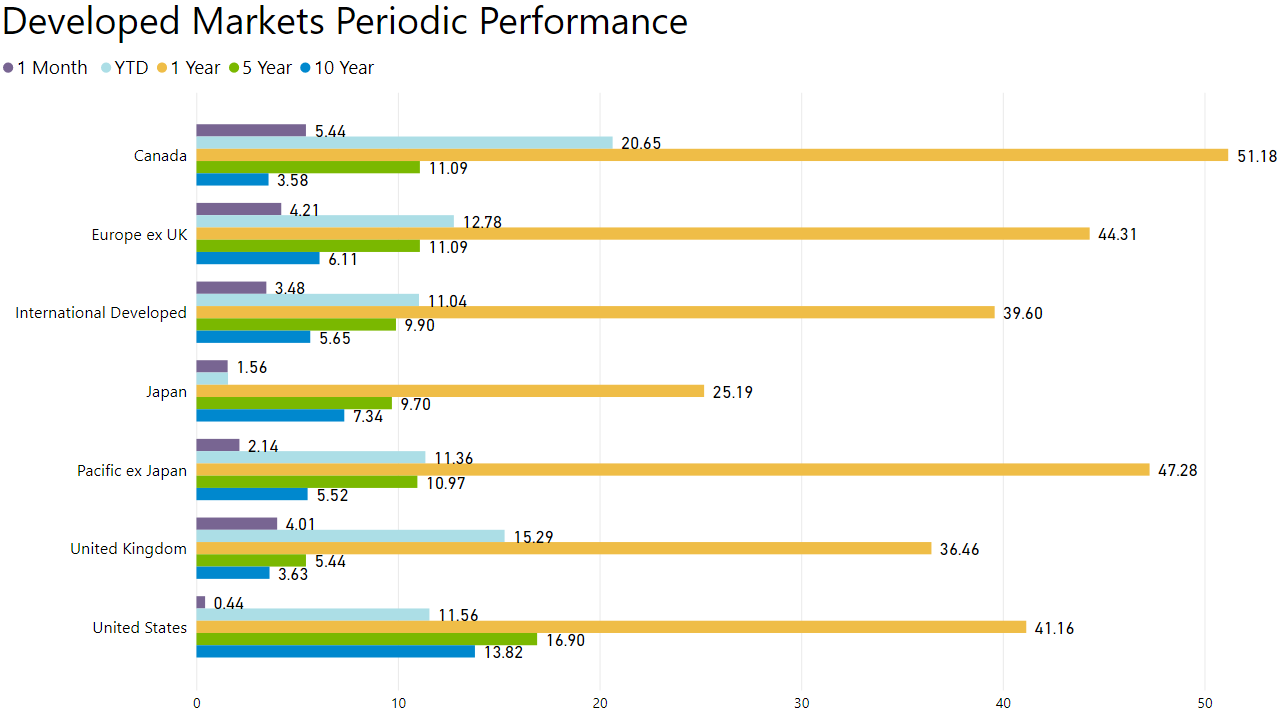

DEVELOPED MARKETS

International Developed Markets Performing Strongly

In the month of May, international developed stock markets rose by 3.48%. Europe ex UK and Canada recorded returns of 4.21% and 5.44%, respectively. The US and Japan lagged other markets. The Canadian stock market, which has a large natural resource exposure, is up 20.65% YTD. International developed markets are up 11.04% YTD. Global economies are accelerating, driven by strong industrial production. Euro area retail foot traffic has picked up considerably and discretionary retail sales are approximately 10% below the pre-pandemic average.

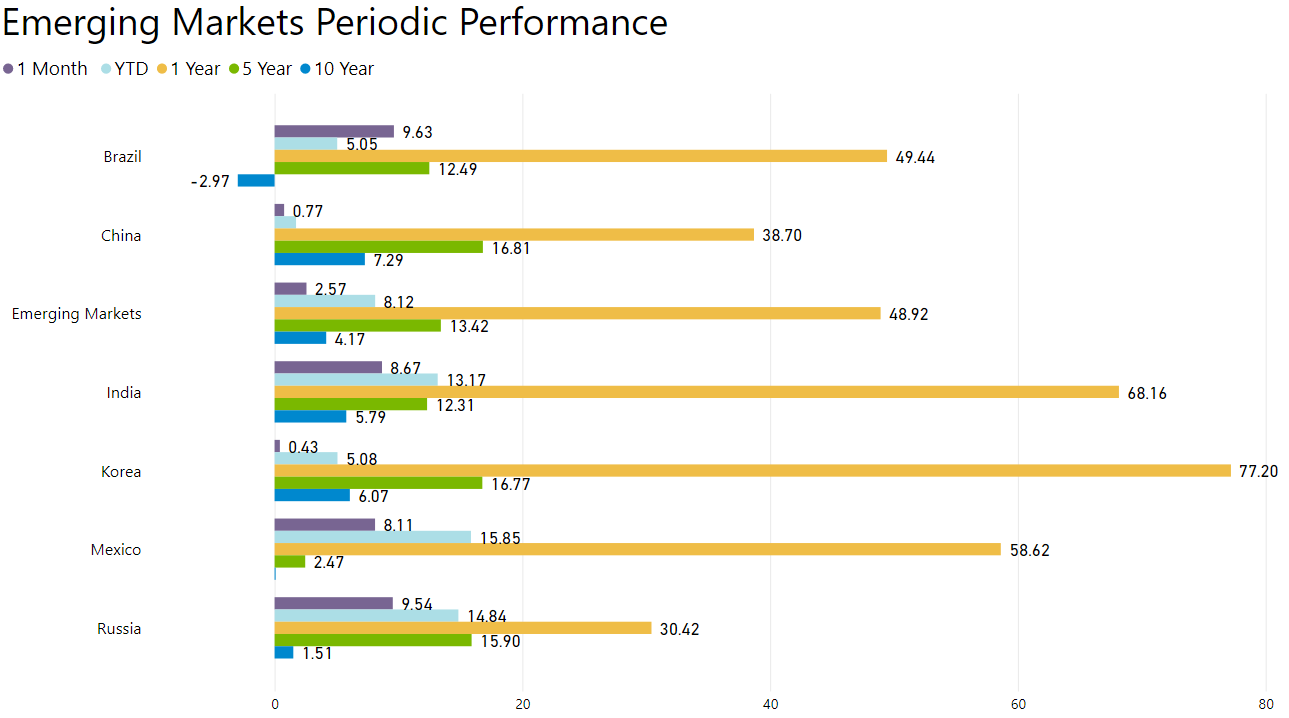

EMERGING MARKETS

Emerging Markets Pick Up in May

Broader emerging markets posted a 2.57% return for the month. Brazil and Russia, both natural resource-oriented economies, recorded returns of 9.63% and 9.54%, respectively. Korea and China lagged other markets in May. Emerging markets in the aggregate are up 8.12% YTD. Commodity-oriented markets may continue to receive a boost as monetary and fiscal stimulus flows through the global economy. These countries may benefit from any infrastructure projects or alternative energy initiatives.

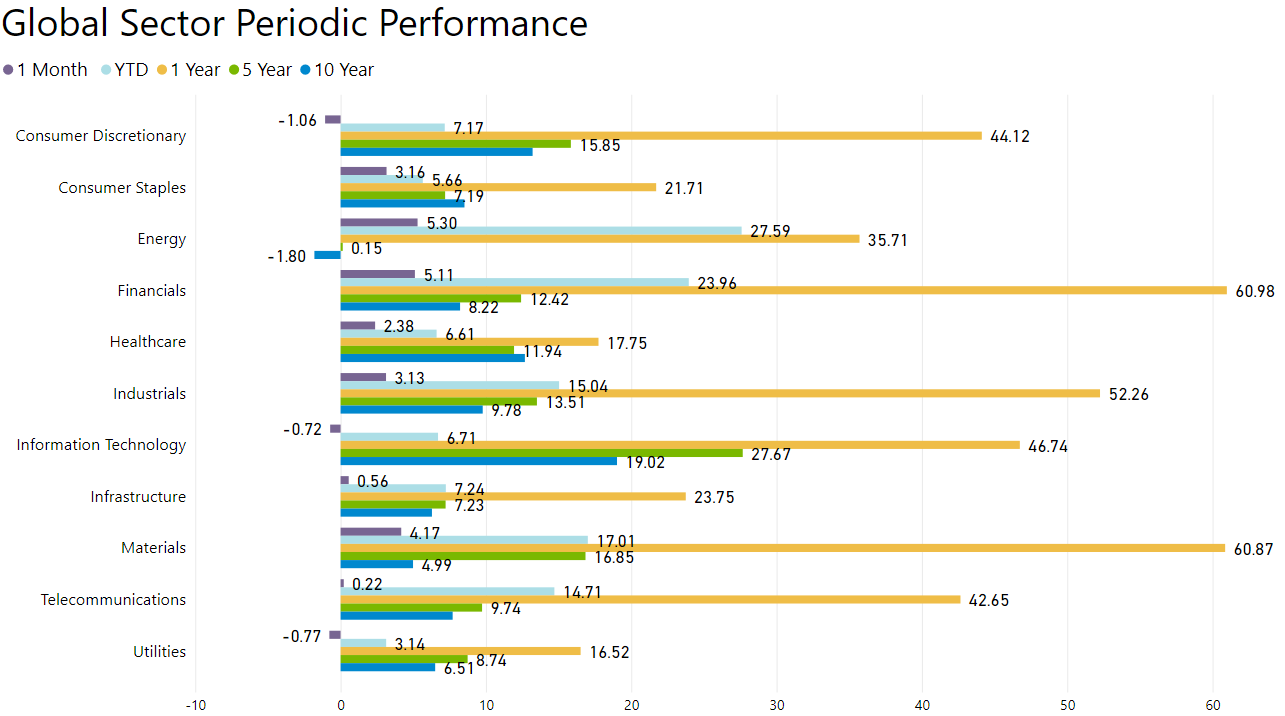

GLOBAL SECTOR

Energy and Financials Outperform

Energy and financials recorded returns of 5.30% and 5.11%, respectively, in May. Consumer discretionary and utilities lagged other sectors. The energy sector, after a difficult ten-year period and tough 2020, is up 27.59% YTD. The reopening of economies and any increase in air travel will benefit energy stocks further. Financials, which benefit from rising interest rates, are up 23.96% YTD.

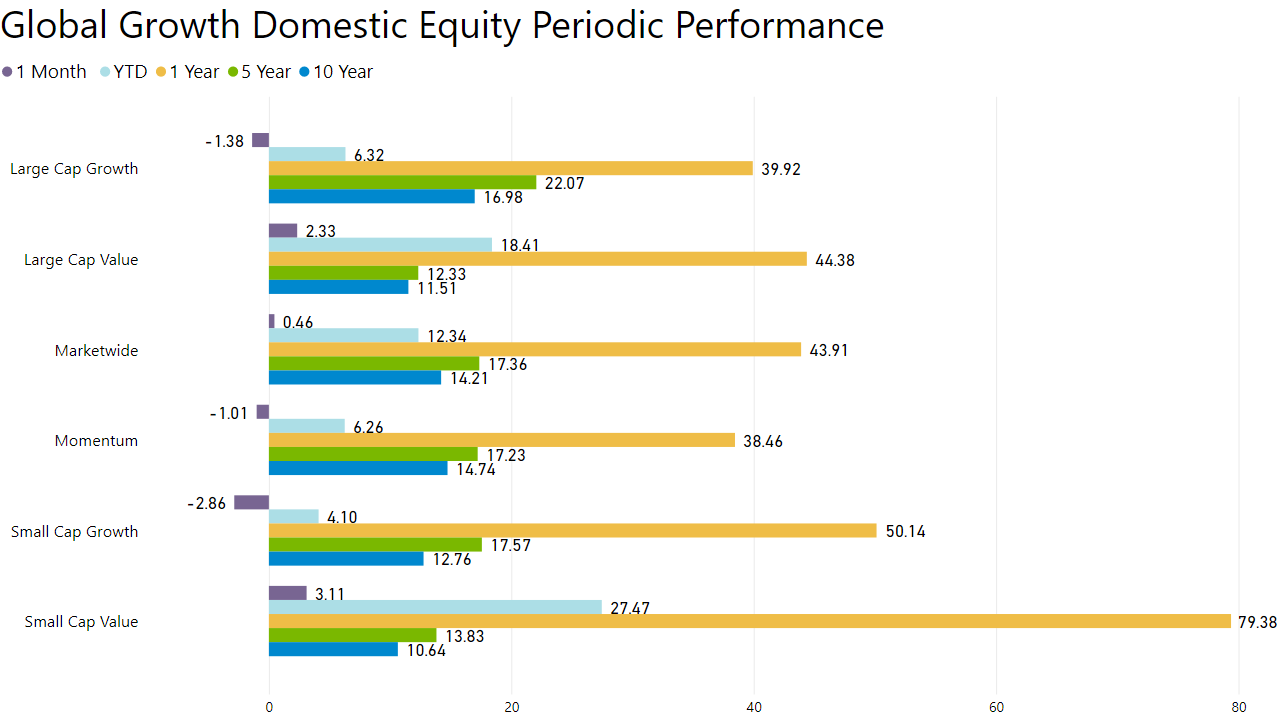

DOMESTIC EQUITY FACTORS

Value Outperformance Continues

In May, value outperformed growth in the large-cap space and small-cap space. Momentum recorded a return of -1.01%. Small-cap value stocks started the year strongly and are now up 27.47% YTD. Even after value’s strong performance this year, relative valuations between value stocks and growth stocks are still high based on many different valuation metrics. Value-oriented sectors such as energy, financials, and materials may still have more room to run.

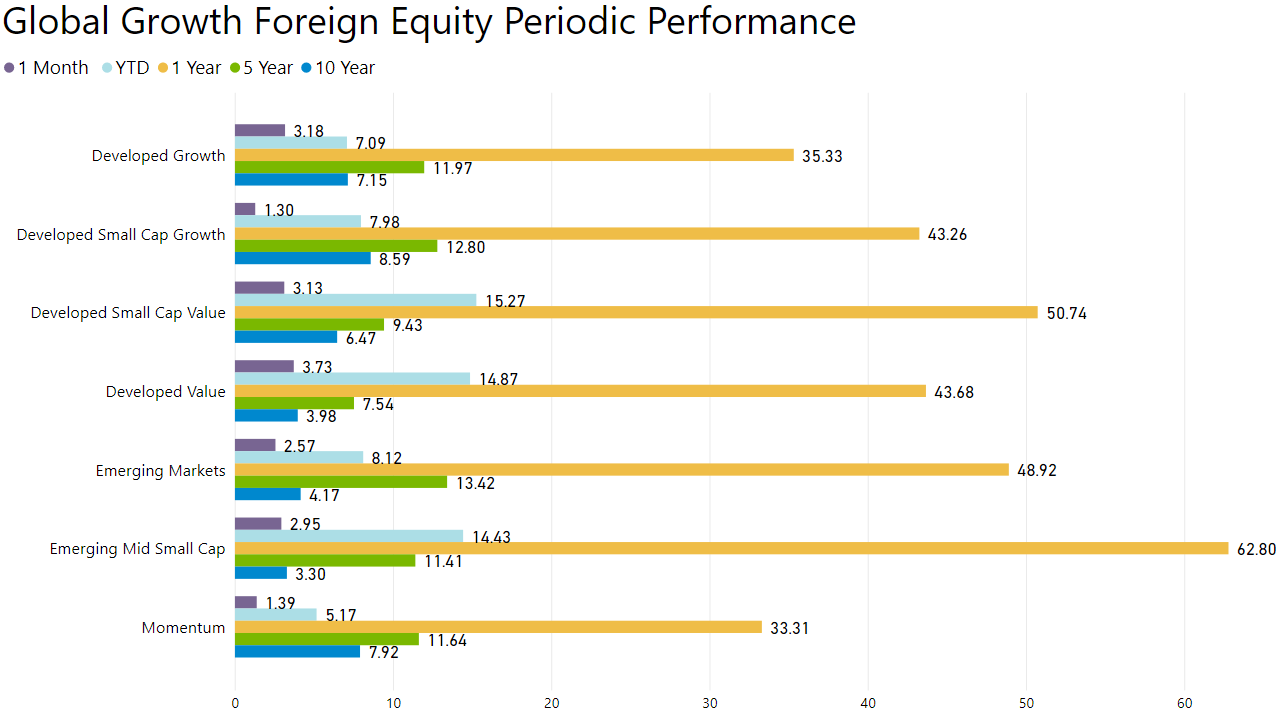

FOREIGN EQUITY FACTORS

Growth Underperforms in International Markets

In the international developed markets, growth underperformed value in the large-cap and small-cap space. Momentum recorded a return of 1.39% while small-cap emerging market stocks posted a return of 2.95% this month. The rotation from growth into value may continue as investors become wary of high valuations in growth stocks. Rising interest rates may also pose more of a risk to growth stocks than value stocks.

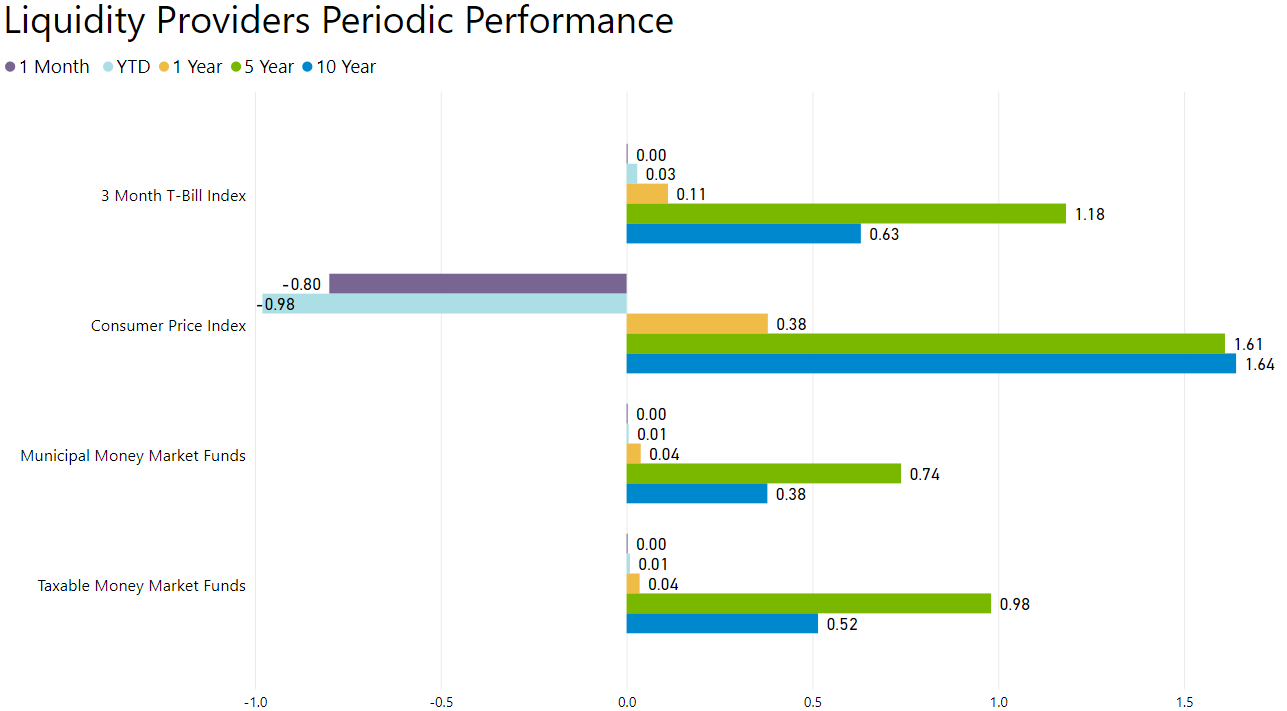

LIQUIDITY PROVIDERS

Federal Reserve to keep Interest Rates Low

In May, the three-month Treasury bill index returned 0.00% for the month. Interest rates on Treasury bills and money market funds are close to 0%. The Federal Reserve continues to keep interest rates near 0%, but the recent inflation numbers may reopen the possibility of higher interest rates. Savers will still face low short-term interest rates for the foreseeable future, which will negatively impact retirees and people close to retirement. The CPI decreased by -0.80% through the end of April.

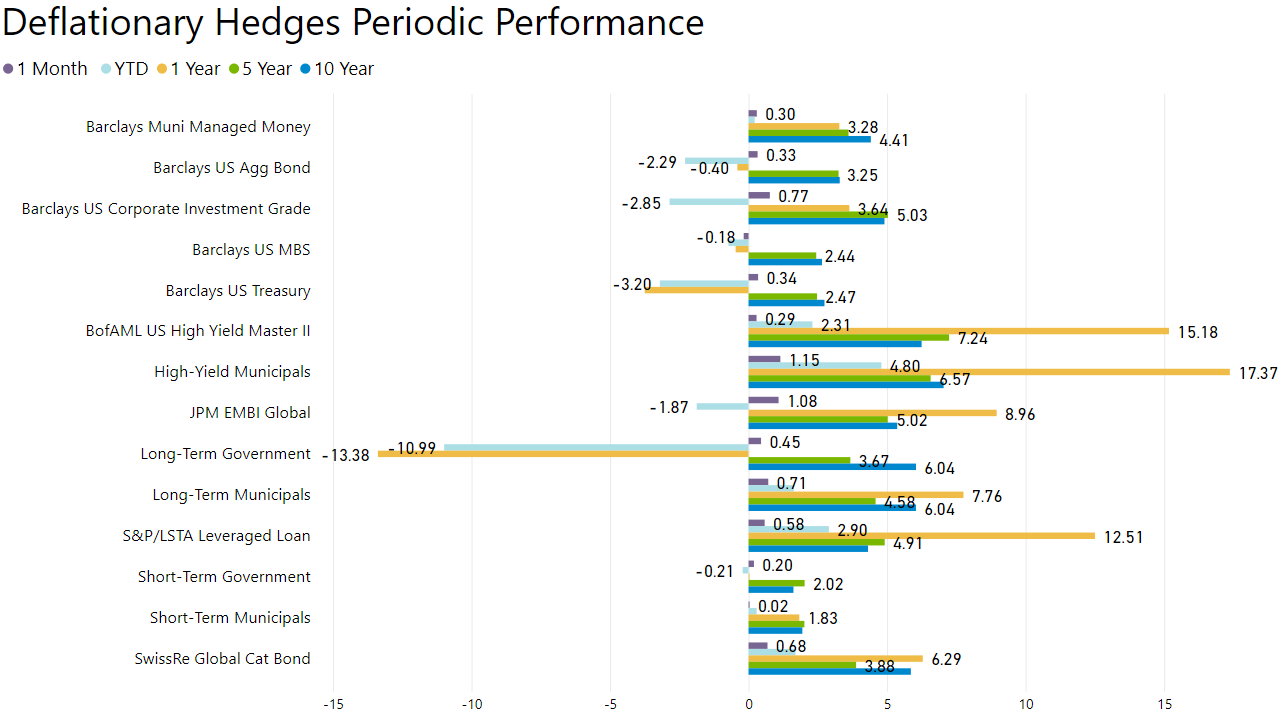

DISINFLATION DEFLATIONARY HEDGES

Fixed Income Steady in May

The returns of deflationary hedges were mostly positive for the month. Long-term government bonds returned 0.45% in May but are still down 10.99% YTD. The Bloomberg Barclays U.S. Agg Bond Index returned 0.33% in May. Catastrophe bonds are up 6.29% over the past year, providing a competitive yield without the equity-like volatility of leveraged loans and high-yield bonds. Real yields on many fixed income investments are still negative or close to 0%. Global negative yielding debt stands at $12.9 trillion through the end of May.

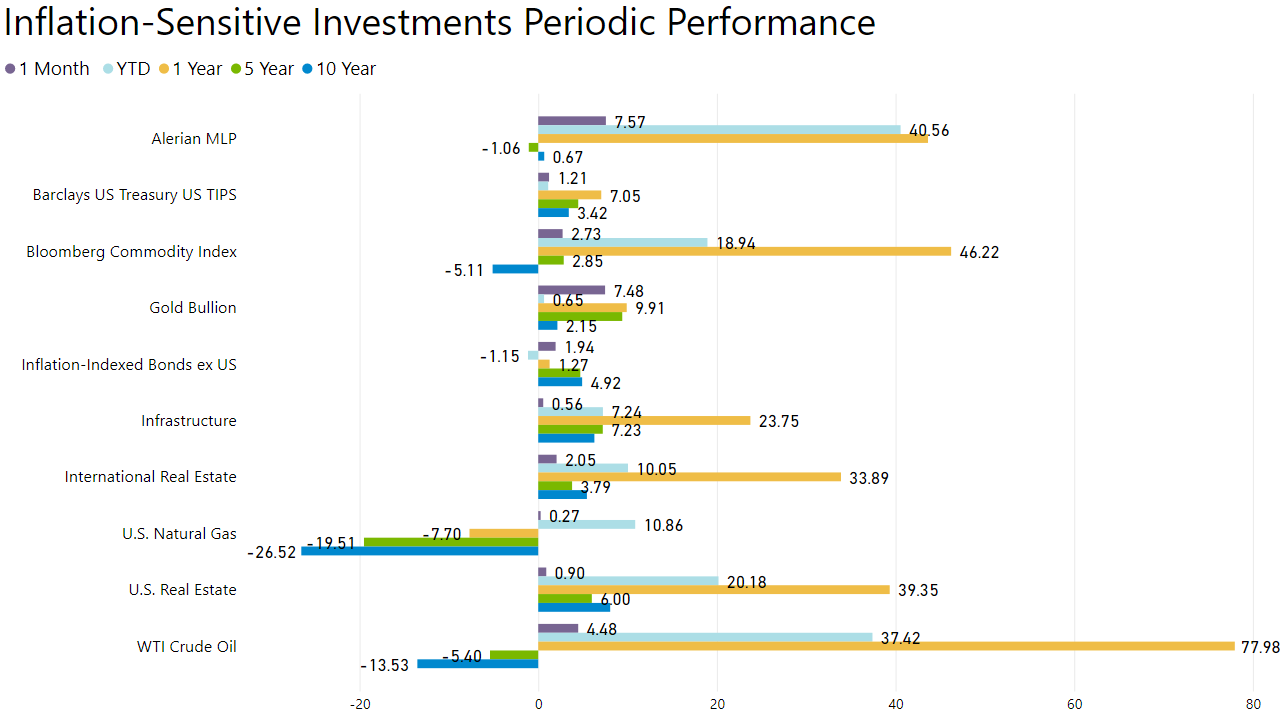

INFLATION SENSITIVE INVESTMENTS

Gold Rallies

Inflation-sensitive investment returns were positive for the month. The Alerian MLP and WTI crude oil were up 7.57% and 4.48%, respectively. The Bloomberg Commodity index posted a return of 2.73%. Inflation-sensitive investments are benefiting from the reopening of economies, supply constraints and pent-up consumer demand. After a strong April, gold bullion rose 7.48% in May. Gold and gold-related investments are now positive YTD. Ongoing large fiscal deficits, high debt levels, and easy monetary policy may create tailwinds for gold investors in the coming years.

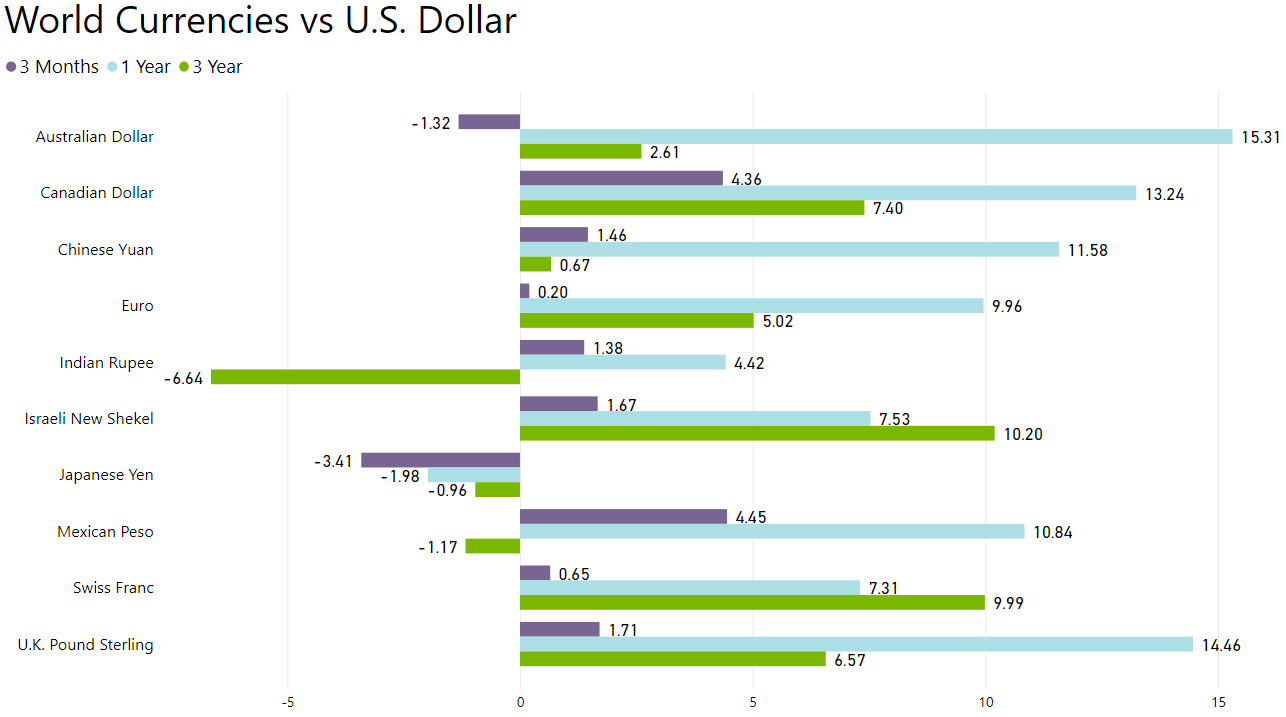

WORLD CURRENCIES

U.S. Dollar Depreciated Over the Past Year

Over the past year, the U.S. dollar depreciated against most other major currencies. The U.S. dollar appreciated against the Japanese Yen but depreciated considerably against the Euro, Australian dollar, and Mexican Peso. The continuation of large U.S. fiscal deficits may weigh on the U.S. dollar in the medium-term to long-term.