Market Uncertainty Increases

Prepared by Brandon Yee, CFA, CAIA, and Thomas Connelly, CFA, CFP®

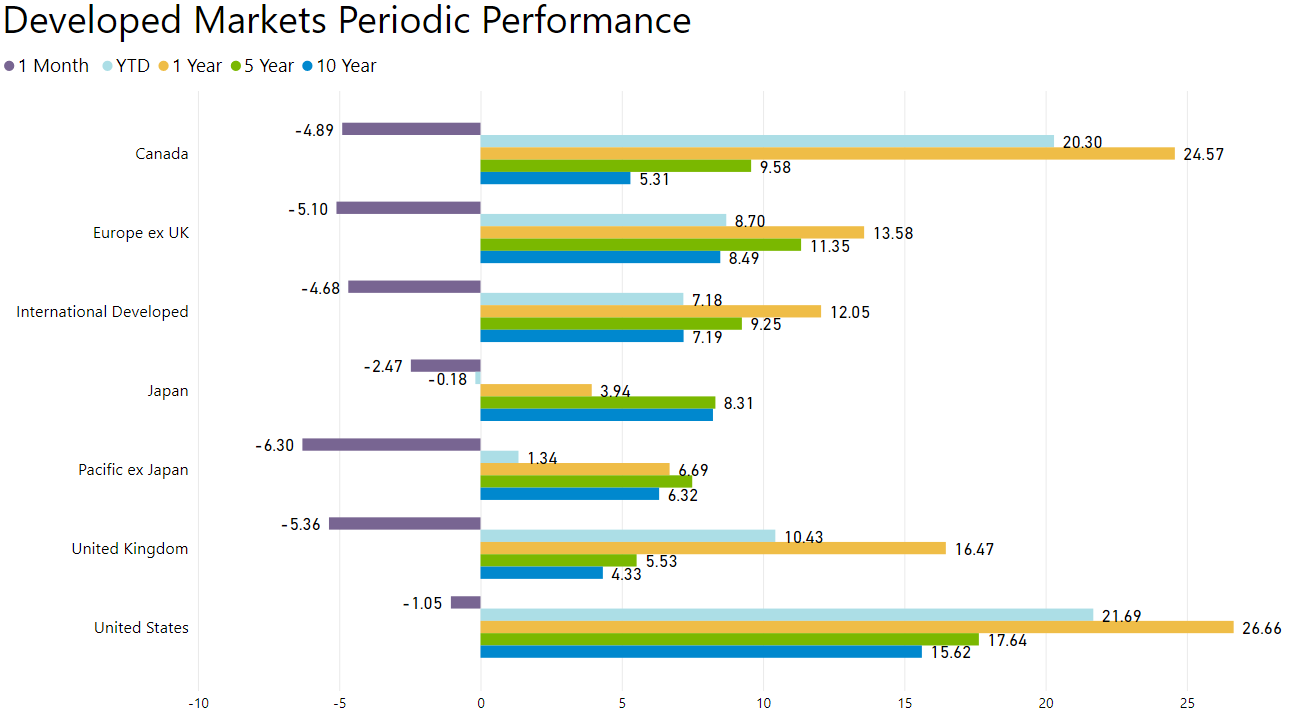

DEVELOPED MARKETS

Developed Markets Face Volatility

In the month of November, international developed stock markets returned -4.68%. Japan and the U.S. recorded returns of -2.47% and -1.05%, respectively. The UK and Pacific ex Japan lagged other markets. The U.S. stock market is up 21.69% YTD while international developed markets are up 7.18% YTD. Markets were volatile as investors assessed the new COVID-variant, omicron, and its potential severity.

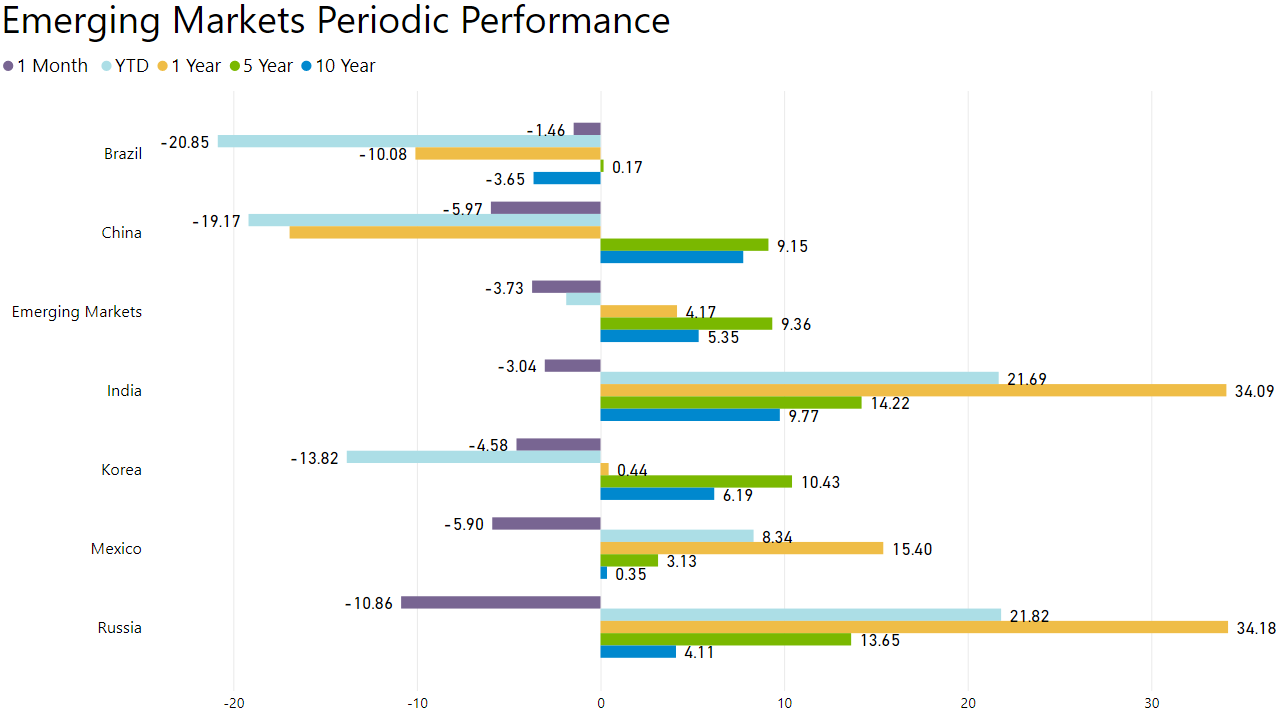

EMERGING MARKETS

Russia Drops as Oil Prices Decline

Broader emerging markets posted a -3.73% return for the month. Brazil and India recorded returns of -1.46% and -3.04%, respectively. Russia and China lagged other markets in November. Emerging markets in the aggregate are down -1.87% YTD, partly due to China’s economic restructuring and restrictive COVID policies. However, emerging markets still trade at a meaningful valuation discount relative to the U.S. market.

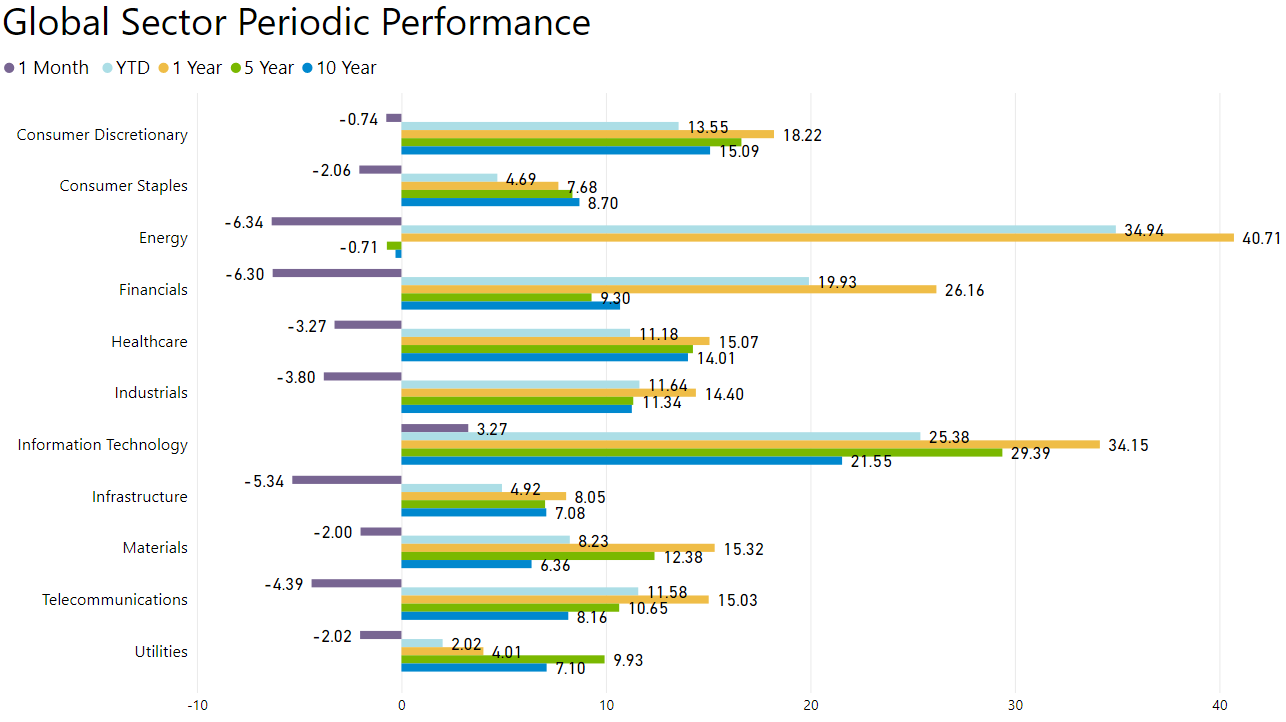

GLOBAL SECTOR

Information Technology and Consumer Discretionary Outperform

Information technology and consumer discretionary recorded returns of 3.27% and -0.74%, respectively, in November. Energy and financials lagged other sectors. Even after a tough month, the energy sector is up 34.94% YTD. Increasingly favorable oil supply and demand dynamics should continue to help energy-related investments. Governments and corporations are encouraging more people to get a COVID vaccine, which should help the reopening of economies and global mobility.

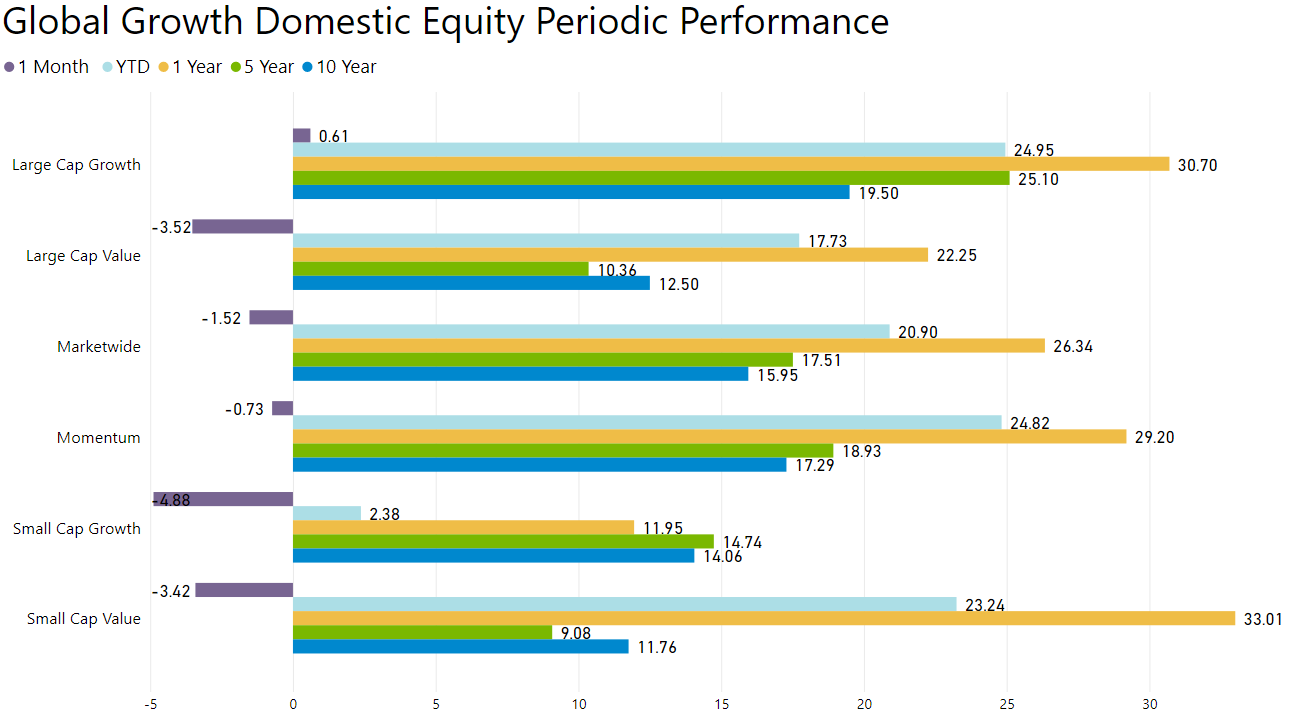

DOMESTIC EQUITY FACTORS

Growth Bouncing Back

In November, value underperformed growth in the large-cap space and outperformed in the small-cap space. Momentum recorded a return of -0.73%. Small-cap value stocks started the year strongly and are up 23.24% YTD. Even after value’s strong performance this year, relative valuations between value stocks and growth stocks are still high based on many different valuation metrics. Value-oriented sectors such as energy, financials, and materials may still have much more room to run.

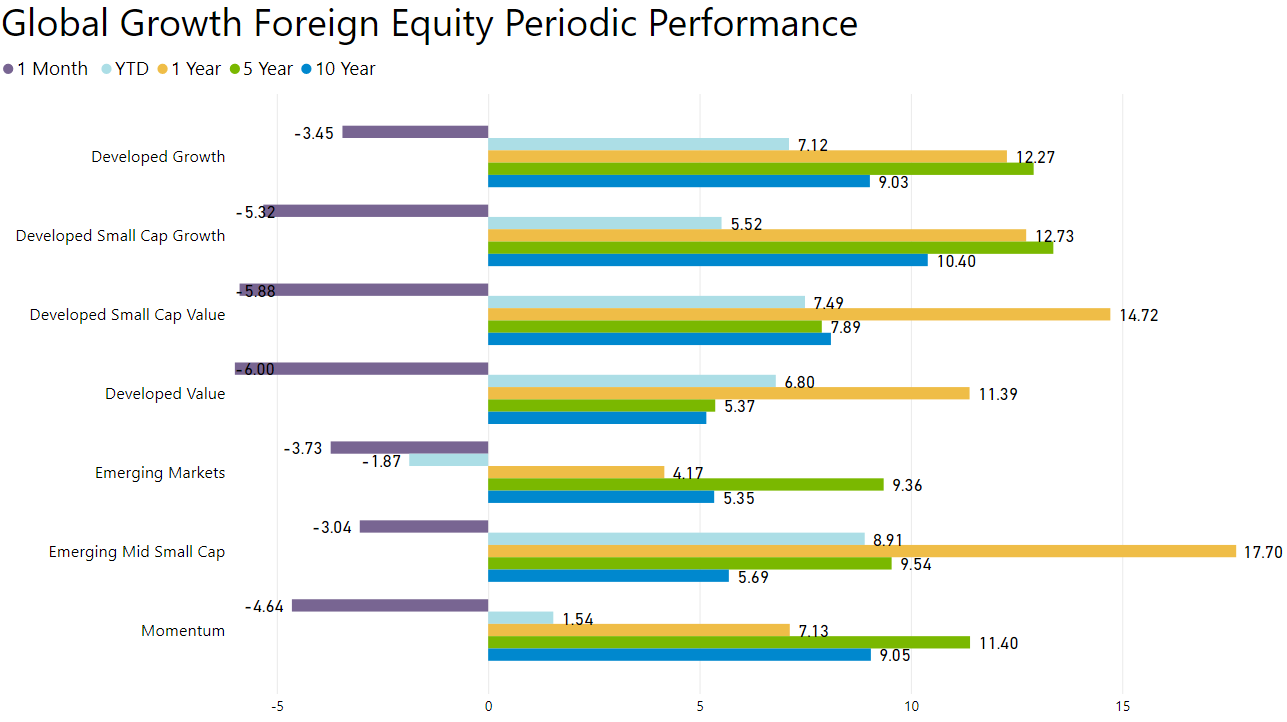

FOREIGN EQUITY FACTORS

Growth Outperforms in International Markets

In the international developed markets, growth outperformed value in the large-cap and small-cap space. Momentum recorded a return of -4.64% while small-cap emerging market stocks posted a return of -3.04% this month. Small-cap emerging market stocks are up 8.91% YTD. The rotation from growth into value may resume as investors become wary of high valuations in growth stocks. Rising interest rates may also pose more of a risk to growth stocks than value stocks.

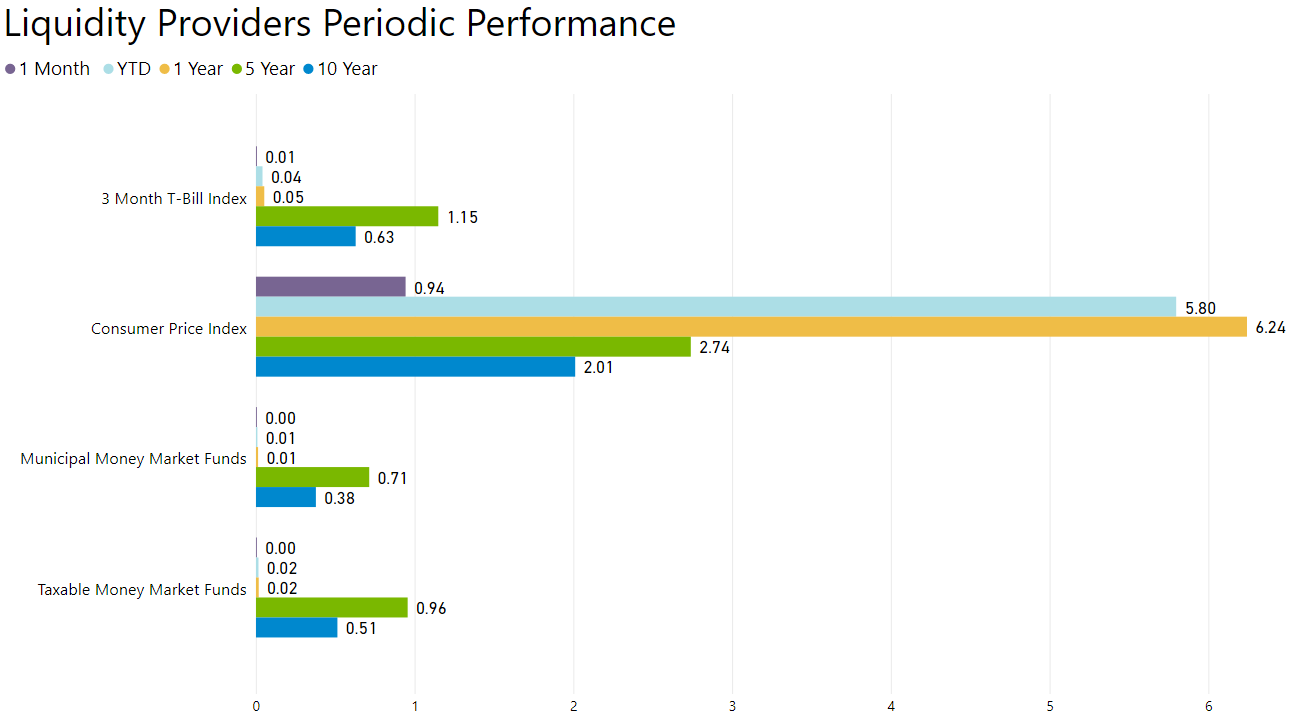

LIQUIDITY PROVIDERS

Interest Rate Hikes a Possibility in 2022

In November, the three-month Treasury bill index returned 0.00% for the month. Interest rates on Treasury bills and money market funds are close to 0%. The Federal Reserve continues to keep interest rates near 0%, but the recently high inflation numbers, labor scarcity, and pending stimulative legislation may reopen the possibility of higher interest rates. However, savers will still face low short-term interest rates for the foreseeable future. If inflation continues to rise and rates are still artificially suppressed, then retirees will be negatively impacted because their purchasing power will decrease. The CPI has increased by 5.80% over the past year through the end of October.

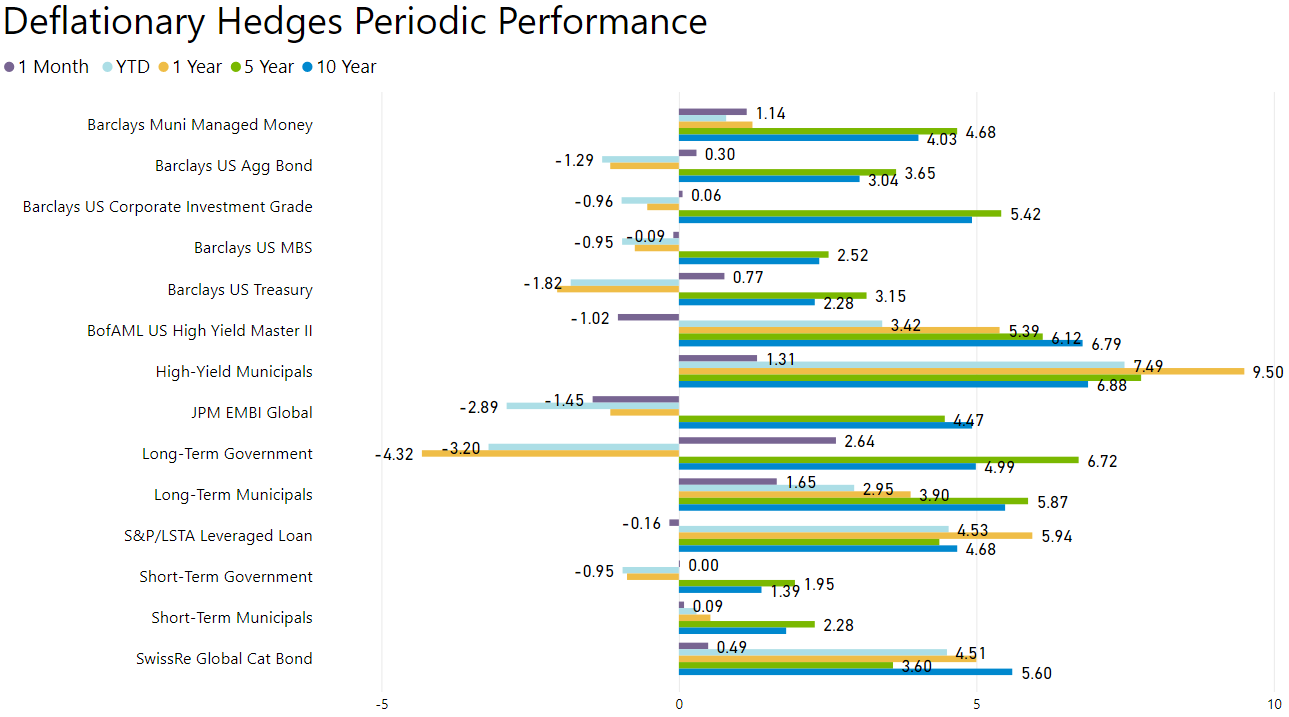

DISINFLATION DEFLATIONARY HEDGES

Government Bonds Benefit from Market Volatility

The returns of deflationary hedges were mostly positive for the month. Long-term government bonds returned 2.64% in November as the Treasury yield curve flattened. They are still down -3.20% YTD. The Bloomberg Barclays U.S. Agg Bond Index returned 0.30% in November. Catastrophe bonds are up 5% over the past year, providing a competitive yield without the equity-like volatility of leveraged loans and high-yield bonds. Real yields continue to remain around historical lows.

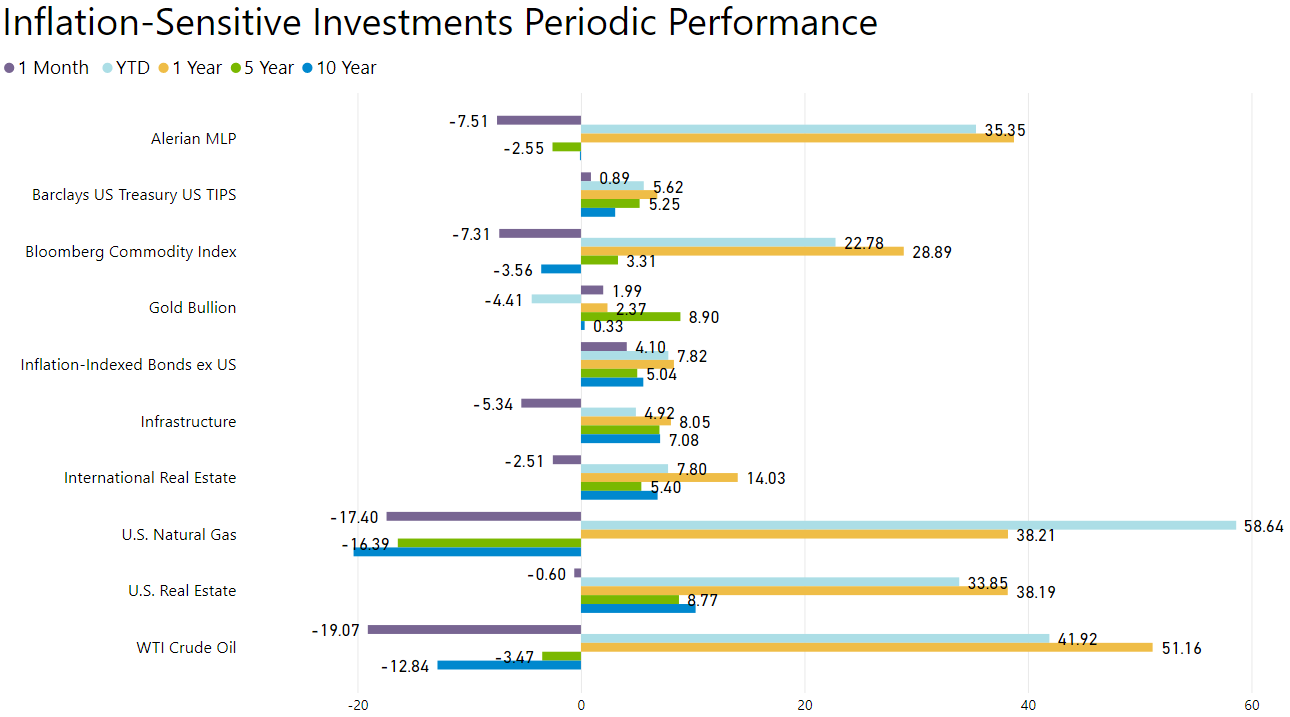

INFLATION SENSITIVE INVESTMENTS

Oil Prices Sink

Inflation-sensitive investment returns were mixed for the month. Gold bullion and U.S. TIPs were up 1.99% and 0.89%, respectively. The Bloomberg Commodity index posted a return of -7.31%. WTI crude oil dropped by 19% but is up 41.92% YTD. Inflation-sensitive investments are benefiting from the reopening of economies, supply constraints and pent-up consumer demand.

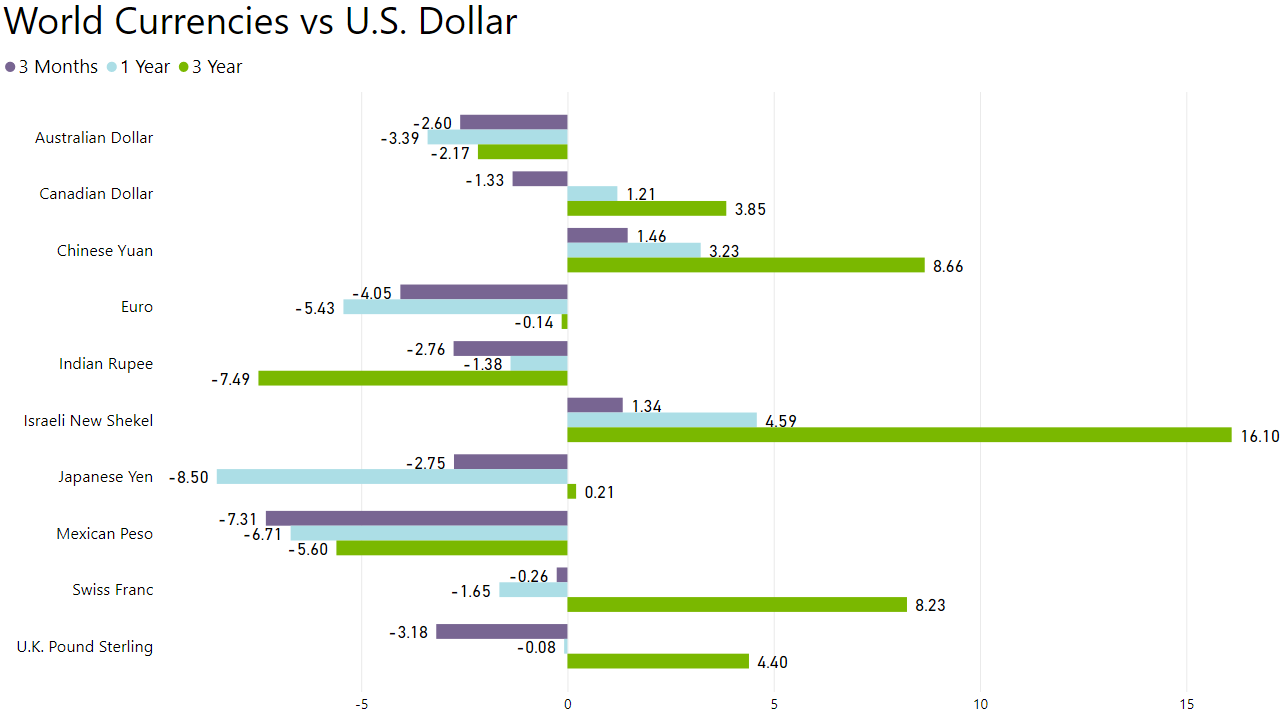

WORLD CURRENCIES

U.S. Dollar Appreciated Over the Past Three Months

Over the past three months, the U.S. dollar appreciated against most other major currencies. The U.S. dollar appreciated against the Yen, Euro and Mexican Peso. However, the continuation of large U.S. fiscal deficits may weigh on the U.S. dollar in the medium-term to long-term.

Brandon Yee, CFA, CAIA – Research Analyst

Brandon conducts investment due diligence for Versant Capital Management, and designs and implements tools and processes to support the firm’s research. His background in biology and finance help him to look at challenges from multiple angles, resulting in unique and well-rounded approaches and solutions.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.