The Coronavirus and the Global Financial Markets

What are the economic consequences for investors?

February 25, 2020

President & CIO, Versant Capital Management, Inc.

Broad stock markets around the world were down 1 to 4 percent yesterday, coinciding with new fears around the still-spreading coronavirus. In this article we discuss the contagion and lethality of the virus and how the different possibilities might affect stock markets.

Coronavirus status

The first diagnosis of a novel coronavirus, also known as COVID-19, was announced in China in early December, 2019. Since that time, the World Health Organization reports 78,811 confirmed cases in 35 countries, of which 77,042 cases are in China. As of Sunday, February 23, there were 1,017 new confirmed cases around the world. To date, the virus has killed 2,462 people. It is incredibly contagious, much like the common cold (a less harmful version of a coronavirus), but more lethal, with an anticipated mortality rate of 2 to 3 percent. The casualty count is lower among the young and healthy and disproportionately concentrated among the elderly, infirm, and those with compromised immune systems or chronic respiratory problems.

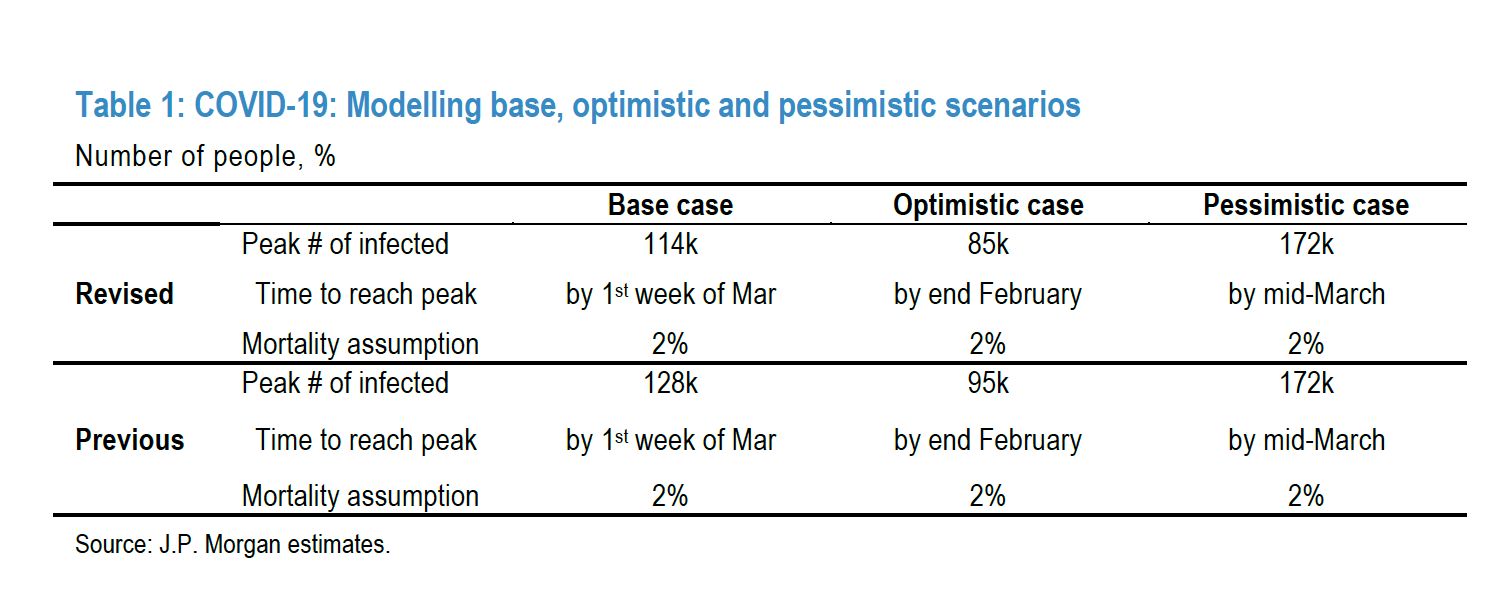

The good news is that confirmed cases in China and most other countries are decelerating, and local and national authorities have responded aggressively to the crisis from the beginning. JP Morgan’s epidemiological model (as of February 24) shown below shows a base, optimistic, and pessimistic infection scenario. The anticipated peak of the epidemic spans from the end of February to mid-March.

News about Monday’s market declines was of recently reported cases in South Korea, northern Italy and Kuwait. In Korea, the first case was reported last Tuesday, and by Friday, there were 152 confirmed cases, including two fatalities. The South Korean prime minister noted that “We have entered an emergency phase,” and the country shifted priorities from preventing infected individuals from entering the country to preventing spread within communities. The situation in Italy is similar. New reported cases and containment efforts are just beginning, but governments are responding quickly and forcefully to new contagion sites.

News about Monday’s market declines was of recently reported cases in South Korea, northern Italy and Kuwait. In Korea, the first case was reported last Tuesday, and by Friday, there were 152 confirmed cases, including two fatalities. The South Korean prime minister noted that “We have entered an emergency phase,” and the country shifted priorities from preventing infected individuals from entering the country to preventing spread within communities. The situation in Italy is similar. New reported cases and containment efforts are just beginning, but governments are responding quickly and forcefully to new contagion sites.

At this point, there is guarded optimism that the coronavirus will be contained but the new centers of infection in Italy and South Korea have shaken that confidence. There is always a possibility of an even more severe crisis, and there are still many unknowns. If you are interested in tracking the evolving coronavirus situation, the World Health Organization posts daily situation reports here and the Johns Hopkins Center for Systems Science and Engineering tracking site here.

Economic Impact of Coronavirus

Our firm’s current view is that there will not be a coronavirus pandemic, and the spread of the virus will soon be contained, at least for 2020. But there are economic consequences, particularly in China, Japan, and the surrounding areas, and, possibly Europe and parts of Latin America, as well. There have been sharp drops in activity and economic indicators across the board in China, which have started to turn around. Bridgewater, the world’s largest hedge fund manager, estimates that if the containment path evolves in a similar manner to the SARS (Severe Acute Respiratory Syndrome) epidemic (which looks increasingly likely), the hit to global growth would be 0.5 to 0.6 percent for 2020.

The economic downturn should be transitory, absent unexpected contagion, and there will be a considerable rebound in late March and April. We expect a V-shaped recovery (a period of economic decline, then a short trough, and finally a rapid recovery), with the recapture of most of the lost economic activity in February and March. Past epidemics such as SARS (from 2002 to 2003, 14 to15 percent mortality), MERS (Middle East Respiratory Syndrome in 2012), and multiple Ebola epidemics were largely contained outside the US. They generated considerable negative media attention but were largely market non-events in the year of occurrence. Typically, equities fall and gold and treasury bonds rise in the early stages, but as the year wore on these market moves faded as the impact of the epidemic became indistinguishable from economic effects and the impacts of monetary and fiscal policy.

The media often generates revenue by attracting attention to stories that create anger or fear. Trying to invest by paying attention to emotion-laden media narratives is very costly for most investors. Investors must get at least three things right to time markets: 1) what effect will the event have on each investment, 2) when to get out, and 3) when to get back in. If you are 70 percent accurate in your predictions, that means the probability of a successful roundtrip trade is only 49 percent. That’s the flip of a coin. Not to mention the additional costs of trading and possible taxes generated. And, by the way, I have never known an investor with a 70 percent accuracy in predicting anything.

Considerations for a Long-Term Investor

Stock market investments are long-term commitments. The benefits of investing are dividends and the growth of dividends or earnings over a long time period. Deciding on whether to sell or hold a long-term investment based on short-term phenomena (such as the coronavirus) is counterproductive unless there is the risk of permanent capital impairment. To help us work through the recent market volatility, we asked the following questions.

- Is the epidemic likely to be long-term and impair the world economy on a long-term basis?

- Is the epidemic likely to impair or destroy the capital base or intellectual base of the global stock market or any subset of that market? No. Even under a pessimistic scenario? Still no.

- Did past epidemics offer any guide? The answer is only to not make short-term market decisions based on epidemics. The only possible exception was the Spanish influenza of 1918, which killed 100 million people worldwide, but that was during a world war and before antibiotics were available. The mortality rate of the current epidemic is nowhere near that of the Spanish flu.

The coronavirus epidemic looks to be under control in China, and economic activity is beginning to rebound. New infection centers emerging in Italy and Korea where authorities are reacting swiftly and forcefully to contain the spread of the virus. There is still much we don’t know, and there is a chance the virus could become more widely spread, but this is not very likely from what we see right now.

Economic activity is down sharply in China, and to varying degrees in the rest of the Pacific, Germany, Italy, and parts of Latin America. Markets outside of Asia had been relatively well-behaved until Monday, when there were sharp declines across most world stock markets. Our firm believes that these declines are transitory and that reduced economic activity will not translate into a global recession. Or, as Warren Buffet more eloquently pointed out on CNBC, “Has the 10-year or 20-year outlook for American businesses changed in the last 24 to 48 hours?”

Related information: “Spreading Global Virus Cases Shock the Stock Market” by Schwab Center for Financial Research

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Versant Capital Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Versant Capital Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Versant Capital Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice. If you are a Versant Capital Management, Inc. client, please remember to contact Versant Capital Management, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Versant Capital Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.