Power of Diversification

Brandon Yee, CFA, CAIA

Senior Research Analyst

In light of recent market volatility and the near-certainty of future market pullbacks, developing a framework for thinking about and investing through market declines can help investors achieve more positive outcomes.

This article will provide a perspective on historical U.S. equity market declines, present historical equity returns for various developed and emerging markets, and highlight the benefits of being a globally diversified investor. The last section will take you through a portfolio construction exercise that demonstrates how a portfolio’s expected risk and return profile changes after adding diversifying investments.

Perspective on Market Declines

Benjamin Franklin once mentioned two certainties in this world: death and taxes. If he wasn’t preoccupied with developing a new nation and had the foresight to predict the evolution of our financial markets, Mr. Franklin would have added stock market declines to the list.

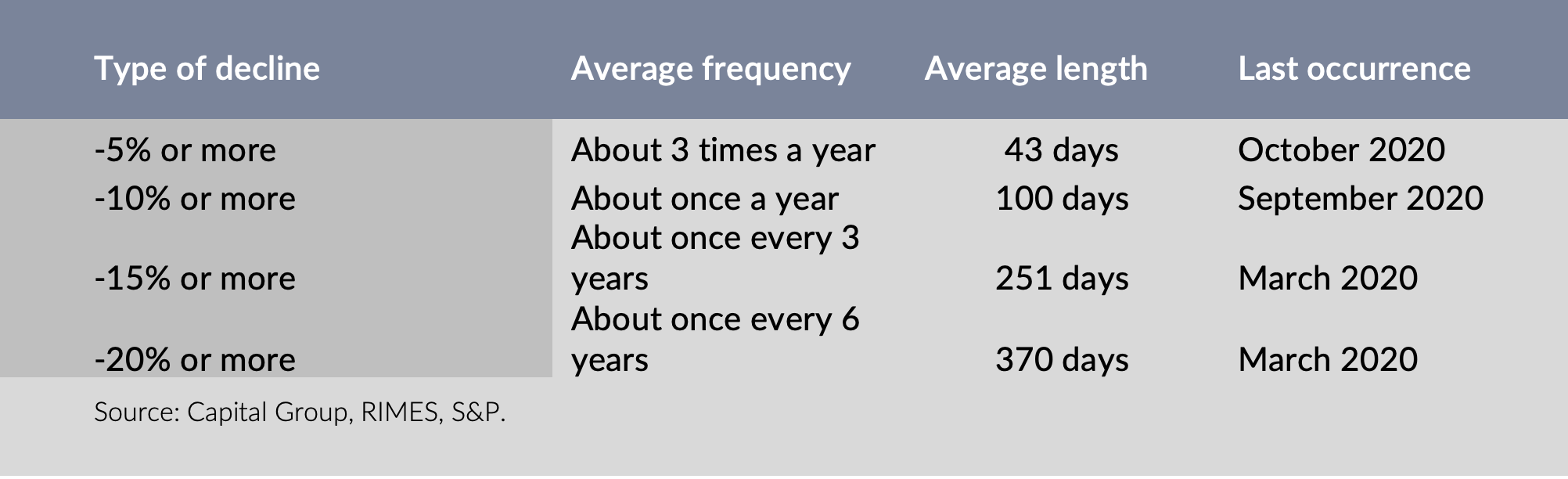

- Since 1951, the S&P 500 declined five percent or more about three times a year on average.

- S&P 500 declines of ten percent or more averaged about once a year.

- Declines greater than 20% were less frequent but arose approximately once every six years.

- Market pullbacks greater than 40% occurred three times, with an average decline of 51%.

TABLE 1- Declines in the S&P 500 since 1951

As investors, it is important to note the high frequency of -5% or more declines. A year such as 2017 — which had historically low volatility — can give investors a false sense of security and tempt them to extrapolate calmer market conditions into the future. However, having this perspective on market declines helps investors realize a year like 2017 was unusual, and higher market volatility is common. At the beginning of 2018, volatility came roaring back as investors worried about central bank actions, inflation, and geopolitical conflicts. Market re-pricing is common (remember Brexit?). As discussed in an article titled U.S. Long-Term Asset Returns, higher levels of risk should be expected for historically higher-returning assets.

Another key takeaway is the difference between the average times to recover from declines of lower magnitudes versus declines of higher magnitudes. Investors have historically recovered from S&P 500 market pullbacks of lower magnitudes in just a few months. The time to realize the full market decline and the time needed for a full recovery is similar. In contrast, investors would have to wait almost six years to fully recover from a greater than 40% decline. The challenge facing investors is differentiating important market developments from noise. Since investors know this to be a daunting task, they should take advantage of investing’s only “free lunch”: diversification.

Historical Developed and Emerging Market Equity Returns

The U.S. equity market is currently approximately 60% of the world’s market capitalization, which means U.S. stocks represent a little more than half of an investor’s opportunity set. For any Costco fans, ignoring international equities is analogous to walking through only 60% of the aisles at your local Costco and possibly missing out on the samples. As awful as missing the samples is, investors with U.S.-only equity portfolios may point to globalization and U.S. firms deriving revenues from overseas as two factors that lessen the importance of global diversification. From a return standpoint, how have the two sides fared historically?

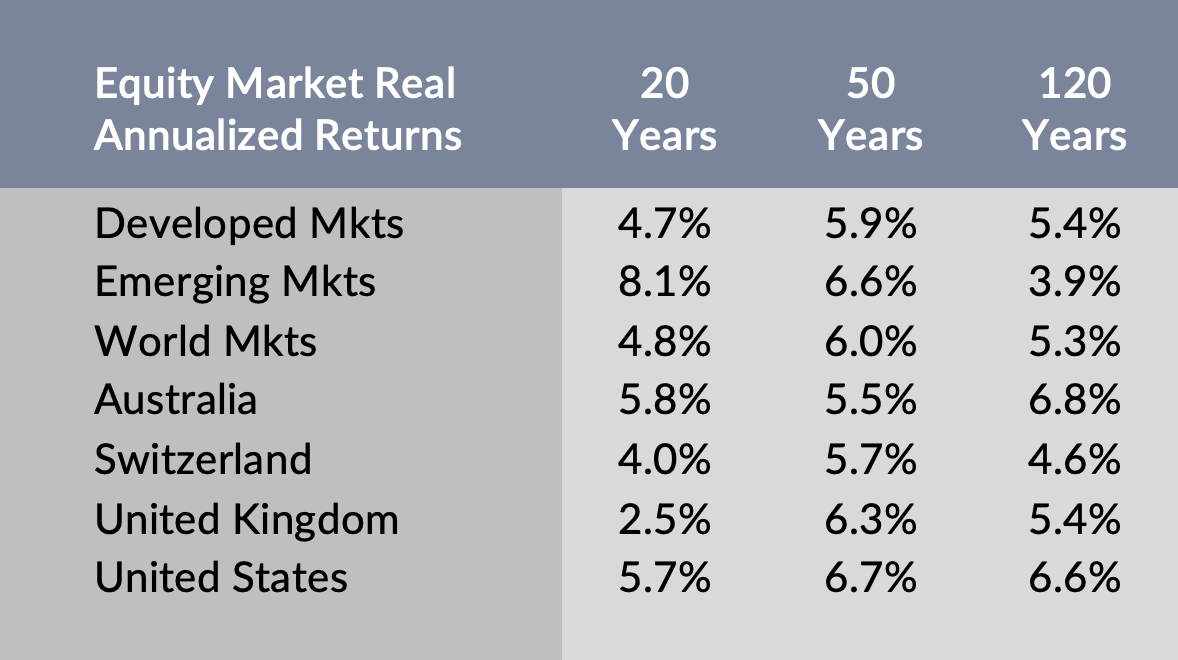

Looking at Table 2, the U.S. market performed well in each period. Over the past twenty years, the U.S. market outperformed developed markets in the aggregate but underperformed emerging markets by a sizable amount. 50-year performance between the U.S. and other parts of the world is interestingly similar. Most importantly for long-term investors, relative performance becomes more muted as the period is increased to 20 years, 50 years, and 120 years. With U.S. market valuations near historical highs and expensive relative to international market valuations, investors should consider diversifying outside the U.S.

Table 2- Equity Market Real Annualized Returns- as of Year End 2020

Source: Credit Suisse.

Benefits of Diversification

Returns are only one part of the story and risk is the other element investors must take into consideration, especially those nearing retirement or in the middle of retirement.

As seen by the high frequency of large declines, the S&P 500 is quite volatile. How does U.S.-only equity portfolio volatility change when international equities are included? What happens when bonds and other investments are added?

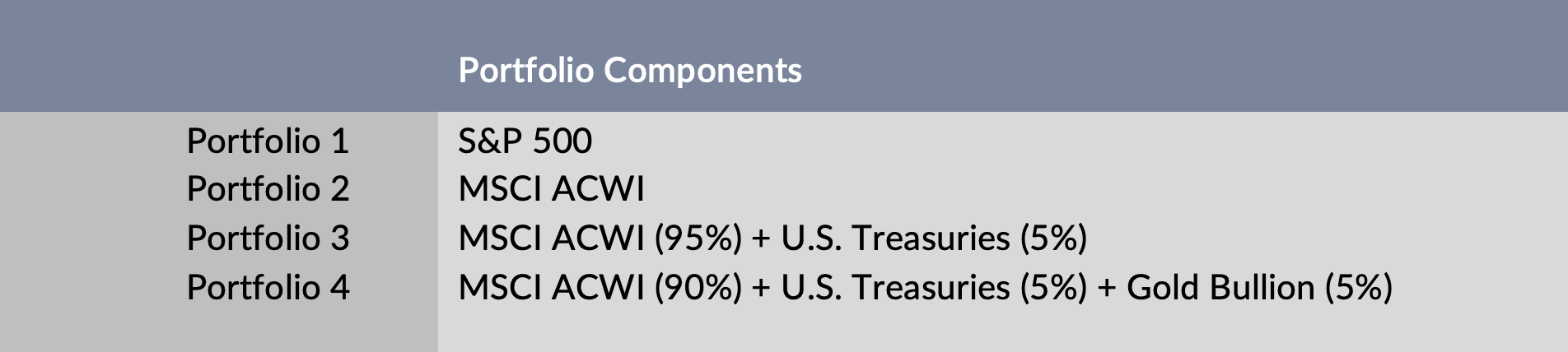

Four different portfolios have been constructed to understand how adding diversifying investments change a portfolio’s risk profile, with each subsequent portfolio adding an additional diversifying element (Table 4). Portfolio volatilities were calculated using the historical volatilities of the indices and investments.

- Portfolio 1 consists solely of the S&P 500, a proxy for the U.S. market.

- Portfolio 2 represents the MSCI ACWI, a globally diversified equity index composed of U.S., international developed, and emerging market stocks.

- Portfolio 3 starts with the MSCI ACWI and adds a 5% allocation to Treasuries.

- Portfolio 4 adds a position to gold, often used as a hedge against inflation and fiat currency devaluations.

Table 4- Constructed Portfolios

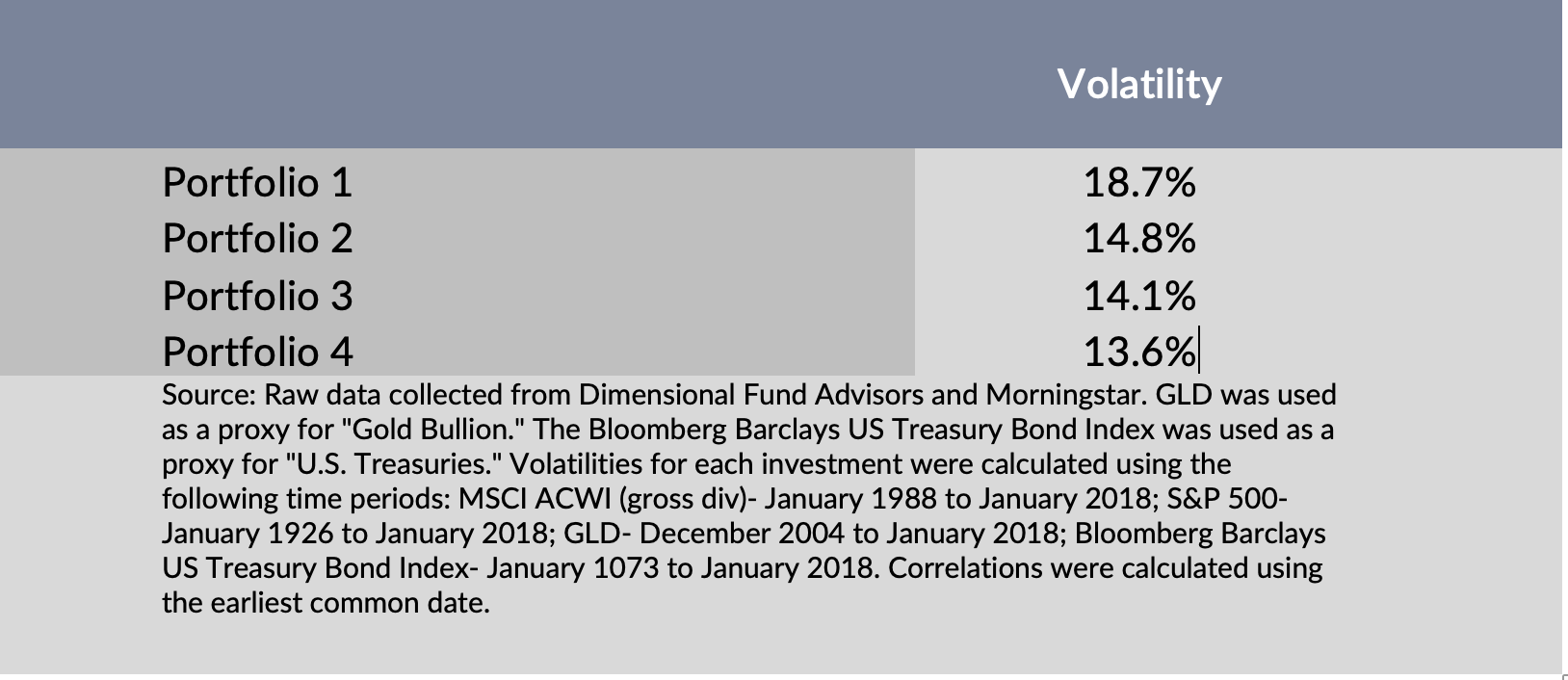

Beginning with Portfolio 1, the annualized volatility of the S&P 500 is 18.67%. When international developed and emerging market equities are added (Portfolio 2), the portfolio volatility decreases to 14.84%. The decrease in volatility occurs because international equities are not perfectly correlated with U.S. equities. In Table 5, investors can see how each subsequent portfolio has lower volatility after adding the additional investment.

From Portfolio 1 to Portfolio 4, volatility was reduced by 27.4%. However, reduced portfolio risk does not necessarily mean a lower return. As stated previously, a globally diversified equity investor has not historically given up much return; yet, portfolio volatility can still go down even if the portfolio’s expected return stays the same or rises.

Table 5- Portfolio Volatilities

Final Thoughts

The world is constantly evolving, and investors give their best guess on how certain events will affect asset prices. This translates into market volatility and the near-certainty of market declines. You may hear on the news about the Dow Jones Industrial Average dropping hundreds of points or the S&P 500 swinging wildly, but the great part is investors do not have to ride that rollercoaster. The investment experience can be quite different when diversifying assets are incorporated into a portfolio and potentially equally rewarding.

DISCLOSURE: For complete information on your tax situation, you should consult a qualified tax advisor. While Versant Capital Management doesn’t offer tax advice, we are familiar with certain tax situations that our clients face regularly. Disclosure: Any tax-related material contained within this document is subject to the following disclaimer required pursuant to IRS Circular 230: Any tax information contained in this communication (including any attachments) is not intended to be used and cannot be used for purposes of (i) avoiding penalties imposed under the United States Internal Revenue Code or (ii) promoting marketing or recommending to another person any tax-related matter.